What to Do if You Just Got a Crypto Tax Letter from the IRS

Have you just woken up to find a letter from America’s top tax authority, the Internal Revenue Service (IRS) in your mailbox, asking you to pay tax on your crypto earnings… and come to the sad realization that you’re not having a nightmare?

Scores of American cryptocurrency traders have received forms from the IRS this month. And if you’re the latest, you may well be in need of some advice right now. CoinTracker, a provider of Bitcoin tax software, compiled a few tops tips what should you know.

Here they are:

Tip 1: Understand what the taxman wants from you

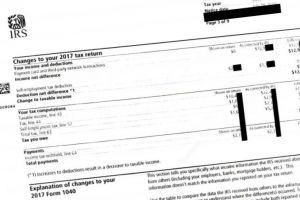

What you’ve received is more than likely a CP2000 form. If so, it’s not exactly a tax bill. It’s more of a call for a response from you. The IRS has actually been issuing these forms to foreign exchange and stock traders for some time, so they’re not specific to crypto earnings. The form indicates that the IRS has somehow detected a discrepancy between what you claim you have earned and the information it has been provided by a brokerage or an exchange.

The amount shown payable is what the IRS thinks is payable based on the information it has. The IRS wants you to respond to this with either:

-Evidence that its estimate is wrong

or

-Your agreement to pay the amount it is asking for

Tip 2: Respond on time

About the worst thing in the world you can do right now is pay too much heed to the part of the CP2000 form that says, “Reminder: This is not a bill.”

True, it’s not a bill. But it could become a bill fast if you ignore it…or hum and haw too much about your response.

______________________

______________________

You have 30 days to provide the IRS with a reply. If not, you will get what’s called a Notice of Deficiency (a sort of surmising from the IRS that your non-response means you have nothing to say in your defense), and then an actual bill for the proposed amount.

So if you do have proof the taxman’s sums are wrong, you need to hurry up and send it to him.

Tip 3: If you feel aggrieved, build a case

Bear in mind that there is a serious deficiency of guidelines available to American cryptocurrency holders – and that’s partly because the IRS is still in the process of drawing them up.

Many tax experts who’ve spent time and effort looking into the matter have expressed serious concerns over the efficacy of the IRS’ methods, which involves looking at the 1099-MISC and 1099-K tax forms that are submitted to it by exchanges. The latter shows aggregated transaction volumes rather than the actual gains that individual traders make on their transactions.

The lack of crypto tax guidelines means most exchanges just file these two forms to the IRS, and the agency makes its calculations based on these.

It could well be the case that this isn’t a fair reflection of your earnings. If so, get in touch with your exchange or broker to ask them to send a detailed statement you can use in your defense.

And it may sound obvious, but if things look a little more complicated, or you feel like you’re in over your head, be sure to seek advice from a tax lawyer with experience dealing with CP2000-related cases.

Meanwhile, as reported, the IRS is “considering at least” three cryptocurrency-related bills that it hopes will “resolve some of the murky legal issues” related to token ownership, trading and business in the United States.