USD Backed by Gold, Believe 29% of Respondents + 11 More Crypto News

Crypto Briefs is your daily bite-sized digest of cryptocurrency and blockchain-related news – keeping you up-to-date with under the radar crypto news from around the world.

Fiat news

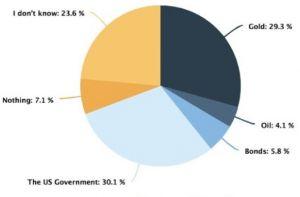

- 29% of surveyed Americans believe that the U.S. dollar is still backed by gold, a recent survey of 1,000 respondents showed. Only 30% accurately stated that it’s backed by the U.S. government, according to the survey commissioned by hash power provider Genesis Mining. (As a reminder, dollar convertibility to gold was ended in 1971.) Moreover, 30% of respondents reported that they hardly ever used cash while 37% reported that they used cash just 1-2 times per week. However, 76% of people oppose the idea of the U.S. government replacing paper money with digital-only money.

What is the U.S. dollar backed by?

Regulation news

- Uzbekistan is set to police cryptocurrency exchanges operating in the country, as well as individual crypto traders. Per an official government release, regulators in the country will require traders to declare the source of their crypto earnings when using domestic exchange platforms. The government has also provided a legal definition of the term “token,” stating that anything that can be classified as a token can be classed as a “substitute for securities.”

- A tech policy committee that answers to the South Korean president has recommended that the country adopts of a legal framework for cryptocurrencies. Per The BChain, the committee, which is charged with forming Industry 4.0-related policy, remarked that the government’s current guarded stance on all things cryptocurrency-related was formed in early 2018, a time when cryptocurrency speculation was rife in the country. However, the committee stated that the policy was ”reducing the global competitiveness of the nation’s blockchain and cryptocurrency industries.”

- Things have just gotten even more difficult for Facebook’s Libra, as the eurozone’s five largest economies have teamed up to prevent its launch next year. Politico reports that the effort is spearheaded by France along with Germany, Italy, Spain and the Netherlands, after a series of backroom meetings in October “to secure a unified front against the Libra currency. […] Their opposition raises the barrier to introducing Libra in Europe and may add pressure on Facebook plus the 20 other companies and organizations behind the initiative to give it up,” states the article.

Adoption news

- Russian tech and hotels operator Maxrooms will begin accepting crypto pay. Per media outlet Rybinsk, Maxrooms’ hotels in Novosibirsk and Rybinsk, in the Yaroslavl region, will begin accepting crypto pay in Bitcoin and other leading tokens. The operator has also released its own token, and says it will offer visitors using it with discounts of up to 30%. The chain says single rooms are available for prices of around BTC 0.0023 (USD 22) per night.

- Samsung is pursuing a blockchain-based telemedicine project in the United States, reports Herald Corp. The media outlet says that the fact that the project makes use of cryptocurrencies as a payment tool means that the electronics giant is hesitant to begin working with the project in its home country of South Korea, where the crypto industry is highly regulated. The company is working on the project in conjunction with IBM.

- Genesis Capital, an affiliate of institutional OTC cryptocurrency firm Genesis Trading, says that Genesis is seeing a continuous sustained growth in its digital asset lending business. Their Q3 report states that in the third quarter of 2019, Genesis added USD 870 million in new originations, breaking their last-quarter record of USD 746 million. Originations increased 38.1% quarter to quarter, marking a sixth consecutive quarter of growth and bringing total originations to USD 3.1 billion since Genesis launched the lending business in March 2018. As of September 30, active loans outstanding stood at USD 450 million, roughly flat from the previous quarter despite a significant decrease in Bitcoin’s price, the reports says.

- Vault12, a distributed, decentralized and serverless digital custody solution for cryptocurrency assets for individual users, has launched on October 30th at San Francisco Blockchain Week as the first of its kind. The company is backed by Winklevoss Capital, True Ventures, Naval Ravikant and Data Collective. The announcement also states that Vault12 uses the principles of Hierarchical Threshold Shamir’s Secret Sharing and advanced proprietary technology to enable an individual’s network of Guardians (trusted friends and family) to safeguard their crypto assets. To incentivize Guardians to help secure users’ Vaults, Guardians will be paid in Ethereum.

Investment news

- China’s Guangzhou province will create a circa USD 140m fund for blockchain investment, per media outlet Dongguan. The project will see the province invest in two projects per year, and the province will consider both public and private initiatives. Commentator Dovey Wan tweeted, “I believe all other local [government authorities in China] will follow,” and claimed that the “overall capital subsidy can be massive.” Elsewhere in the country, tech company Xunlei says it is also keen to invest in promising projects, and will create its own USD 100 million blockchain fund, per an official release shared on Yahoo.

- Canadian investment fund manager 3iQ has received a favorable ruling from its public hearing before a panel of the Ontario Securities Commission (OSC) regarding The Bitcoin Fund, a closed-end bitcoin fund that is expected to be listed for trading on a major Canadian stock exchange. The announcement says that the OSC panel has directed the OSC Director to issue a receipt for a final prospectus of the Fund.

- Biometric cybersecurity startup Keyless raised USD 2.2 millionin pre-seed funding led by blockchain ventures firm gumi Crypto Capital and with the contributions by Ripple’s developer initiative, Xpring, Blockchain Valley Ventures, LuneX and others. According to their press release, this brings Keyless’ total investment to USD 2.5 million to develop decentralized solution that will transform private key management. It already developed and started testing for its their product The Keyless Authenticator.

Policy news

- Beijing is “tipping the scales” in the race for blockchain supremacy say experts from ConsenSys and Blockchain.com. Experts from both companies were quoted in a Reuters report, with a ConsenSys official stating that China may become “the first-mover and thereby build in all the default features” when the new financial paradigm takes shape.