U.S. Agents to Hunt North Korean Crypto Hackers + 14 More Crypto News

Crypto Briefs is your daily bite-sized digest of cryptocurrency and blockchain-related news – keeping you up-to-date with under the radar crypto news from around the world.

Security news

- The United States National Security Agency has launched a new cybersecurity unit – with staff members who are “prepared” to block North Korea’s attempts to stop weapons programs with cryptocurrencies. VOA Korea reports the move is part of a set of measures that will see the USA tighten sanctions on Pyongyang. Washington has reportedly become disillusioned with the peace process after a number of missile launches. The UN has previously accused Pyongyang of amassing some USD 2 billion in hacking and phishing raids on cryptocurrency exchanges.

Blockchain news

- China’s Ministry of Education has struck a deal with South Korean blockchain company Medium. The agreement could see China move its academic records system (including grades, performance reports and more data) for kindergarten and high school students onto a blockchain-powered platform. Per IT Daily, the government wants to do away with paper-based records at schools in favor of blockchain-powered digital solutions for some 270 million students. Medium claims its platform can perform at speeds of 100,000 transactions per second.

- Co-founders and Stanford cryptographers at Stanford-based Findora, a developer of a public blockchain for building financial applications, Ben Fisch and Benedikt Bünz, together with Alan Szepeniec, revealed ‘Supersonic’ – “the first practical, trustless, succinct, and efficiently verifiable zero-knowledge proofs (ZKP). In an emailed announcement, the company says that these proofs are smaller than 10 kilobytes, take only milliseconds to verify even for the most complex statements, and that that they are likely at least 25 times smaller than any other trustless ZKP system with comparable verification times.

- Following a successful trial conducted in the Netherlands in early October, a blockchain and DNA-based marine fuels tracking solution has been commercially launched last Friday. The American Journal of Transportation reports that BunkerTrace, a joint venture of Forecast Technology and BLOC (Blockchain Labs for Open Collaboration), adds DNA markers to fuel at every stage of the supply chain and records each transaction in a blockchain-based system. It is ready for adoption by bunker suppliers, ports and operators, the article says.

Exchanges news

- Bithumb Global has launched a Russian-language version of its platform, reports LetKnowNews. The move is part of Bithumb’s international expansion strategy, the company said. The South Korea-based exchange has been targeting fast-growing markets such as India in recent months, and says it moved the Bithumb Global platform out of Beta testing late last month.

- On October 29, Bittrex International will be closing, but Bittrex Global will be launched, as a new European exchange utilizing the Bittrex technology platform, according to the exchange’s blog post. This essentially means that Bittrex will be moving headquarters from Malta to Liechtenstein.

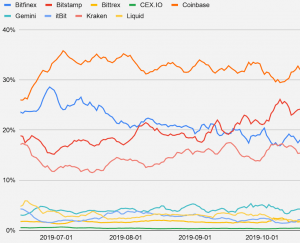

Bitfinex’s market share may finally be slipping, recent signals show. According to crypto market analysis firm Coin Metrics, since the beginning of September, Bitfinex’s BTC/USD market share has been decreasing, while Luxembourg based exchange Bitstamp’smarket share has grown. The reason behind Bitfinex’s volume decline is likely not the recent Hong Kong protests, but a combination of increased regulatory scrutiny, particularly in regards to the investigation and lawsuit, and decreased fees.

Exchange market share of BTC/USD volume, 7 day moving average

Source: Coin Metrics - Prominent crypto advocate and IT security entrepreneur, John McAfee, announced via a Twitter post that anyone can launch an IEO (initial exchange offering) on his recently launched decentralized exchange, McAfeedex.com “without permission, without fees, without us holding any monies and with you keeping 100% of sales,” said McAfee, adding that the first decentralized IEO is live.

Regulation news

- In America, the Congressional Financial Services Committee will consider a draft law that would see stablecoins classified as securities under the Securities Act (1933). The bill is the brainchild of congresswoman Sylvia Garcia, who proposes making an amendment to the much-maligned 1933 act to define “managed stablecoins” as securities.

- New York authorities are set to re-examine the requirements of its BitLiscence permits system, and is seeking public input on the matter. According to Bloomberg Law, the state’s Financial Services Superintendent said, “The regulations are working well, but we want to hear from industry about how they’re operating in practicality for industry and if there are any tweaks that we should make.”

- The Algorand Foundation says it has obtained Sharia certification, paving the way for expansion into Islamic markets. Leading clerics in a number of territories have ruled that certain cryptocurrency-related projects are not Sharia-compliant, but Algorand says, in a press release, that the independent Shariya Review Bureau (SRB) has given its business practices an all-clear verdict.

- Multinational finance firm ING has claimed that banks could “refuse to do business with Facebook” over Libra worries. Regulatory pressure is escalating in Europe and the United States, and ING warns banks may be scared off. Per the Financial Times, ING CEO Ralph Hamers stated somewhat ominously that banks fearing that Libra or similar tokens could be used for illegal activities could “take measures and exit the client, or not accept the client.” Hamers said that “large, regulated institutions” like ING “don’t want to risk anything.”

- Ripple said in their latest announcement that it has expanded its global regulatory team and that it’s become the first major blockchain company with a dedicated global regulatory office in Washington D.C. Furthermore, Craig Phillips, former Counselor to the Secretary at the U.S. Treasury Department, has joined Ripple’s Board of Directors, while Ripple joined the Blockchain Association, where Michelle Bond, Ripple’s Global Head of Government Relations, will sit on the board.

Market news

- The Trump administration acted to deflate the Bitcoin bubble of 2017 by allowing the introduction of futures products, Coindesk reports. The article quotes Christopher Giancarlo, who served as the U.S. Commodity Futures Trading Commission (CFTC) chairmain before leaving in April, as saying: “One of the untold stories of the past few years is that the CFTC, the Treasury, the SEC and the [National Economic Council] director at the time, Gary Cohn, believed that the launch of bitcoin futures would have the impact of popping the bitcoin bubble. And it worked.” (Learn more: Research: Bitcoin Dropped Due to Bitcoin Futures Launch)

Investment news

- Digital asset manager, Morgan Creek Digital, raised the first USD 60.95 million tranche from eleven investors of its targeted USD 250 million for its second venture capital fund. The public filing to the U.S. Securities and Exchange Commission (SEC), the fund called Morgan Creek Blockchain Opportunities Fund II LP began its first offering on Oct. 16 and it is an ongoing funding round.