Bitcoin SV Delisting: Shots Fired, What Did They Hit? (UPDATED)

After Friday’s Twitter hint by Changpeng Zhao, CEO of Binance, that the exchange might delist Bitcoin SV (BSV), then actually confirming it on Monday, the crypto-net has exploded. Reactions are strong, debates heated, and they are everywhere, with the majority of the crypto-verse celebrating the exchange’s decision, while others argue that it might set a bad precedent. (Updated on 12:15 UTC: comments by Vitalik Buterin have been added in the “A strong message” section.)

For example, Jimmy Song, a Bitcoin Core developer, posted his “unpopular opinion” on Twitter, arguing that “Delisting coins is satisfying short term, but ultimately bad. It’s giving the perception that exchanges are king-makers or legitimatizers. They are not”, to which Eric Lombrozo, co-CEO & CTO Ciphrex Corp, replied that “When you have a mountain of evidence that something is being sold through deliberate forgeries and your potential liabilities outweigh any revenue, it is no longer a good business decision to continue to offer it. I expect to see more of this in the coming months.”

Binance announced the decision to delist BSV after their CEO said that Craig Wright, the main backer of BSV, “is fraud”. Moreover, Wright faced a strong backlash from the crypto community after he served legal papers on the individual behind the Twitter account @Hodlonaut (that is not available now) due to Hodlonaut’s “targeted campaign” to “harass and libel” Wright with “highly defamatory and abusive tweets.” Wright is often dubbed Faketoshi due to his claim that he is Satoshi Nakamoto and general lack of any sort of proof.

Meanwhile, Adam Back, co-founder and CEO of Blockstream, th blockchain technology company famous for their Bitcoin satellite, also gave an “unpopular opinion: listing coins should be listed on technical factors only. [In my opinion] many alts/forks/ICOs starting with oneCoin, bitConnnect but many more are not “investable” (I wouldn’t buy any of them) but some want to trade them and it’s a free world. It shouldn’t be a popularity contest”. He went further to explain what he means by “technical factors”, saying “practical criteria like trade volume, network security, code maintenance – popularity of those promoting a coin is not a good factor: consider Bitcoin itself is unpopular to some establishment. Freedom of choice and resilience is important. High listing fees is also a negative.”

However, when the Twitter user Warboat accused Binance of hypocrisy and subversion, saying “Proof-of-delist consensus by crypto cartel. Crony capitalism come full circle to the cryptoconomy. Binance, you are subverting natural selection and history will show you to be corrupt”, the CEO replied with an explanation, distancing himself and the major exchange from the arguably massive influence they have in the crypto-sphere.

He later added, “We don’t make decisions for other exchanges. Our decision is part of the natural selection process, so is yours. We are just a small part of the community, who are super supportive of our decision.”

A strong message

Meanwhile, in a blog post, published on Wedneday, Ethereum co-founder Vitalik Buterin said that “delistings do send a strong message of social condemnation of BSV, which is useful and needed.” Moreover, delistings won’t make it that hard for people to buy or sell BSV, he stressed, reminding that some exchanges will keep BSV on their platforms. For example, Coinex will not delist BSV “because it is an great social experiment.”

Buterin also argued that, for example, in the cases of Kraken and Shapeshift, “delisting BSV is more like reallocation of a scarce resource (attention/legitimacy) than it is censorship.” Meanwhile, Binance does accept a very large array of cryptocurrencies, adopting a philosophy much closer to anything-goes, he added.

“So to conclude: censorship in public spaces bad, even if the public spaces are non-governmental; censorship in genuinely private spaces (especially spaces that are not “defaults” for a broader community) can be okay; ostracizing projects with the goal and effect of denying access to them, bad; ostracizing projects with the goal and effect of denying them scarce legitimacy can be okay,” Buterin said.

Most followers are defending both Binance’s decision and the reasons behind it, stating that the majority wants BSV to be delisted (and some going even further, suggesting that Bitcoin Cash (BCH) should be next), and that those who don’t agree can just make their own exchange. A Twitter user under the handle @Mikeshashimi adds: “It’s funny how people are berating a private business’s decision. Binance, or other exchanges, does not owe it to anyone to list or delist a project/coin.”

For now, Erik Voorhees, founder and CEO of crypto exchange ShapeShift, confirmed a few days ago that his company will delist BSV as well, while Blockchain, a major cryptocurrency wallet, decided to follow suit, saying that they “have determined to end all support of BSV within the Blockchain Wallet by May 15, 2019.”

Other popular exchanges are launching Twitter polls to test the waters, asking their followers if they should delist BSV as well. Kraken’s poll showed that 71% of 70,545 total voters are in favor of delisting the coin, finding it “toxic”, so on April 16th, Kraken announced that it will follow the will of the people and delist BSV.

Meanwhile, cryptocurrency exchange BitForex, which is ranked 5th by trading volume, has deleted its poll regarding the future of Bitcoin SV and decided instead to keep the coin listed and tradeable.

However, as reported, some other exchanges confirmed that they’ll keep BSV on their platforms, such as OKEx, which argues that BSV doesn’t meet their delisting criteria. Meanwhile, Paolo Ardoino, Chief Technical Officer Bitfinex said that delisting would harm their customers. Nonetheless, one of the greatest proponents of Bitcoin SV, Calvine Ayre, announced the launch of a new “BSV-based” exchange, Float SV, on 19th April.

_____

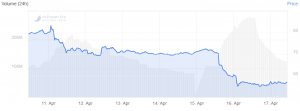

BSV price chart: