‘Prohibitively Expensive’ Ethereum Network Fees ‘Are Healthy’

Ethereum (ETH) users are paying higher than normal fees for transactions on the network, per a new report – to the extent that some token holders are holding fire on making ETH dealings.

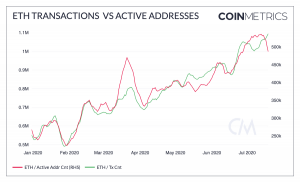

According to the latest Coin Metrics-produced State of the Network report, the past week has seen a drop in the amount of “unique active ETH addresses” – despite the fact that there has actually been a seven-day average increase in the number of transactions carried out on the Ethereum network.

The report’s authors noted,

“High fees can make it prohibitively expensive to send transactions, especially for use cases like gaming and collectibles that depend on large amounts of low-cost transactions.”

Ethereum has the lion’s share of the blockchain gaming and collectibles-associated decentralized app (dapp) market.

However, the authors suggested that the users of another type of dapp may be responsible for the change. They claimed that higher fees spells good news for ETH miners, and added that rising fees prove that the network is in rude health.

They wrote,

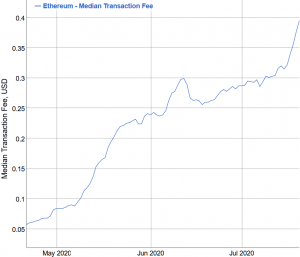

“Decentralized finance (DeFi) continues to push ETH fees higher. ETH median fees are approaching USD 0.40, which is the highest they’ve been since mid-2018. High fees are a mostly healthy sign – high fees typically signify high demand for block space, and create more revenue for the miners securing the network.”

According to BitInfoCharts data, the median transaction fee for the Ethereum network has climbed from well under USD 0.10 in late April to their current rate of around USD 0.50.

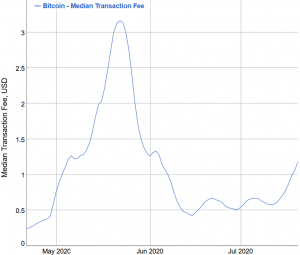

The number is still much lower than Bitcoin (BTC) network transaction fees, though. In late June, BTC transactions cost about USD 0.50 – the same price one might pay now for an ETH transaction. However, BitInfoCharts data also shows that in recent weeks BTC transaction median prices have also climbed steeply – and now stand at over USD 1.