Justin Sun’s Tron Reveals More Details of USDD Backing in a Move to Distance It from UST

Crypto entrepreneur Justin Sun’s blockchain Tron (TRX) has revealed details about the backing of its new algorithmic stablecoin USDD in what appears to be an effort to maintain confidence in the project following the collapse of major algorithmic stablecoin terraUSD (UST).

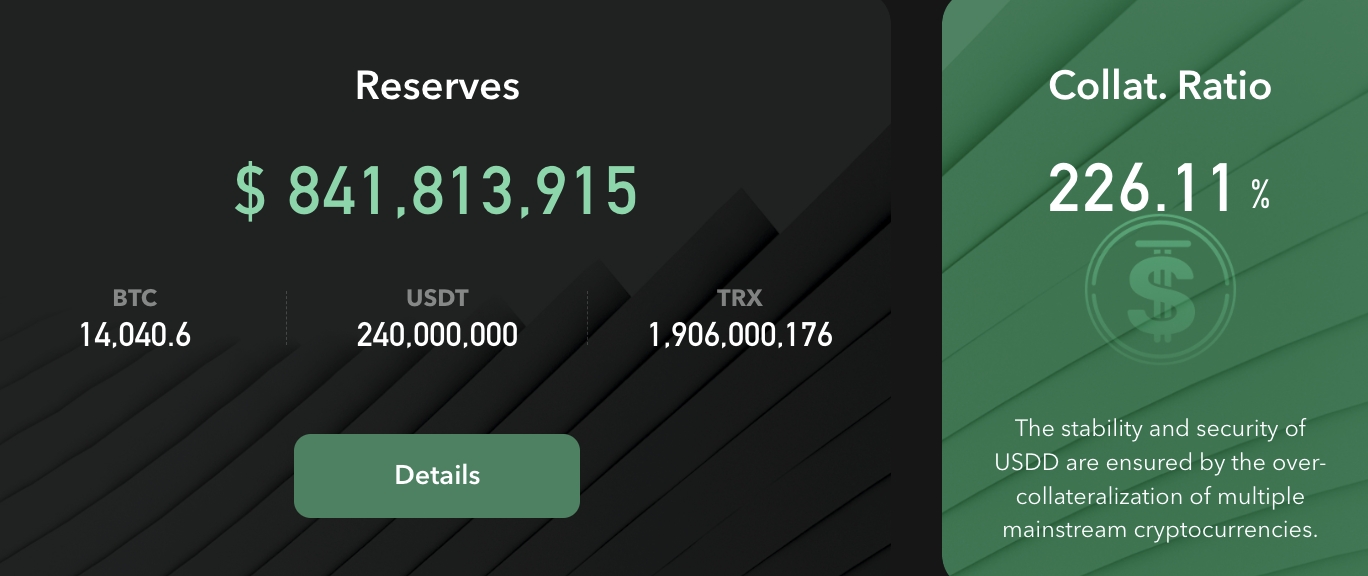

According to the Tron DAO Reserve’s website, USDD is backed by various cryptoassets and stablecoins, which combined will always make up at least 130% of the total amount of USDD in circulation. Among the collateral assets is Tron’s native TRX token, the stablecoin tether (USDT), and bitcoin (BTC).

The stablecoin on Sunday for the first time shared real-time updates on its collateralization ratio on its website. As of Monday at 09:00 UTC, the DAO said it has USD 841.8m in its reserves, with a collateralization ratio for USDD of 226.1%.

Naturally, it is speculated that the move to overcollateralize USDD comes after the collapse of UST, which was only partially backed by other digital assets.

According to comments by Justin Sun, the move to overcollateralize USDD has always been the plan, although he admitted that it had been moved higher up on the list of priorities after UST’s collapse.

“This has been in the plan, but Terra/Luna definitely accelerated and prioritized this for our team […] We want to have USDD to be overcollateralized, which I think will make market participants more comfortable about using us in the future,” Sun was quoted by Bloomberg as saying.

The new stablecoin was unveiled by Justin Sun as recently as April this year, with Sun then calling it “the most decentralized stablecoin in human history.” However, the plan was widely criticized for building on the same model as the failed UST, which famously offered 20% yields to depositors on Anchor Protocol.

According to the TRON DAO Reserve website, USDD currently offers a 30% interest rate to holders who stake their coins. The return matches the “benchmark interest rate” of 30% for the stablecoin that was promised in the project’s white paper from the beginning – significantly more than what UST offered.

According to data from CoinGecko, there are currently just over 667.5m USDD coins in circulation, and the price has managed to stay within close range of its USD 1 peg since inception earlier this year.

Meanwhile, TRX is the 13th coin by market capitalization. It’s up 5% in a day and 4.7% in a week, trading at USD 0.084 (at 10:30 UTC).

____

Learn more:

– USDD vs UST: Is Justin Sun’s New Stablecoin Just a Clone of UST?

– Tron’s Justin Sun Launches ‘Most Decentralized Stablecoin,’ Bitcoin Might Get a Role Here Too

– Big Wallets Exited Anchor/UST While Smaller Fish Continued to Invest – Jump Crypto

– Binance CEO Shares Lessons Learned From Terra Fall, Says He is ‘Pleased by the Crypto Industry Resilience’

– Small-cap Stablecoins Struggle to Maintain Peg as Crypto Market Crashes

– Tether in the Spotlight After USD 9B Worth of Redemptions