Japan’s Crypto Exchange Association Just Lost Influential Boss

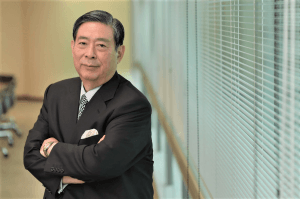

The CEO of Japan’s SBI Group, Yoshitaka Kitao, has stepped aside as the head of the self-governing Japan Virtual Currency Exchange Association (JVCEA) just over two weeks after he was re-elected to the role.

Kitao is one of the most influential figures on the Japanese cryptocurrency and conventional finance scene, and serves as a board member at Ripple. Last month, SBI announced that Kitao was also appointed as an advisor to the China Investment Association’s blockchain board.

Neither the JVCEA nor SBI have explained why Kitao has decided to step aside. But per Nikkei, the former JVCEA president may have stepped down in an effort to “even out the number of industry representatives” on the JVCEA’s board.

A total of 13 board members were elected on June 24, per the JVCEA. In addition to seven crypto exchange chiefs (including Kitao), six non-industry professional were voted in, including a member of the Financial Services Agency (FSA)’s influential cryptocurrency study group, a consumer affairs expert, a banking professional, lawyers and two university professors.

Kitao’s departure makes the board membership an even 6-6 split of exchange chiefs and non-industry experts.

However, Nikkei also states that many insiders feel that Kitao’s departure will undermine the authority of the JVCEA as the SBI chief is such a powerful player in the world of Japanese finance.

As previously reported, Japanese exchanges hope that they will be allowed to continue self-regulating, possibly fearing the increasing power of the FSA, and the JVCEA has previously received official self-governing status from Tokyo.

SBI’s exchange was earlier this month renamed from SBI Virtual Currencies to SBI VC Trade, according to a company statement.

__________________

__________________

Elsewhere, Nikkei also reports that per the findings of a Bank of Japan survey of 25,000 Japanese people aged 18 to 79 conducted in March, some 8% of respondents said they had acquired cryptocurrency holdings.

The survey found that the majority of token holders were in their 30s, followed by those in their 40s.