Greta Thunberg Might Like This Research on Bitcoin Mining + More News

Crypto Briefs is your daily, bite-sized digest of cryptocurrency and blockchain-related news – investigating the stories flying under the radar of today’s crypto news.

Mining news

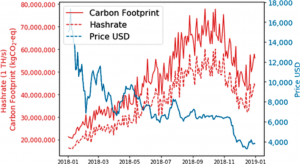

- Environmental activists now can somewhat soften their stance towards Bitcoin mining. According to a report in American Chemical Society (ACS)’ Environmental Science & Technology, researchers from Aalborg University (Denmark) estimate that past and future environmental impacts of Bitcoin (BTC) mining could be lower than what was previously believed. The report looked into the electricity consumption and carbon dioxide emissions in 2018 for all stages of Bitcoin mining, and found that the Bitcoin network consumed 31.29 TWh with a carbon footprint of 17.29 million metric tons of CO2 equivalent (MtCO2-eq.) (total U.S. greenhouse gas emissions in 2017 stood at 6,457 MtCO2-eq.), an estimate that is in the lower end of the range of results from previous studies, the main drivers of that impact being the geographical distribution of miners and the efficiency of the mining equipment. “While the overall hashrate is expected to increase, the energy consumption and environmental footprint per TH mined is expected to decrease,” the report added.

- Frankfurt-based information technology company Northern Bitcoin AG announced that it has merged with its U.S. competitor, Whinstone US, Inc. According to the announcement, the company already operates its own Bitcoin Mining Site in Louisiana and is currently building by far the largest Bitcoin Mining Facility worldwide with a capacity of one gigawatt on an area of over 100 acres (40 ha) in Texas. “By completing the transaction at the beginning of 2020, the joint venture will establish itself as a global leader in Bitcoin mining,” says the company.

Digital fiats news

- The U.S. Federal Reserve (Fed) chairman Jerome Powell says the Fed is still investigating the matter of whether it should develop a central bank digital currency. Per a letter addressed to politicians (and posted by a Twitter user) who had enquired about the status of a so-called digital dollar, Powell responded that the Fed was “carefully analyzing the costs and benefits of pursuing such an initiative.”

Adoption news

- PayPal CEO Dan Schulman said in a recent interview with Fortune that he only holds one cryptocurrency, and that is Bitcoin. He also discussed PayPal’s withdrawal from Facebook‘s Libra Association, saying that “It wasn’t an acrimonious divorce or anything like that. It’s just that they will start going down a road that we’re very interested in looking at and monitoring, and maybe later, there are ways we can work together.” Speaking about PayPal’s blockchain initiatives, Schulman said that there’s a lot of promise there, “but it really needs to do something that the traditional rails can’t do.”

- The Royal Dutch Football Association (known locally as the KNVB) has piloted a blockchain-powered ticket sales platform at the Netherlands’ recent national team match versus Estonia. According to Ajax fanzine Ajax Life, Amsterdam-based football club Ajax, who reached the semi-finals of the Champions League earlier this year, will also take part in the pilot. The KNVB and Ajax are reportedly keen to use blockchain technology to crack down on black market ticket sales.

- More high-level Asian blockchain collaborations appear to be forthcoming in East Asia. Days after Naver’s Line and Softbank’s Yahoo Japan announced a merger deal-in-principle, LG subsidiary LG CNS says it has struck an MOU deal with chat app giant Kakao. The latter operates the Klaytn platform, whose governance council LG holds seats on. LG CNS has also launched its own mainnet, Monachain, which it currently uses to track lost and stolen mobile phones. The parties, per eInfomax, say they will collaborate on a range of blockchain-based developments.

- Russian commercial bank Sberbank has patented a blockchain solution for repo (repurchase) agreements. In a statement, the bank, which has recently turned its back on cryptocurrency-related business, stated that its solution makes use of smart contracts and distributed ledger technology, allowing “the parties to a deal can register the terms of a repurchase agreement inside a self-executable decentralized environment.” Sberbank says it is the first Russian bank to develop a blockchain solution for repo deals.

- Venezuela’s president Nicolás Maduro has announced he will back the country’s state-issued Petro token with 30 million barrels of crude oil, in addition to 180,000 tons of iron briquettes, per the state-run media outlet VTV. Maduro had previously declared that the Petro would be pinned to untapped oil resources. This latest move is seen by most as an attempt to win credibility for the token. The president also announced a deal with a licensed exchange and Venezuela-based tech provider that he said would enable 100,000 merchants to accept Petro payments.

Crypto exchanges news

- Crypto exchange ShapeShift said it now allows users to trade on its platform with zero commission and zero trading fees. While trading is commission free, standard network miner fees still apply to each trade, the announcement states. According to ShapeShift’s CEO and Founder Erik Voorhees, commission-free trading is enabled by their native FOX token (an ERC20 token), which is also live as of today. Each new account at ShapeShift gets 100 FOX, and by holding them, users get USD 1,000 of free trading volume on a rolling 30 day basis, with each token hence granting USD 10 of free trading volume every 30 days, in perpetuity, the exchange says.

- Sebastian Sonntag, the CEO of peer-to-peer crypto marketplace LocalBitcoins said in recent interview that the marketplace maintains positive growth of 135,000 new users monthly. LocalBitcoins is restructuring internally, and it’s going through a transitional period, following the deadline for moving to a new tier verification structure.

Investment news

- Mythical Games, a game technology studio, said it has closed an additional USD 19 million USD in venture funding, bringing total funding to USD 35 million to date. The round was led by Javelin Venture Partners, while the new investors include Avon Ventures, Alumni Ventures, and Hashed, with participation from current investors Galaxy Digital and Struck Capital.