Launched in October 2018, Venezuelan Petro bills itself as the first cryptocurrency to receive full support by a state. Petro is backed by resources such as oil. The currency has often been politicized, drawing both supporters and detractors.

Venezuela’s Petro (Petromoneda, PTR) has been described as the “national” cryptocurrency since its announcement back in December 2017. In August 2018, Petro became the country’s second official currency, being made equal to the country’s fiat currency Venezuelan bolivar. Despite its name being associated with oil, the Petro currency’s backing by oil is limited to 50%, while an additional 20% is reserved for gold and iron and 10% for diamonds.

The fact that Petro is officially backed by the state means that the Venezuelan authorities hope that it will primarily solve the problems of its native country, followed by its gaining traction in the international crypto and financial world:

- Venezuela has experienced prolonged economic crisis for several years now and Petro is seen as the shortcut to both mitigating and resolving it. One of the worst problems faced by Venezuelan economy is hyperinflation which has plagued the country for years. The devaluation of its national currency, the Venezuelan bolivar was followed by the inflation rate which, back in July 2018, headed for one million percent value. Petro is now pegged to the bolivar in an effort to support the recovery of its fiat counterpart.

- Plunging oil prices have hurt Venezuelan economy and Petro’s backing by oil is expected to make the impact of this trend less severe. According to OPEC, oil accounts for 98% of Venezuela’s exports earnings. When the prices of crude oil plummeted back in 2014, Venezuelan economy experienced shrinking by the magnitude of almost 30% until 2017. The Petro’s fixed exchange ratio to the Venezuelan barrel of oil is valued at 1:1 and the currency’s prices are decreed by the government. Some crypto experts believe that Petro does not deserve to be treated as an official cryptocurrency since its price is set by the government instead of being determined the market forces.

- While this is not stated publicly, Petro is recognized as a way to circumvent sanctions imposed by several U.S administration on Venezuela. The U.S. governments have gradually imposed an increasing number of sanctions on Venezuelan military and political authorities based on the alleged human rights abuses. While the full-on sanctions on Venezuelan oil sector are still being considered, Petro’s architecture should allow it to bypass the sanction mechanisms and allow for its free trade with the rest of the world.

- Finally, Petro has international ambitions as well, hoping to become a global digital means of exchange between sovereign countries, particularly in the oil industry. Venezuela’s Minister of Petroleum Manuel Quevedo tweeted that Venezuela will present Petro as a major digital currency backed by oil to the Organization of the Petroleum Exporting Countries (OPEC) in 2019.

Is Petro Really a “Revolutionary” Cryptocurrency?

Petro’s developers see it as a tool to“revolutionize the world economy” and a project that will use blockchain technology to bring about an end to the centralized financial hegemony and help the countries build a “multipolar world”. The pillar of this project is the existence of Petro as a state-supported digital coin backed by natural riches of its native country. As such, Petro can be arguably described as a “politicized” cryptocurrency since its goals go beyond meeting the users’ or markets’ needs.

Selling this idea to the global audience means that Petro will first have to win over the Venezuelan population to which it promises the following benefits:

1. Purchase of Petros at stable prices. The crypto users will have access to a dedicated web portal for using their fiat money to buy Petro tokens. As of December 2018, Petro’s price in relation to the bolivar was 9,000 bolivars for 1 Petro, up from the initial price of 3,600 bolivars. To allay the fears of the crypto market’s notorious volatility, the Venezuelan government promises that Petro will maintain stable prices since each emission of it will be backed by the equivalent amount of the “Venezuelan commodities”, such as barrels of oil which are fixed to Petro.

2. Venezuelan commodities, good and services can be acquired with Petro. This digital coin is designed to be used for the purchase of commodities made in Venezuela, including final products. This includes using Petro as a means of payment for various products, including food, real estate, flight tickets etc. The government’s crypto-regulatory body called SUNACRIP is tasked with creating smart contract system that will be used to manage transactions and serve as the foundation of future commercial agreements. This process is still left open to negotiations which will remain valid as long as Petro is used as the intended currency for the transactions.

3. Petro is planned to be used for the payment of taxes and public services. A payment infrastructure is said to be under development to allow for streamlined transfers with Petro. In mid-2018, Venezuelan government instructed the banks which operate in the country to start accepting Petro as a regular means of payment.

4. The Petro platform will be used for the transfer of remittances and payment of salaries. Members of the Petro community will be allegedly allowed to make transfers with the tokens for various transactional purposes. In addition, the workers’ wages in Venezuela can now be tied to Petro.

5. As the “national” cryptocurrency, Petro aims to become a financial shortcut for the unbanked population in Venezuela. Once the system is in place, each unbanked user should be able to create a Petro wallet and use it to transfer money, just like they would be able to do with debit or credit cards, but with the advantage of having to pay lower fees.

Use Cases Involving Petro

So far, the number of use cases involving Petro is apparently limited, yet the government tries to push the currency into everyday use through various projects:

- In July 2018, there was an announcement that Venezuelan government will use Petro tokens to build housing facilities for the homeless people in their country. Based on this project, the government will invest as much as 909,000 Petros (USD 750,000) to build an affordable housing network.

- In November 2018, the Venezuelan government has made Petro the only officially approved currency in which the citizens can pay for the issuance of their passports.

- Petro is already available as a means of payment which the international shipping operators can use to pay for the use of port services in Venezuela.

- Pensioners in Venezuela will receive their annual bonuses in Petro starting in 2018.

- Traki, a Venezuelan nationwide retail chain, often called the “Walmart of Venezuela”, has announced the acceptance of Petro as a legal tender at its stores, alongside other cryptocurrencies which are also gaining traction in Venezuela, such as Bitcoin, Bitcoin Cash, Ethereum, Litecoin and Dash.

- In early November 2018, the Venezuelan government launched the Petro savings plan, with the promise that each buyer of Petro will have an option to convert Petro into any digital or international convertible currency such as bitcoin and yuan, provided that the conversion takes place until December 31 2018.

International Status of Petro

At the international stage, however, Petro still faces the U.S. sanctions, with those imposed in March particularly targeting it as the forbidden currency for US citizens to make transactions with.

Yet, during the presale for this currency which took place in February 2018, the Petro allegedlyraised more than 5 billion dollars based on 201,000 officially documented purchase offers. The buyers arguably came from 133 countries that have expressed interest in investing in Petro, including Russia, Brazil, China, the United States, Mexico, Germany and other countries. At the same time, some experts went on to say that Petro should be described as a “scam” based on the quality of organization of its initial sale.

In response, the Venezuelan authorities put a lot of effort into promoting the Petro currency as a valid alternative to the dominance of certain fiat currencies, such as the US dollar, in oil trading business. To that effect, the state of Venezuela will start using use the Petro cryptocurrency in international transactions related to oil and oil-based products in 2019, with the government authorities promising to submit Petro to the OPEC and validate it as “solid and reliable currency” for the international oil trade. Based on the reports from October 2018, the worth of the contracts involving the purchases made with Petros exceeds USD 500 million.

In May 2018, Russia’s Evrofinance Mosnarbank became the first international financial institution to accept transactions with Petro. The same institution is preparing to offer special Petro wallets to its customers. This hardly comes off as a surprise, as Russia is reported by some media to be behind the Petro project which is described as a tool designed to skirt the US sanctions.

Turkey and China are also counted among the supporters of Petro and its representatives have expressed interest in using it as the currency for transactions between their countries and Venezuela.

Availability of Petro

Upon its launch in October, Petro was available for purchase with fiat currencies which included dollars, yuans, euros, rubles and rupees, with supported cryptocurrencies being Bitcoin and Litecoin. Purchases of Petro can be allegedly made with cash by having the buyer visit the premises of the Venezuelan National Superintendence of Cryptoassets and Related Activities (SUNACRIP), or by going to the Petro’s official website. As of December 2018, the official wallet on the currency’s website is still unavailable.

One of the issues Petro faces in its quest for international recognition is the fact Google suspended Petro’s digital wallet app from its store. As a response, the Venezuelan government resorted to issuing certificates of purchase which serve as the proof of ownership as well as a makeshift “wallet”. To make the procedure run in line with administrative demands, the buyers of Petro are required to undergo know-your-customer (KYC) verification which also includes fingerprinting.

As of December 2018, the availability of Petro on the major crypto exchanges is still limited. In October 2018, the Venezuelan government announced that it authorized six exchanges to transact with PTR: Amberes Coin (amberescoin.com), Afx Trade (afx.trade), Bancar (bancarexchange.io), Cave Blockchain (caveblockchain.com), Cryptia (cryptiaexchange.com) and Criptolago (criptolago.com.ve).

How Does Petro Work?

By its relationship with the Venezuelan currency bolivar, Petro can be said to operate as a sort of an equivalent of its stablecoin, similar to what Tether (USDT) aims to become for the US dollar. Despite claiming to use its “own blockchain” in its white paper, Petro’s technical foundation is sometimes described as being built upon the NEM blockchain, while some call its design a clone of Dash. This prompted the NEM representatives to confirm that NEM is an open source tech and that it does not have control over projects built on it.

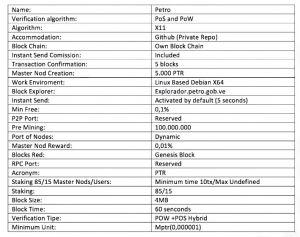

The minimal unit of the Petro coin is called Mene (mPTR) and it’s the equivalent of one-millionth part of the Petro or 1/1.000.000. Petro describes itself as using the hash X11 algorithm as the “safest algorithm” for cryptocurrencies. Block verification model used with Petro is described as the hybrid of the Proof of Work and Proof of Stake. The implemented PoS requires the existence of an agreement between nods and prevents double spending problems as well as potential cyber attacks, based on its need for 100% consensus.

Blocks on the Petro blockchain are generated on the 60-second basis or by demand, which is described as the “guarantee” of sufficient speed in processing of new blocks. Each transaction is verified after 10 blocks are generated. To make the blockchain less demanding and arguably more efficient, the Petro developers promise that each block will have a logical capacity of the 4MB worth of information, with the block time amounting to 60 seconds. Creation of master nods requires 5.000 PTR and transactions are described as being delivered in less than five seconds.

Petro is supposed to be treated “pre-mined” by the Venezuelan government which means that new PTR tokens cannot be created after its issuance takes place. Petro is supposed to be issued in a series of emissions in limited quantities. The initial amount of issued Petros in the first emission is supposed to be limited to 100 million, with 51% of the tokens set aside as the reserve and 49% made available to the public. Instead of mining, “passive income” with Petro is generated by holding or accumulating its coins. The incentive for staking is to be distributed by the following ratio: 85% for the master nodes and 15% for the users, with the possibility for this model to be changed by the SUNACRIP in the future.