Crypto Market Sentiment Drops, Three Major Coins Remain Positive

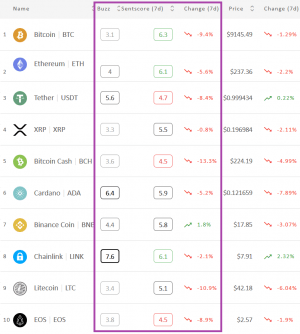

After last week’s jump towards the positive zone, crypto market sentiment score (sentscore) took a step away from that level. The combined moving 7-day average sentscore for the top 10 coins now stands at 5.45, compared to 5.77/10 seven days ago – but still being higher than 4.92 recorded two weeks ago.

The scores of all but one coin decreased over the course of the last seven days. Unlike a week ago, when all but tether (USDT) were green, now only binance coin (BNB)‘s sentscore has increased.

The three that stand out the most, thanks to their largest drops among the top 10, are bitcoin cash (BCH), litecoin (LTC), and bitcoin (BTC), respectively.

The decrease in the overall sentscore includes one of the four coins that were in the positive zone last week dropping out of that group, this being cardano (ADA), now sitting at the verge of the positive zone. The remaining three – BTC, ethereum (ETH), and chainlink (LINK) – all saw drops in their respective scores as well.

More coins have dropped back into the 4-4.9 range, but no coin is near the negative zone.

Sentiment change among the top 10 coins*:

Interpreting the sentscore’s scale:

– 0 to 2.5: very negative

– 2 to 3.9: somewhat negative zone

– 4 to 5.9: neutral zone

– 6 to 7.49: somewhat positive zone

– 7.5 to 10: very positive

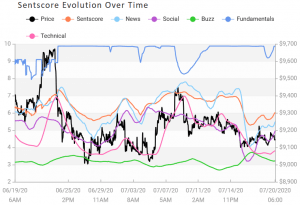

Now zooming in on the 24-hour timeframe, even with the daily growth in individual scores of the vast majority of the top 10 coins, we find the combined average sentscore down yet again. It is below the 7-day sentscore, as well as the last Monday’s 24-hour sentscore of 5.4 – now standing at 5.2. Only bitcoin is in the positive zone, and with the score of 6, with most others sitting in the 5-5.9 range. Nonetheless, of the three below that level, one – BCH – dropped into the negative zone.

Daily Bitcoin sentscore change in the past month:

As for the other 29 coins outside the top 10 list, we see a mixed bag in the last week. While some increased significantly, up to 13% or more, others had similar percentages but in the opposite direction.

___

* – Methodology:

Omenics measures the market sentiment by calculating the sentscore, which aggregates the sentiment from news, social media, technical analysis, viral trends, and coin fundamentals-based upon their proprietary algorithms.

As their website explains, “Omenics aggregates trending news articles and viral social media posts into an all-in-one data platform, where you can also analyze content sentiment,” later adding, “Omenics combines the 2 sentiment indicators from news and social media with 3 additional verticals for technical analysis, coin fundamentals, and buzz, resulting in the sentscore which reports a general outlook for each coin.” For now, they are rating 39 cryptocurrencies.