Countries Should Prevent ‘Regulatory Arbitrage’ for Stablecoins – FSB

The Financial Stability Board (FSB) has warned governments that “global stablecoins” that enter the mainstream financial system through mass use across borders could represent a risk to financial stability. To mitigate this, the agency said countries should work to prevent “regulatory arbitrage and harmful market fragmentation” in the stablecoin space.

The emergence of global stablecoins (GSCs) would pose greater risks to financial stability than existing stablecoins, said the report, and it may also “challenge the comprehensiveness and effectiveness of existing regulatory, supervisory and oversight approaches.”

The FSB report stated that,

“Ensuring appropriate regulation, supervision and oversight across sectors and jurisdictions will therefore be necessary to prevent any potential gaps and avoid regulatory arbitrage.”

Headed by the US Federal Reserve Governor and Vice Chairman Randal K. Quarles, the FSB is an international organization set up in 2009 by the G20 countries to monitor and make recommendations about the global financial system. The organization is currently made up of central bankers and government officials from the world’s largest economies, as well as a number of international organizations.

In the report, titled Regulation, Supervision and Oversight of “Global Stablecoin” Arrangements, the FSB further claimed that the current generation of stablecoins are still not being used for payments “on a significant scale,” making them less of a threat for now.

However, the report also noted that “vulnerabilities” in the stablecoin and digital asset space have grown over the course of 2020 and 2021. Specifically, it warned that increased participation in the market for digital assets by retail investors “could give rise to broader financial stability issues through an erosion of trust in the financial system.”

This new report comes after the international body last year published its “high-level recommendations” for governments to regulate global stablecoins. The recommendations, which still stand today, among other things, included points like:

- ensure authorities have “the necessary powers and tools, and adequate resources, to comprehensively regulate, supervise and oversee” global stablecoins;

- ensure cooperation and coordination between authorities, “both domestically and internationally”;

- ensure global stablecoins have systems in place for “collecting, storing and safeguarding data.”

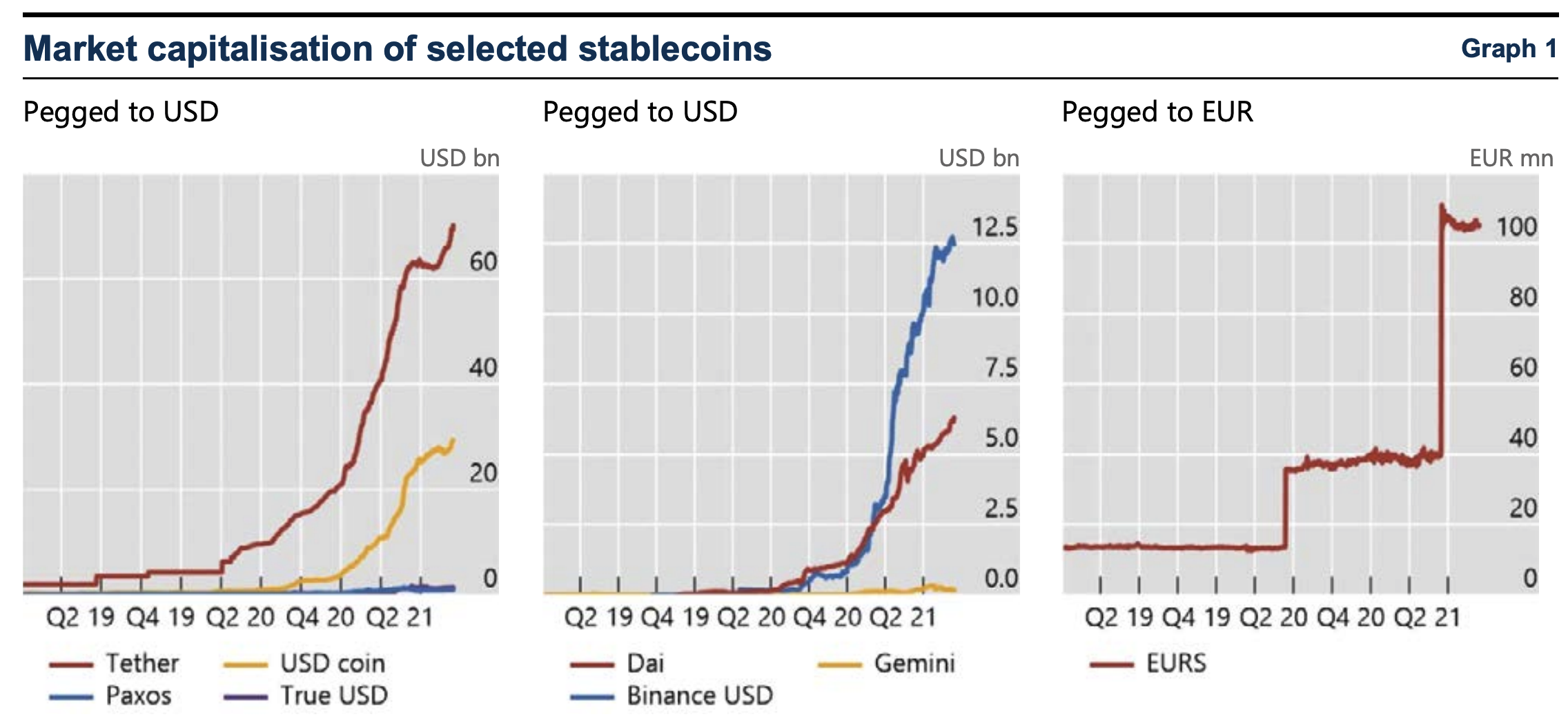

Since the publication of the recommendations, the FSB noted that the market capitalization of existing stablecoins has continued to grow, along with the broader crypto market, to a level of about USD 123bn as of September 2021.

As the currently most important USD-pegged stablecoins, tether (USDT), USD coin (USDC), and binance USD (BUSD) were all named in the report, while EURS was named as the leading euro-pegged stablecoin.

However, the report said that the functions performed by the existing stablecoins remain “limited” as of now, given that they are mainly used for investing in “speculative crypto assets.”

“Nevertheless, this dynamic, where stablecoins can help to facilitate speculation in crypto assets and DeFi [decentralized finance] structures, with increased participation by retail investors, could raise broader issues of trust in the financial system as a whole,” the FSB wrote.

Finally, the G20-appointed agency said that it will “continue to support” the implementation of its high-level recommendations, and that by July 2023 it will have completed a review of its recommendations in coordination with other relevant international organizations.

____

Learn more:

– Stablecoins Reign Among Top Coins: Why and What It Might Mean

– USDC Operator Happy After Yellen Calls Stablecoins ‘National Security’ Concern

– ‘Same Activity, Same Regulation’ For ‘Global Stablecoins’ – FSB Chair

– BIS Unsure if ‘Global Stablecoins’ Can Help Cross-border Payments

– CBDC Shilling and Bitcoin Bashing Might Reach the G20 Level

– This Is How G20 Might Keep Crypto And Stablecoins at Bay