Bitcoin Price Prediction – US Inflation Hits 40 Year High, Fuels Big Rate Hike Sentiment

Most cryptocurrencies experienced a bloodbath during the US session, with a dramatic selling trend following the release of US CPI figures. Recalling our Asian session Bitcoin price prediction, Bitcoin has traded dramatically bearish, losing more than 3% to trade below $19,000.

In September, a key measure of consumer prices in the United States hit a 40-year high, highlighting persistent, higher inflation that is putting pressure on households and driving the Federal Reserve toward another large interest rate hike.

Another hotter than expected #CPI surprised investors. Sept. CPI rose .4%, double expectations. YoY prices rose 8.2%. The 6.6% YoY rise in core CPI is the most since 1982. OER had biggest monthly spike since 1990. The #Fed is losing its #inflation fight. Soon it will surrender.

— Peter Schiff (@PeterSchiff) October 13, 2022

Why is Crypto Crashing – CPI Day Data

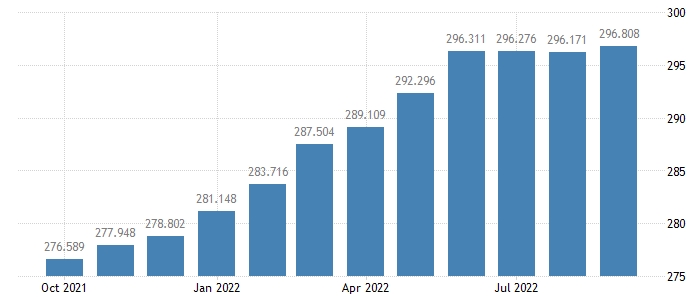

September 2022 marked the third consecutive month in which annualized consumer price inflation in the United States was less than 9%. It was the lowest rate since February, but it was still higher than the 8.1% predicted by the market.

The core CPI increased by 0.6% over the previous month for the second time in three months. The Consumer Price Index (CPI) rose 0.4% month-over-month and 8.2% annually.

The annual rate also remained significantly above the US Federal Reserve’s 2% target, indicating that policymakers are likely to maintain their hawkish rhetoric and rapidly raise interest rates. The Consumer Price Index in the United States was 296.808 in September, compared to 296.171 the previous month and 296.43 points expected by the market.

In response to stronger-than-expected economic figures, policymakers have launched the most vigorous tightening campaign since the 1980s. Although the job market and consumer demand have shown remarkable resilience thus far.

In September, the unemployment rate fell to a level not seen in half a century, and companies have continued to increase wages in order to compete for the labor they need to meet consumer demand.

#CPI even higher than the inflation nowcast, which was already higher than consensus. But look ahead – on track for a 9% annualized headline m/m #CPI for next months report. It's pretty much baked in at this point.

— Bob Elliott (@BobEUnlimited) October 13, 2022

The #FOMC has no choice but to keep tightening. pic.twitter.com/KiyOMK6BoL

The CPI figure, following on the heels of last week’s positive employment report, guarantees a further rate hike of 75 basis points at the Federal Reserve’s policy meeting in November. Financial market participants bolstered their wagers on the upcoming massive increase.

Hence, the release of US CPI figures triggered a sharp sell-off in both the cryptocurrency and stock markets.

Bitcoin Price Prediction after CPI Data Dip – $18,000 Is the Bottom?

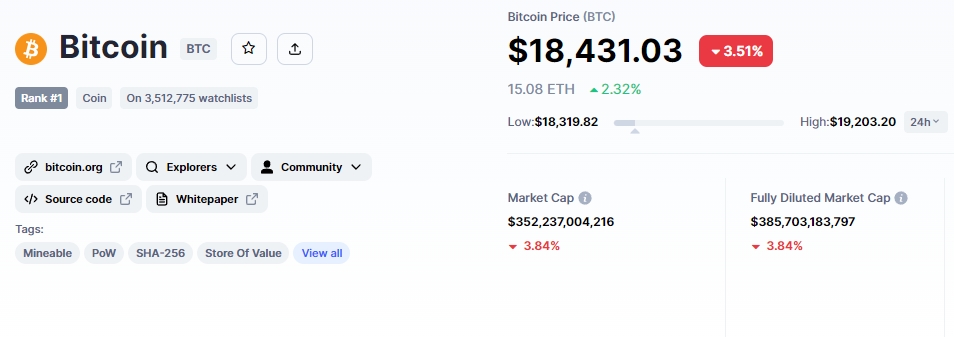

The current Bitcoin price is $18,366.82, and the 24-hour trading volume is $32 billion. Bitcoin has fallen by 3.84% in the last 24 hours. With a live market cap of $352 billion, CoinMarketCap currently ranks first. It has a maximum supply of 21,000,000 BTC coins and a circulating supply of 19,177,900.

Bitcoin has broken through a strong triple-bottom support level of $18,665. The MACD and RSI indicators in the 4-hour timeframe support a selling trend. The MACD, in particular, has shown a bearish crossover, indicating a high likelihood of a bearish trend continuation.

For the time being, the BTC/USD coin may find immediate support near $18,250, which is extended by a triple bottom pattern. Bitcoin is likely to show a bullish correction above the $18,250 level.

At the same time, the formation of the “three black crows” candlestick pattern indicates a strong selling trend. Following a break above $18,250, Bitcoin is likely to target the next support level of $17,930 or $17,599.

Alternative Crypto – Tamadoge & IMPT

Tamadoge, a meme coin, is gaining traction, rising more than 12.28% in the last 24 hours to $0.04158. OpenSea now sells ultra-rare Tamadoge NFTs starting at 1 WETH. Moreover, TAMA has become the third most valuable meme coin in the crypto space.

If you’re wondering where to buy Tamadoge at the moment, the top cryptocurrency exchanges right now are OKX, MEXC, XT.COM, BKEX, and BitMart.

In addition to Tamadoge, a new project IMPT also remains in the highlights. The project’s native currency, the IMPT token, has already raised more than $4 million after only 9 days of the presale, having sold 226 million tokens.

Despite the fact that the blockchain-based carbon credit marketplace launched its auction during a cryptocurrency bear market, demand for the marketplace token remained high.

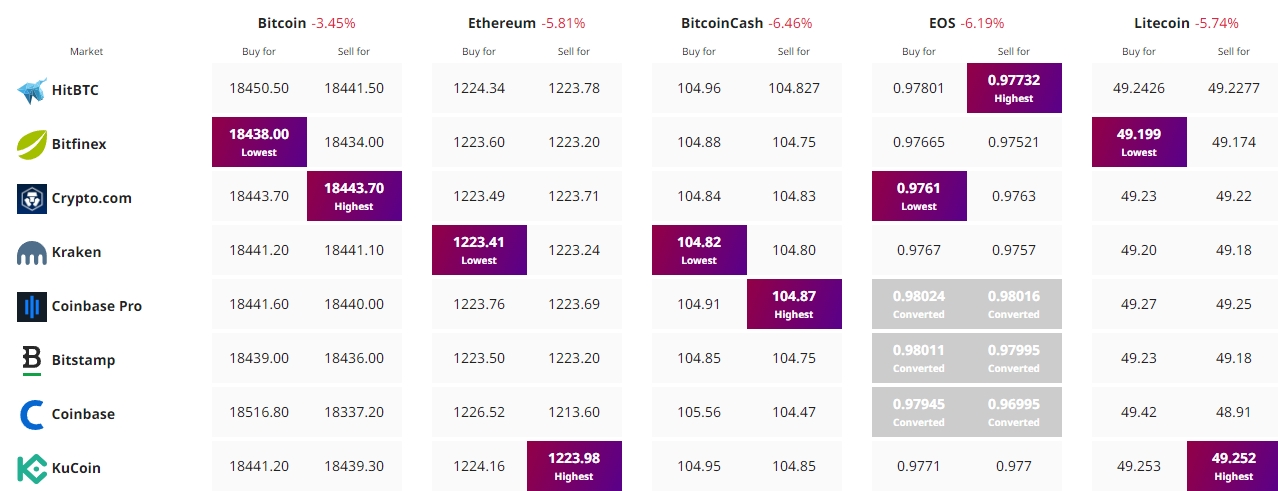

Find The Best Price to Buy/Sell Cryptocurrency: