Bitcoin Price Prediction: Indecision as Symmetrical Triangle Forms, $26.5K to $27.5K Range in Focus

In the current market, Bitcoin is showing signs of indecision as a symmetrical triangle formation takes shape.

Traders and investors are closely watching the price action within the $26.5K to $27.5K range, as it holds the key to the next significant move in Bitcoin’s price.

Let’s analyze the technical indicators and factors influencing the market to gain insights into the potential direction of Bitcoin.

Bitcoin 2023 Conference in Miami: Unveiling the Future of Cryptocurrency

The Bitcoin 2023 conference, known as the largest global Bitcoin gathering, kicked off this week in Miami Beach with a noticeably smaller attendance compared to previous years.

While organizers expected around 15,000 attendees this year, the event drew over 35,000 participants in 2022.

The atmosphere at the conference has been more subdued due to the recent decline in digital asset values and various cryptocurrency scandals, resulting in some empty seats and a less vibrant atmosphere.

Bitcoin 2023 Conference Kicks Off in Miami | CoinMarketCap https://t.co/ngDeH5090J

— AstroModi (@AstroModiEN) May 19, 2023

At the Bitcoin2023 conference in Miami today, MicroBT, a leading Bitcoin mining equipment manufacturer, unveiled three new mining rigs, including one that is currently the most powerful in the market.

Amidst the ongoing debate surrounding the substantial energy consumption of miners, the primary focus of the rig manufacturer for the new machines was to utilize sustainable energy sources.

In their news release, the company emphasized the need to upgrade the power source for Bitcoin mining by exploring greener alternatives, considering the energy crisis and the impact of global warming.

Bitcoin mining rig maker MicroBT unveiled one of the most powerful machines on the market: the M53S++ can, which deliver 320 TH/s of computing power. @egreechee reportshttps://t.co/UrFn9aNefU

— CoinDesk (@CoinDesk) May 18, 2023

The event this year featured notable speakers such as author Michael Lewis and U.S. presidential contender Robert F. Kennedy.

However, the lower turnout is attributed to the current crypto winter that is affecting the industry.

Industry gatherings like Bitcoin 2023 play a crucial role in fostering networking and facilitating in-person connections among experts in the digital asset space as the crypto market continues to evolve.

Nonetheless, the reduced interest from organizers and investors in the Miami Bitcoin 2023 conference, compared to previous years, had an impact on the value of BTC/USD on Friday.

MicroStrategy Considering the use of Bitcoin Ordinals for app development Michael Saylor claims

During the Bitcoin 2023 Conference in Miami, Michael Saylor revealed that MicroStrategy is actively exploring the use of Ordinals for application development.

MicroStrategy Looking at Bitcoin Ordinals for App Development, Says Michael Saylor

— Decrypt (@decryptmedia) May 19, 2023

► https://t.co/Ock6ofeZCk https://t.co/Ock6ofeZCk

The introduction of Ordinals in January, a technology used to create NFT-like assets on the Bitcoin network, has triggered a new wave of experimentation with the pioneering cryptocurrency.

Saylor emphasized that businesses currently lack adequate security compared to Bitcoin, and leveraging the capabilities of the largest cryptocurrency could potentially provide a “new level of security” that is currently unavailable.

Saylor’s remarks helped alleviate some of the pressure on BTC/USD prices.

Coin Cafe Ordered to Repay $4.3M in Fees for “Wiping Out” Investors’ Bitcoin Accounts

Coin Cafe, a cryptocurrency trading platform, has been compelled to reimburse its users with $4.3 million.

The platform faced allegations of imposing “excessive and undisclosed fees” for storing Bitcoin, resulting in complete depletion of funds in certain accounts.

Coin Cafe Ordered By New York AG to Pay Back $4.3M in Fraudulent Fees https://t.co/r7ZODk90HO #nft #nftcommunity #cryptocommunity

— CryptoLab (@crypto_thinktk) May 18, 2023

According to New York State Attorney General Letitia James, the exchange was discovered to have charged “excessive” fees for Bitcoin custody without adequate disclosure to clients.

Consequently, some investors experienced complete depletion of their accounts.

In addition to condemning the “misleading marketing” practices, James highlighted the role of “ineffective regulation” as a contributing factor.

She emphasized the need for stricter oversight in the Bitcoin market.

The looming possibility of regulatory measures in the crypto market also exerted downward pressure on Bitcoin prices this week.

Bitcoin Price

Bitcoin is currently trading at $26,925, experiencing a decrease of 1.20% on Friday.

The increasing demand for crypto regulations and a decline in interest in the Bitcoin 2023 Miami Conference are exerting pressure on the largest cryptocurrency by market cap.

However, Michael Saylor’s positive remarks continue to support BTC/USD.

The BTC/USD pair is currently facing a barrier at the $27,200 mark, and a successful bullish surge above this point could drive the BTC price towards $27,700.

The existence of a double top pattern provides additional support for this important level, and a breakthrough at $27,700 could potentially propel BTC even higher towards $28,200.

The BTC/USD pair faces an immediate support level at $26,600, and a breach below this point could potentially lead to a decline towards $26,200.

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), two widely used technical indicators, currently indicate a neutral market condition for Bitcoin.

Bitcoin’s price exhibits volatility, with fluctuations occurring above and below the 50-day exponential moving average. This indicates a mixed sentiment among investors regarding the market’s direction.

Today, the $26,750 level holds significant importance. If Bitcoin’s price maintains above this level, it may be worth considering buying positions, with targets set at $27,250 and potentially $27,650.

Top 15 Cryptocurrencies to Watch in 2023

The Cryptonews Industry Talk team has curated a list of promising cryptocurrencies for 2023 that exhibit strong potential.

These cryptocurrencies demonstrate significant prospects for growth in both the near and distant future.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

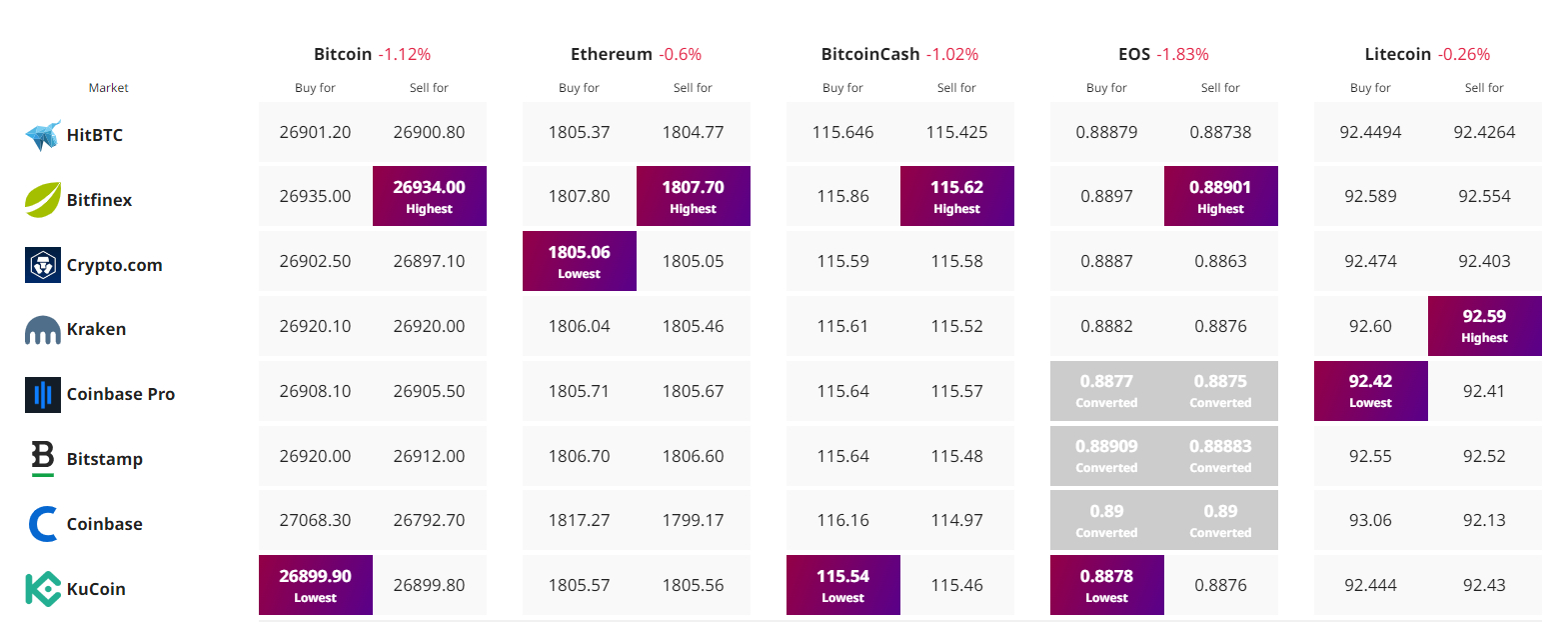

Find The Best Price to Buy/Sell Cryptocurrency