Bitcoin Fees Rising, Surprising Even Industry Insiders

After the third halving, Bitcoin (BTC) fees are on the rise again, as it’s getting more difficult to get a transaction included into the nearest block.

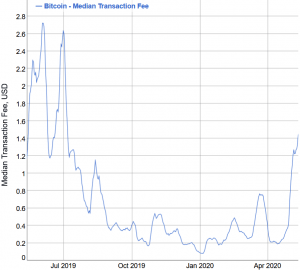

After reaching its highest point in the past ten months of USD 3.19 on May 8, the average BTC transaction fee dropped 40% to USD 1.92, just two days later. However, it’s been rising again since, first to USD 2.5 on May 11, then USD 2.8 on May 12.

The 7-day moving average shows a near-constant rise since mid-April, including an increase in fees from USD 2.27 on May 10 to USD 2.5 on May 12.

Looking at the median transaction fee, we find it rising from USD 1.15 to USD 1.8 between May 10-12. In the same time period, the 7-day moving average shows an increase from USD 1.28 to USD 1.46.

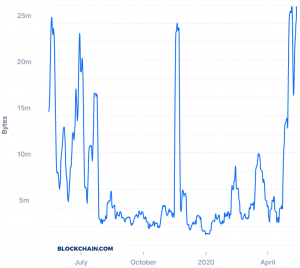

After the halving, block time is increasing, while the number of unconfirmed transactions is growing, forcing users to pay higher fees in order to get their transactions confirmed faster. However, users still can use Bitcoin SegWit transactions to reduce fees.

The aggregate size in bytes of transactions waiting to be confirmed

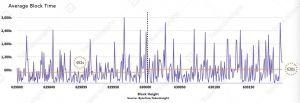

As reported yesterday, 12 hours following the halving, the average block time returned to nearly 10 minutes per block, from c. 8 minutes a day before halving. And it’s getting longer now. Bitinfocharts.com shows the current (15:28 UTC) block time to be 11 minutes 26 seconds.

According to Johnson Xu, the Chief Analyst at TokenInsight, a token data and rating agency, the chart below shows the actual 200 block time pre-halving and post halving. Before the halving, on average, it took 490 seconds (more than 8 minutes) to find a block, after the halving, it increased to 630 seconds, or 10 minutes and 30 seconds.

“This clearly shows that there is some drop in hashrate after the halving, indicated by longer than pre-halving average block production time,” he said.

‘And that’s “low”??!’

Meanwhile, a discussion is being led online over Bitcoin fees: whose duty is to know the rates, and is the need to check different sources and determine a fee one’s willing to pay for a simple transaction something that needs fixing?

Founder and CEO of open-source tool for generating Ether wallets and handling ERC-20 tokens MyCrypto, Taylor Monahan, discovered a higher-than-expected fee after a year of no BTC transactions. “Is it really [USD] 4 to send a basic [transaction]?,” she asked on Twitter. “And that’s “low”??!”

As a hodler, she said she was surprised how little she knew about what constitutes a reasonable fee. Some argued that it’s each person’s duty to check the fees. “Don’t blame Bitcoin unless you checked the mempool [where all the valid transactions wait to be confirmed by the Bitcoin network] for yourself and found a rate you were willing to pay,” writes ‘BitcoinHal’. Monahan, however, finds that this is exactly the problem, not with BTC per se, but crypto in general. “They don’t solve this problem, they only avoid via non-use,” she writes, adding: “The problem isn’t the price, it’s how a normal person can determine the price.”

She goes on to reiterate that she didn’t say fees aren’t useful or needed, but difficult to figure out. “Which is absurd. How are non-crypto folks supposed to do this.”

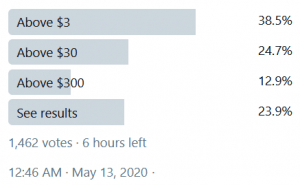

Meanwhile, Eric Wall, the Chief Investment Officer at crypto asset management firm Arcane Assets, asked Bitcoiners at what fee level they get dissatisfied with BTC, with most replying ‘above USD 3.’

Also, in a separate survey, 42% of respondents said that they’d support a hard fork if the fees surpass their pain threshold and stay there for a month with no sign of abating.

Many people commented though that their answer depends on the Bitcoin price, on whether the question is asked for now or for ten years from now, on whether there’s another coin with this level of mainstream adoption, etc. Others argue that the answer is ‘never.’

__

Meanwhile, BTC is now (15:28 UTC) trading at USD 9,127. It’s up 3% in a day and down 1.6% in a week.