Binance Provides Proof of Reserves in Response to FTX Collapse – This is How Much Money They Have

The major crypto exchange Binance has revealed details about its reserves as nervousness started to spread in the crypto community following the collapse of rival exchange FTX.

According to the information Binance has revealed so far, the exchange held the following digital assets as of November 10:

In total, the current market value of these cryptoassets at the time of writing is close to $71bn.

The exchange stressed in an article published on its website that the above is “not a complete set of data,” and that further details will be shared in an upcoming full audit report.

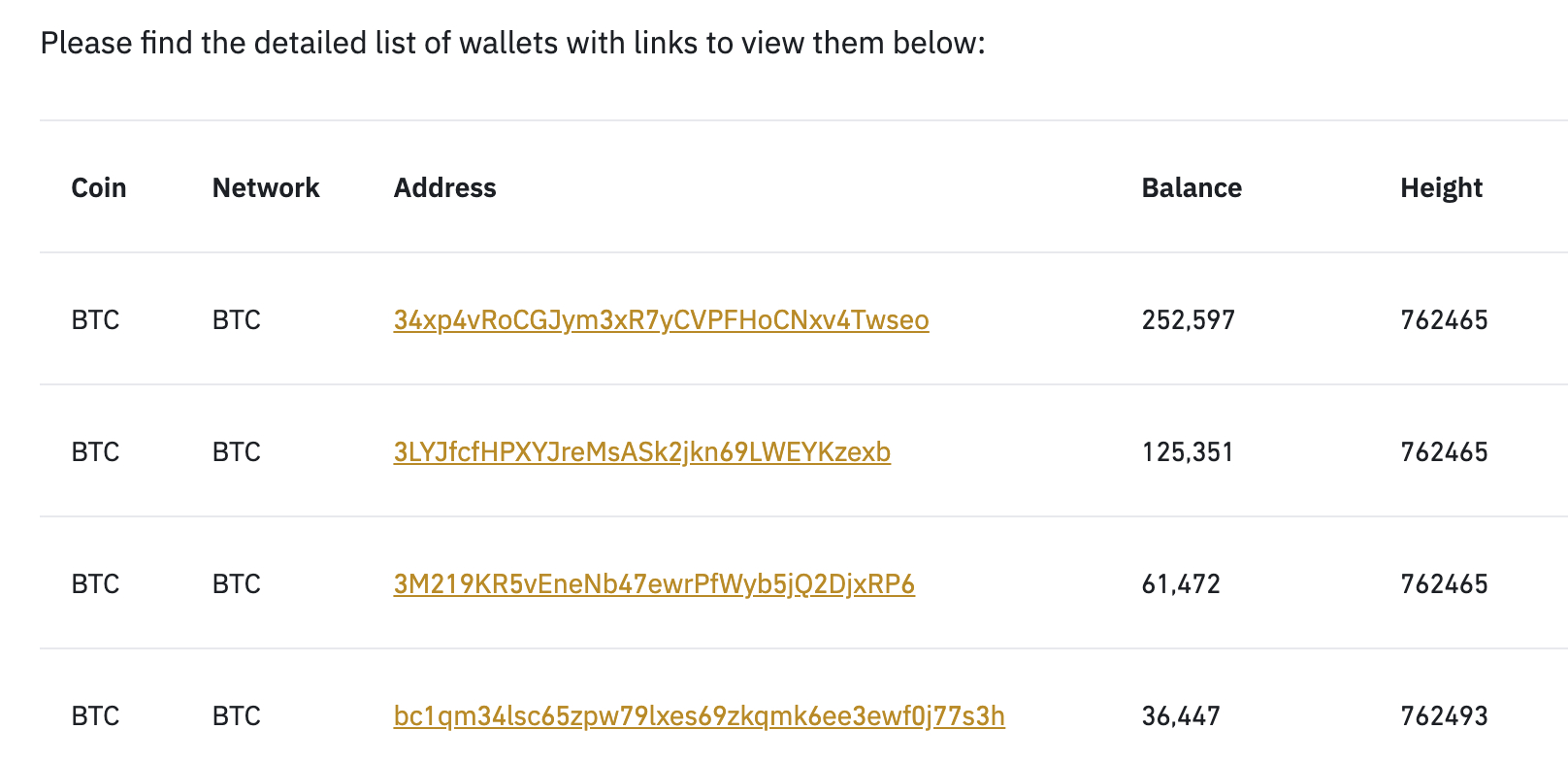

In addition to the balance of the six major coins, the article also provided the specific wallet addresses that are under Binance’s control on the BTC, ETH, BSC, BNB, and TRX networks.

The same information was also shared by Binance CEO Changpeng (“CZ”) Zhao himself on Twitter. He added in a follow-up tweet that this list of addresses is tentative until a full proof of reserves has been completed, which he said “may take weeks.”

This is while we are waiting for the proof-of-reserves to finish. Waiting on a vendor that everyone uses. But it seems like may take weeks, we might try to find someone else.

— CZ 🔶 Binance (@cz_binance) November 10, 2022

Binance added on its website that its so-called “SAFU fund,” an emergency insurance fund for users, has been topped up and now stands at $1b.

Other companies follow suit

In addition to Binance, companies such as Crypto.com, Kraken, OKX, Deribit and a number of others have either published, or said they will publish, proof of reserves, after CZ first encouraged industry players to do so.

All crypto exchanges should do merkle-tree proof-of-reserves.

— CZ 🔶 Binance (@cz_binance) November 8, 2022

Banks run on fractional reserves.

Crypto exchanges should not.@Binance will start to do proof-of-reserves soon. Full transparency.

The latest update on Friday came from Crypto.com CEO Kris Marszalek, who shared his company’s wallet addresses directly in a Twitter thread. Like Binance’s CZ, Marszalek also stressed that the wallets represent only a portion of the reserves, and that a full proof of reserves report can be expected “in the next couple of weeks.”

Please expect a full audited Proof of Reserves from us in the next couple of weeks, confirming the full 1:1 reserve of all customer assets.

— Kris | Crypto.com (@kris) November 11, 2022