Binance CEO Says Expansion to Japan Is ‘Unlikely’

The Binance chief and founder Changpeng “CZ” Zhao has talked down the possibility of his exchange expanding to Japan. Although he stopped short of ruling out launching a Japanese branch, he indicated that the prospects of opening a Binance platform in Tokyo were “unlikely.”

The Binance boss was speaking in a Q&A session with the Japanese media outlet Coin Post, and gave a further indication that East Asian markets, particularly those in South Korea and Japan are hard to crack.

Last week, Binance Korea announced it was closing its doors, with a full “hard” shutdown slated for next month.

And earlier this year, Binance suffered another blow in its hopes to crack the Japanese market with the TaoTao crypto exchange ending a possible partnership deal after 10 months of negotiations.

Shortly after, TaoTao was taken over by domestic financial giant SBI, another indication that if rich pickings are to be had in the crypto market, it will likely be domestic players who are making them.

Zhao stated that he had “seriously considered establishing a base in Japan” after the Japanese government introduced its regulatory permit system back in 2017.

But, he added, a number of bottlenecks had hindered Binance’s progress into the Land of the Rising Sun. These included, he said, the fact that Binance’s international platform handles some 80+ tokens, but Japanese law strictly polices the tokens exchanges are allowed to handle. Only Financial Services Agency (FSA)-approved tokens can be offered in trading pairs.

The FSA has so far approved just 30 tokens.

“The situation in Japan hasn’t changed much” since 2017, he added.

Zhao also stated that he had contemplated making an acquisition deal with an established Japanese player, but opined that Japanese legislation would minimize Binance’s advantages over Japanese competitors.

The 21 existing Japanese exchanges have close ties to banks and other market players, another factor that makes the market so difficult to crack for overseas players. They also have close ties to key media groups and have strong marketing departments with deep experience of working in the Japanese market.

These, Zhao concluded, “aren’t Binance’s strong suits.”

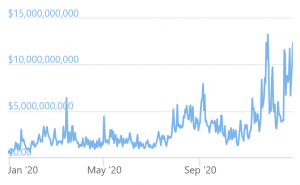

Trading volume on Binance:

As reported, Binance expects to have profits of USD 800m to USD 1bn this year, up from about USD 570m last year.

Meanwhile, while another major crypto exchange, BitMEX left Japan earlier this year, Kraken has returned to this market, while Coinbase is seemingly still working on this. Also this year, Japanese market-leading crypto exchange bitFlyer said it has linked its bitFlyer Europe operations with its domestic platform – allowing European traders to access bitcoin (BTC)-Japanese yen trading pairs.

___

Learn more:

Crypto Exchanges to Spend 2021 Focusing on DeFi, UX, and New Services

Major Exchanges Are Hiring: Here’s What the Data Is Saying

Binance.com Closing Another Door On Americans, Responsible For 7% Of Its Traffic

Binance Shoots Itself In The Foot Amid Regulatory Scrutiny On Exchanges

Binance Takes The Largest Piece of Crypto Activity Pie in Africa

Binance Prepares ‘For the Next Wave’ With ‘Largest Upgrade’