In Five Months ICOs Raised More Than In Five Years

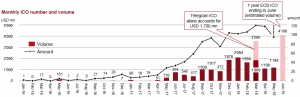

Over 537 initial coin offerings (ICOs) conducted in the first five months of this year raised a combined total of USD 13.7 billion – more than the sum of all ICOs before this year, starting 2013, according to a second global ICO report, done by the Crypto Valley Association (CVA) and Strategy&, the strategy and consulting division of CVA member PwC, a consulting firm.

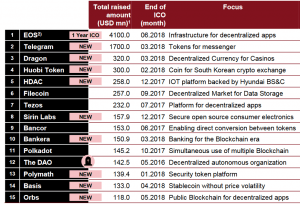

1) Calculations based on currency exchange rates on end date of ICO. As Ether and Bitcoin exchange rates are highly volatile, actual and current market capitalization of the companies today may differ significantly from figures shown in the table. ICO funding amount until 29.05.2018 considered

The report concludes that ICOs have gone through a hype cycle in 2017, and are “more mature and established” in 2018. Daniel Diemers, Fintech Leader Switzerland, Head of Blockchain EMEA at Strategy&, says for the press release, “After all the hype of 2017, this year has seen the ICO sector becoming more mature and established, with an improved focus on best business and legal practice, investor relations and fundraising.”

Also, according to the report, strategically, ICOs continue to crowd out traditional venture capital (VC) funding, especially in technology and Blockchain-related startups. However, hybrid models (combining classic VC/PE (private equity) funding and ICO) are increasingly establishing themselves as a valid funding alternative, it added.

Other findings in the report:

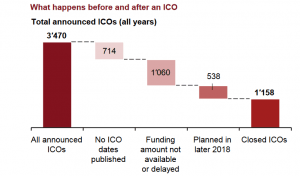

- Around a third of all announced ICO projects close successfully

- Many projects are delayed and loose momentum during ICO preparation processes – reasons can reach from legal struggles to problems within the ICO project team

- ICOs for which no funding amount is available are believed to be cancelled – however, it can’t be excluded that those project continued away from public attention

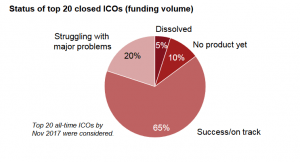

- The majority of top funded ICO projects are on track and the product is further being developed – only few have no product yet

- Some companies that launched ICOs struggle with major difficulties such as legal or governance issues

- ICO projects with smaller scale funding then the top 20 have a higher tendency to get off track or even dissolve – reasons can be manifold (e.g. legal, team, technical, product, etc.)

Telegram and EOS are what the report calls “first true ICO Unicorns” due to the amount they raised – USD 1.7 billion and USD 4.1 billion, respectively. The rest of the 15 biggest ICOs since 2016 includes Dragon, Huobi Token, and HDAC. Not a single one followed the Unicorns in terms of amount raised: the most was raised in the Dragon ICO, a total of USD 320 million, according to the report.

1) Calculations based on currency exchange rates on end date of ICO. As Ether and Bitcoin exchange rates are highly volatile, ac

tual and current market capitalization of the companies today may differ significantly from figures shown in the table. ICO funding amount until 29.05.2018 considered. Petro, the acclaimed USD 5bn ICO by the Maduro government of Venezuela was not considered, as the political opposition claims that the funds did not reach Venezuela

2) EOS conducted a two – phased ICO. In the 1st phase (5 days in June 2017), USD 185m were raised. The second phase lasted 350 days, ending in June 2018.

Countries with the most ICO traction are the Cayman Islands, British Virgin Islands and Singapore, the first two due to hosting the ICO Unicorns. The UK has also been gaining significant traction, as has Hong Kong. To date, around a third of all announced ICOs have successfully closed the funding round.

The US is also deemed an ICO hub where tokens are currently treated as securities, but its regulation policy is described as, “Overall positive attitude, but market still awaits more clarity on protectionary regulations.” It is followed by Switzerland and Singapore, which are treating tokens as assets. Liechtenstein, Gibraltar and Malta are “[following] in the footsteps of Switzerland to position themselves as ICO-friendly hubs.”