What is DeFi in Crypto?

A popular question many beginners in the cryptocurrency space often ask is what is DeFi or what is decentralized finance? DeFi or Decentralized Finance is the term used to describe technologies that are central to powering cryptocurrencies. These technologies such as the blockchain, remove the need for traditional intermediaries within the financial ecosystem, enabling direct peer-to-peer transactions.

Unlike centralized financial institutions, DeFi is completely unregulated, which means that there are no third-party regulators managing transactions or policies. Instead of a central institution controlling the process, all affairs are registered on the blockchain, so what exactly is the blockchain?

Blockchain

The blockchain is a distributed register or ledger that records all transactions in the ecosystem, and is public for all to see. Transactions are secured by encrypted code, which provides anonymity to the person(s) conducting the transfers.

Every transaction is recorded in a block, and validated by the ecosystem via automated processes. Information cannot be altered by any party.

Centralized Finance (CeFi) vs Decentralized Finance (DeFi)

To understand what is DeFi? We have to go deeper into the types of financial structures that exist and what separates them. There are several differences between Centralized Finance (CeFi) and Decentralized Finance (DeFi), one of the main ones is that there is no singular controlling institution in DeFi.

An example of Centralized Finance is the U.S. Federal Reserve, which is called a “Central Bank”, not only does it print the Dollar, but it is also responsible for interest rates, market stimulus, and general monetary policy for the economy. If you go back to 2008, during the financial crisis, the Federal Reserve refused to rescue the failing investment bank, Lehman Brothers, which many say was the catalyst for the crisis.

In terms of DeFi, decentralized finance in crypto was established as a response to the above, to empower individuals to be the custodians of their capital, without agencies like the Federal Reserve, or Lehman Brothers in-between.

Advantages of DeFi

So what are the general advantages of DeFi (Decentralized Finance)? Let’s list them below.

- No single controlling authority

- Easily accessible, no need to apply for a bank account

- Transactions cannot be changed or influenced

- Pee-to-peer, no broker fees

- Fast transaction speed

- Overall transparency in the operation process

Downsides and Risks of DeFi

Although there are many positives of decentralized finance and DeFi protocols, there are also some downsides.

- Lack of governance

- No customer service or protection

- Threat of hacks

- Require manual labor to secure wallets

DeFi Wallets

As briefly mentioned above, you will need a wallet to store your cryptocurrency, however not a traditional one, but a DeFi wallet. So what is this?

DeFi wallets are simply an electronic storage unit for your crypto, which you will be the sole custodian of. A self-custody wallet enables you to house the cryptocurrency, depending on the network of origin. So, if you have Ethereum, and need to store this in a DeFi crypto wallet, the wallet will need to be compatible with the Ethereum network or ERC-20.

MetaMask is an example of an ERC-20 DeFi wallet, which enables you to deposit your ETH, however, if you want to store some BRC-20 tokens, this cannot be done on MetaMask, and you would need an alternative, such as Trust Wallet, which is compatible with the Bitcoin network.

Here are some examples of DeFi wallets:

- MetaMask – Best DeFi wallet in 2024 operating on the ERC-20 network

- Trust Wallet – Well-known wallet for BNB Chain, BRC-20 tokens, and more

- Ledger – Hardware and self-custody wallet, for those who want extra security

- Crypto.com Wallet – Wallet operated by a popular Centralized Exchange (CEX)

All of these wallets have been built to interconnect with DeFi protocols, which are individual programs and systems that help to maintain the wider ecosystem and its automated self-governance. An example of this is a smart contract, which is simply the predefined conditions that all parties have agreed to fulfill.

Types of DeFi Protocols

The role of DeFi protocols is to simply set the rules, with algorithms in place that enforce them on the blockchain. These protocols are in place to govern the usage of cryptocurrencies and other digital assets, like NFTs (non-fungible tokens) on the network.

DeFi protocols are only used on programmable networks such as the Ethereum Virtual Machine (EVM), but not Bitcoin. Bitcoin’s protocols are in place for the governance of Bitcoin transfers, halving, and maintenance of total supply, 21 million BTC.

For programmable networks there are several types of DeFi protocols, and different use cases, below are some of the main.

Decentralized Exchanges (DEXs)

Simply put, a Decentralized Exchange (DEX) is a peer-driven marketplace, where all DeFi transactions take place between individuals. In this system, traders cannot exchange traditional FIAT currencies like USD for Bitcoin but only exchange crypto.

Transactions are done based on smart contracts that help define the terms of engagement between both parties. The use of Automated market makers (AMMs) is also present in DEX, which are robot traders acting as both buyer and seller, to provide liquidity.

Here are some of the main Decentralized Exchanges (DEX)

- UniSwap

- PancakeSwap

- dYdX

Stablecoins

Similar to how Gold is pegged to the USD, stablecoins are cryptocurrencies that have their value tied to another asset. These tokens aim to provide market stability and bring assurance to the market.

As traditional FIAT currencies are not available to trade on Decentralized Exchanges (DEX), stablecoins are used as an alternative store of value against the intraday volatility of other cryptocurrencies.

They are kept stable by leveraging the central bank of the currency they are pegged to, for example, the Federal Reserve and USD. Listed below are the main stablecoins in the market.

- Tether (USDT) – The largest stablecoin with a market cap of over $96 billion, and is pegged to USD.

- USD Coin (USDC) – Held against the U.S. Dollar at a 1:1 ratio to offer stable “digital money for the digital age”.

- TrueUSD (TUSD) – Also has a 1:1 ratio with USD, and is the first cryptocurrency to offer live on-chain attestations

Lending and Borrowing DeFi Protocols

Advocates of Centralized Finance (CeFi) will often comment that the benefit of having an authority figure, can enable functions such as lending and borrowing assets from the said party, but this can also be done in a decentralized manner.

DeFi protocols enable holders of cryptocurrencies to become lenders or borrowers using platforms such as AAVE, where they can supply the tokens they intend to lend. Once supplied, using smart contracts, the token will become available for others to borrow, and make native, based on the platform, in this instance AAVE or aTokens).

The borrower will then need to provide a guarantee that is more than the value of the amount being borrowed, this rate of exchange is ratioed and packed inside of an APY (annual percentage yield)

Here are the top platforms for DeFi Lending and Borrowing:

- AAVE – Leading platform for Lending and Borrowing, facilitates transactions using its native aTokens.

- MakerDao – Creator of the DAI stablecoin, this platform offers stability in the DeFi lending ecosystem.

- Compound – Offers an algorithmic interest rate model, and maintains rate based on general supply and demand.

Yield Farming Platforms

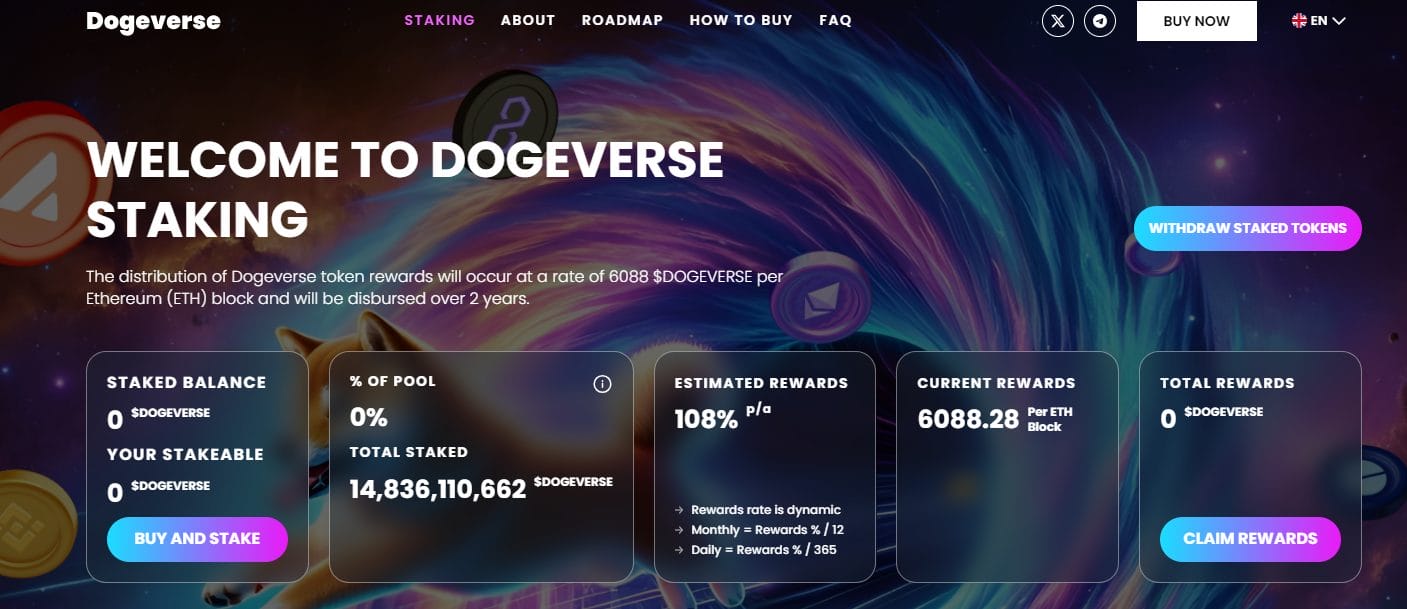

Yield farming is the process where investors stake, and make their cryptocurrencies available to be used on DeFi platforms, in exchange for payment. One of the main use cases of yield farming is to generate liquidity on DeFi platforms, with rewards such as additional crypto provided as a result.

Some notable Yield Farming Platforms include.

- Bitcoin Minetrix

- Meme Combat

- Coinbase

Decentralized Insurance Protocols

One of the drawbacks of Decentralized Finance is that there are some vulnerabilities in terms of being exposed to hackers, or simply losing security keys. Decentralized Insurance Protocols aim to provide cover in the instances where your decentralized finance crypto gets compromised.

Insurance pools are crowd-funded, with money set aside based on the specific threat a user who has bought the insurance has listed as a concern. Should the event occur, the insured party will be sent the funds, after the claim has been verified.

For example, if someone buys insurance against a hack, and this takes place, a claim will be filed and go through a decentralized decision-making process. An investigation will commence, or claim will be directed to voting, where all holders of the insurance protocol token will vote to approve or deny. If approved, funds will be removed from the pool. If denied, they will remain, and earn a yield for those who funded the pool.

Best Practices in DeFi to Minimize Risk

Generally, due to the vulnerability associated with DeFi crypto, it is important to have various safeguards in place. Firstly, make sure that you are educated and aware of the risks associated with DeFi, the possibility of hacks, losing security keys, trading high-risk crypto, and so on.

Then implement processes to help minimize these risks, here are some tips to consider below.

Do Your Due Diligence on a DeFi Project

Whenever you see a DeFi project that you are interested in investing in, you need to make sure you fully research it. Read the project whitepaper and roadmap, and investigate its online reputation to see what is being written about it. Engage with its social media, and see if other would-be investors are asking questions that you might not have thought about.

Treat this as if you were to buy a car you saw listed online, would a photo and description be enough to convince you, or would you need to investigate further?

Have a Good Trading and Risk Management Strategy

It’s vital to have a good strategy for both making an investment and managing it thereafter. If you are a Hodler, and trading long-term, what fundamentals have you researched to let you believe that it is a good investment?

If active trading, are you using technical analysis? How are you calculating your position sizes to ensure you are not overexposed? For example, how much of your account size are you risking per trade? Good traders often risk 1-3% of their account on a single trade, so even if it goes against them, they still have at least 97% left to look for more opportunities.

Use Digital and Physical Security Tools

Digital DeFi wallets like MetaMask are great for holding your ERC-20 tokens, however, you could also consider going offline and using a hard wallet if you wanted more physical security. If you do stick online, make sure you have two-factor authentication on all accounts.

Ultimately, you need to be diligent, as instead of having a custodian, controlling and charging you to manage your transactions, you will need to be more self-sufficient and ensure you keep on top of all the security of your assets.

References:

- https://theguardian.com/commentisfree/2018/sep/03/federal-reserve-lehman-brothers-collapse

- https://www.coindesk.com/learn/what-is-yield-farming-the-rocket-fuel-of-defi-explained/

DeFi Frequently Asked Questions (FAQs)

What is DeFi in simple terms?

Decentralized Finance (DeFi) is a self-governing ecosystem where individuals control the security, storage, and distribution of their digital currencies.

Is DeFi different from crypto?

DeFi is the network where crypto operates. Crypto is the currency that is used to power the DeFi ecosystem.

What is Total Value Locked (TVL) in DeFi?

Total Value Locked (TVL) is the phrase used to quantify the amount placed or locked into a DeFi platform.

How can I make money in DeFi?

You can earn rewards by staking, lending, and borrowing, and gain rewards from providing liquidity to DeFi platforms.

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Eric Huffman

Eric Huffman

Michael Graw

Michael Graw

Kane Pepi

Kane Pepi