Is Bitcoin Safe? Understanding the Security of Bitcoin

Bitcoin was developed as an alternative to traditional monetary systems, providing a way for people to transact without banks or other intermediaries. What began as a “peer-to-peer electronic cash system,” as first described in the Bitcoin whitepaper, has become a store of value for some and a speculative asset for others. Before investing in Bitcoin or trading BTC, it’s important to answer the question, “Is Bitcoin safe?”

In this article, we’ll tackle the question of crypto safety, discussing Bitcoin in particular. Is Bitcoin legit, and is Bitcoin a safe investment? In short, Bitcoin can be extremely risky. In fairness, the same can be said of traditional finance systems.

Let’s explore the facts you should know before investing in Bitcoin.

Is Bitcoin Safe to Use?

First, it’s helpful to understand how Bitcoin works, how the network secures transactions, and how Bitcoin differs from traditional finance. In traditional finance, we use US dollars or other fiat currencies, such as British pounds. These fiat currencies aren’t backed by anything. However, they are accepted as “legal tender for all debts, public and private.”

When we need to send money to someone else, a bank or payment provider often acts as an intermediary. The bank tracks balances and decides whether a transaction completes — or reverts.

By contrast, Bitcoin doesn’t need banks to keep track of account balances. Instead, balances and transactions are recorded on the blockchain, which we’ll cover in the next section. Bitcoin is also permissionless — and censorship-resistant, meaning there’s no intermediary to determine whether a transaction can be completed based on corporate whims or regulatory restrictions.

When you initiate a Bitcoin transaction, the transaction is broadcast to the network and will be included in an upcoming block, assuming your Bitcoin wallet balance equals or exceeds the transaction amount (plus network fees).

Lastly, bank deposits are liabilities for the bank; deposits are money the bank owes you rather than your money. If the bank encounters financial difficulties, you might not be able to access your deposited funds. In the US, FDIC insurance protects up to $250,000 per depositor. Amounts above the FDIC limit are considered uninsured deposits.

By contrast, Bitcoin was designed for self-custody. This means you can hold your own bitcoins without counterparty risks, such as risky loans or insufficient collateral, either of which can cause bank failures.

The Underlying Technology: Blockchain

The term blockchain aptly describes the way crypto networks record transactions. Bitcoin transactions are grouped into data blocks. These blocks are then linked together using a cryptographic hash to form a chain.

The hash is a representation of the previous block, encoded using the SHA-256 algorithm. Hashing the previous block provides a unique output that would change dramatically if any of the source data changes. The result is a chain that can’t be broken without “mining” all the subsequent blocks again.

Bitcoin mining uses proof of work (PoW) as its consensus mechanism, a method of agreement on the state of the blockchain that requires an investment of computational power. This strategy makes the Bitcoin network extremely secure due to the expense involved with changing a previous transaction. After six confirmations (six blocks), a transaction is considered irreversible.

Decentralization and Security Implications

In a crypto context, decentralization means no central authority or intermediary is controlling the currency’s value, such as a government, or whether transactions can occur at all, such as a bank that can decline transactions.

But decentralization takes on a deeper meaning as well, encompassing governance and distribution, as well as transaction validation.

There’s no single entity controlling the Bitcoin network itself. Changes to the network happen slowly, requiring agreement from node operators. Nodes are computers on the network that host copies of the blockchain. Bitnodes shows more than 54,000 Bitcoin nodes globally, with nearly 16,000 currently reachable.

Bitcoin mining is also decentralized, with an estimated 1.1 million miners across the globe contributing hash rate to the network. These miners work to find a new block to hold transactions while the network ensures there is no double-spending.

By contrast, a bank is often the last word on whether a transaction is valid (or permitted) in traditional finance. Decentralization also refers to the distribution of Bitcoin’s native cryptocurrency (bitcoins). The Bitcoin blockchain’s fair launch means that venture capitalists and team members didn’t get bitcoins before the network launched. This means these groups don’t hold undue influence over the network, as might be the case with other cryptocurrencies.

Encryption and Secure Transactions

Bitcoin uses encryption at every step of the process, from wallet keys and addresses to recording transactions on the blockchain.

However, the transactions themselves are visible to all. Transparency on the blockchain is part of what makes Bitcoin attractive because anyone can verify dates and amounts. This, of course, also creates some security concerns.

Blockchain transactions show wallet addresses, making it easy to view balances. Your name is not shown, but anyone with whom you transact — and who may know your identity — can see your balance and transaction history.

Bitcoin transactions are secure because it’s nearly impossible to reverse a completed transaction. However, the blockchain’s open ledger creates a security risk that may require additional steps to obscure. We’ll discuss ways to address this issue in the section on “Storing Bitcoin Safely.”

Is Bitcoin a Safe Investment?

Bitcoin has been both the best-performing asset in a generation and, for many, the worst-performing asset in a sensibly diversified portfolio.

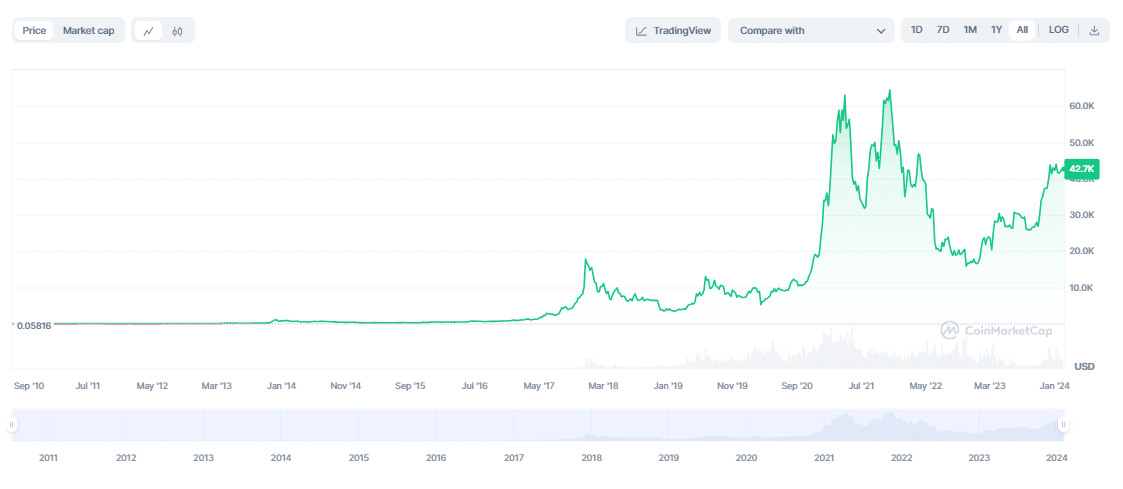

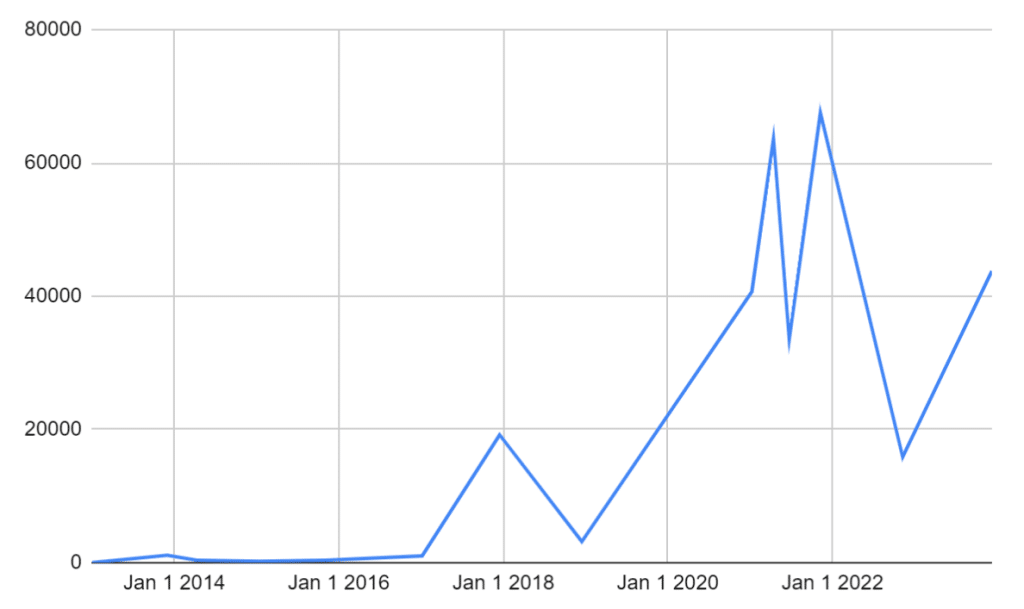

After reaching an all-time high of nearly $69,000 in October 2021, Bitcoin’s price fell to a low of about $15,500, a drop of close to 80%. By comparison, early investors with steady hands enjoyed a runup from pennies to Bitcoin’s current price range of $40,000 to $45,000. As illustrated, Bitcoin’s price is still highly volatile.

However, volatility contributed to the incredible gains Bitcoin investors have seen since the network’s launch in 2009. Bitcoin’s relatively small market capitalization also contributes to roller-coaster price charts. At about $837 billion worldwide, Bitcoin’s market cap is smaller than single companies like Amazon (currently $1.62 trillion), Apple (currently $2.87 trillion), and Alphabet (currently $1.77 trillion).

As the Bitcoin market grows, many investors expect a smoother price chart with less severe dips.

Bitcoin’s Inherent Value

Despite the current volatility, there are reasons to be optimistic about the future price. Part of Bitcoin’s inherent value revolves around the network’s security, as discussed earlier, but supply and demand dynamics play a big role going forward.

Bitcoin is scarce by design. This intentional scarcity leads many to describe Bitcoin as digital gold. Developed against a backdrop of the great financial crisis, when traditional finance and derivatives markets threatened to plunge the world into economic darkness, Bitcoin took a decidedly different approach.

Whereas traditional fiat currencies can inflate supply until values collapse, Bitcoin limits supply to 21 million bitcoins. About 19.6 million bitcoins have been mined to date. Each of these bitcoins is then divided into a smaller denomination, called a satoshi or “sat.” Each Bitcoin equals 100 million satoshis. Theoretically, Bitcoin can be divided further, making it infinitely divisible yet still finite in supply.

Bitcoin Compared to Traditional Investments

Bitcoin and other cryptocurrencies can’t be valued in the same way as traditional investments, such as stocks. Metrics like price-to-earnings and debt ratios don’t apply. Instead, metrics like adoption rates drive prices, combined with changeable factors, such as investor sentiment.

Competing cryptocurrencies also play a role. It’s not uncommon for traders to move from one cryptocurrency to another en masse based on news or technical indicators. With a smaller market compared to traditional investments, these movements can affect prices.

The US Commodity Futures Trading Commission (CFTC) views Bitcoin as a commodity, not unlike gold or silver. Most commodities trade based on supply and demand metrics, increasing in value if demand outstrips supply and vice versa.

Bitcoin’s fixed supply bodes well for prices, assuming demand remains strong. With the world population at about 8 billion, there are about 262500 satoshis available for every living person based on Bitcoin’s 21 million bitcoin supply.

Layer 2 networks, like the Lightning Network, can divide satoshis further using millasatoshis, with each millasatoshi equal to 1,000 satoshis. Bitcoin doesn’t need to grow its supply to serve as a useful unit of account. However, increased demand for bitcoins increases the value of satoshis and even millasatoshis.

Volatility and Market Fluctuations in Bitcoin

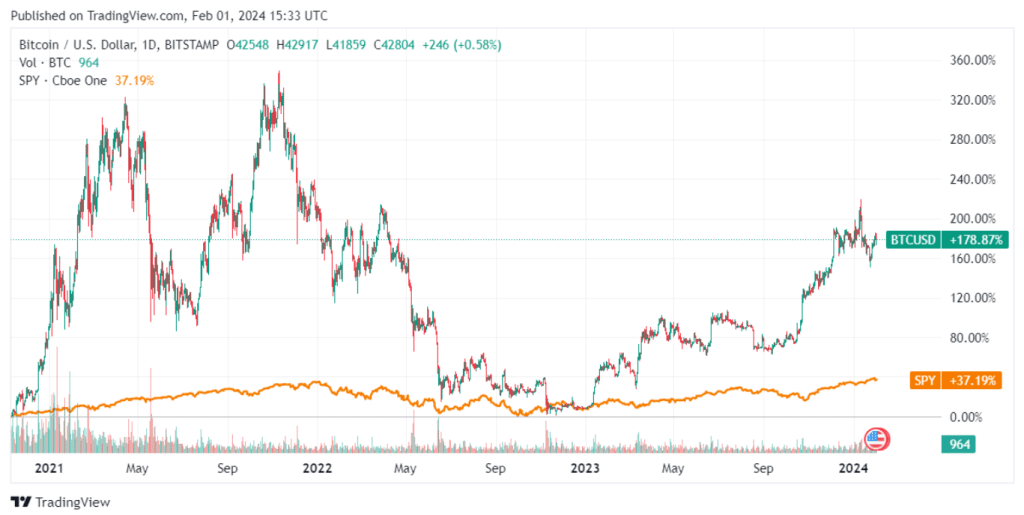

Bitcoin’s price action remains volatile compared to traditional assets. The chart below compares the performance of the popular SPY exchange-traded fund (ETF) that tracks the S&P 500 index. Bitcoin’s runup in 2022 culminated in gains of nearly 350% between November 2020 and November 2021. During the same period, the S&P gained about 34%.

However, the following 12 months brought Bitcoin’s price down to its recent lows of $15,500, a drop of 78% from its all-time high of nearly $69,000.

Understanding Bitcoin’s Price Fluctuations

With a relatively low market cap compared to today’s top equities, Bitcoin’s price often fluctuates by greater percentages than traditional assets. In addition, several factors contribute to Bitcoin’s volatility.

- Leverage trading: Many crypto exchanges support leverage trading for Bitcoin and other digital assets. Leverage trades use your existing assets as collateral, enabling larger trades. When markets move against the trade, however, the collateral can be liquidated. These forced selling events often cascade, causing sudden drops in price marketwide.

- Macro events: in recent months, Bitcoin’s price has reacted to actions of the US Federal Reserve and Treasury. Actions seen as inflationary can be good for Bitcoin’s price, whereas more conservative actions can dampen enthusiasm. Bank failures can also affect Bitcoin’s price. The failure of Silicon Valley Bank sent Bitcoin’s price soaring from $20,000 to nearly $27,000 in four days.

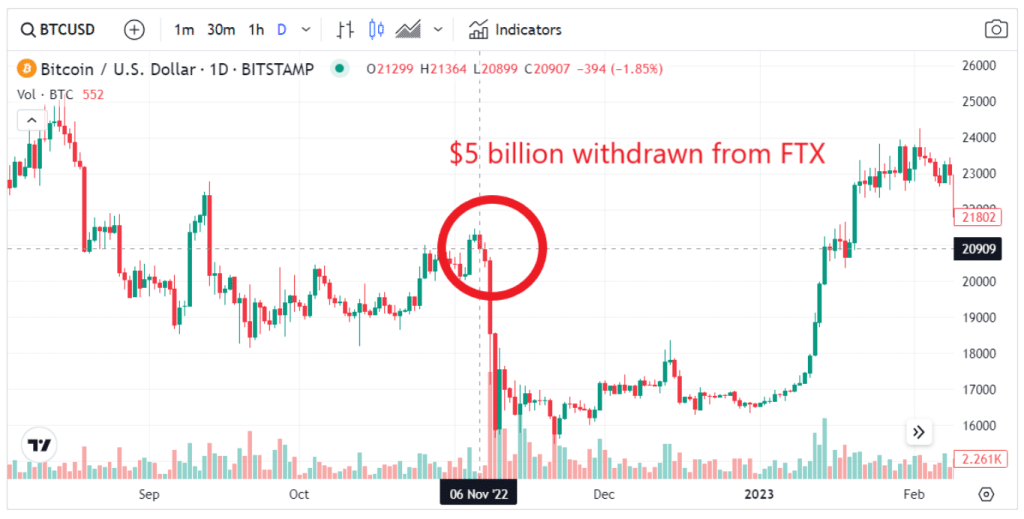

- Industry events: The collapse of the FTX exchange, sent an already embattled Bitcoin market tumbling lower. Users withdrew $5 billion in assets from the FTX exchange on November 6th, 2022. The chart below illustrates the effect on the BTC market.

Historical Trends in Bitcoin’s Value

While Bitcoin’s long-term trend has been up, several stumbles between 2018 and today left investors wondering, “Is crypto safe?”

Fortunes have been made and lost throughout Bitcoin history, with investors often selling at the bottoms and buying exuberantly at short-term tops.

In the past, Bitcoin halvings, in which the supply of new bitcoins was reduced by 50%, led to new highs. However, historically, only buying prior to halvings leaves money on the table.

In the next section, we’ll discuss ways to and optimize purchases and manage risk as a Bitcoin investor.

Managing Risk in a Volatile Market

A disciplined investment strategy combined with appropriate allocation of investment capital can help take the sting out of Bitcoin’s volatility while also giving you exposure to a historically explosive asset.

- Dollar-cost averaging (DCA): Consider buying on a fixed schedule, investing an equal amount in dollars at each purchase. This strategy, called dollar-cost averaging, automatically optimizes your purchases by buying more when prices dip and buying less when prices rise. As a bonus, DCA removes the emotion from investing, sidestepping common mistakes like buying at the top or selling at the bottom. Instead, you get a blended average cost.

- Diversification: Weigh the percentage of your portfolio that Bitcoin or other cryptocurrencies should represent. You may also need to consider your time horizon. Generally, younger investors have more time to recover from market mishaps, whereas investors nearing retirement may want to reduce exposure to riskier investments.

The Risks Associated with Bitcoin

So, is it safe to invest in Bitcoin today? The crypto market as a whole brings several risks, many of which aren’t unique to Bitcoin but also apply to Bitcoin investing.

Cybersecurity Concerns

Bitcoin investing comes with many cybersecurity risks you’ll encounter with bank or brokerage accounts: there are people in the world who want to steal your funds.

Practice safe use of passwords when using exchanges, including using strong, unique passwords and using two-factor authentication, preferably with an authenticator app like Google Authenticator.

The Threat of Cryptocurrency Scams

The crypto space is famous for its scams. One common scam involves promises to “double your bitcoin,” in which you send your bitcoins to the scammer, receiving nothing in return.

The Federal Trade Commission (FTC) offers several helpful tips for newer crypto investors. Most crypto scams follow similar patterns.

Exchange Failures and Wallet Security

Exchanges themselves can bring risks. If you store your crypto on an exchange and the exchange fails, you may not ever be able to access that crypto again.

In 2022, the industry saw a tsunami of crypto bankruptcies ranging from crypto hedge funds to consumer exchanges. To protect your crypto, you can take custody of your bitcoins in a self-custody wallet. More on wallets in a bit.

Regulatory Uncertainties and Legal Aspects

In the US and in other jurisdictions, the industry has struggled with price uncertainty due to a perceived lack of clarity from regulators. Due to its decentralized nature, Bitcoin is generally considered one of the safest crypto assets from the perspective of regulatory risk.

Most agree that Bitcoin is not a security and, as such, is not subject to regulation by the SEC. Current SEC Chairman Gary Gensler confirmed in congressional testimony that Bitcoin does not pass the “Howey test,” a way to determine if an asset is a security subject to SEC regulation.

However, a new law passed by Congress or an executive order could still put ownership of Bitcoin or other crypto assets in peril.

Storing Bitcoin Safely

Is cryptocurrency safe to hold yourself, and how can you store your crypto safely? Holding crypto in a self-custody wallet removes the risks associated with exchanges or similar crypto platforms. However, crypto wallets come with a learning curve.

What is a Bitcoin Wallet?

A crypto wallet holds the private keys that control your Bitcoin on the blockchain. Options include software wallets, often called hot wallets, or hardware wallets, which are cold wallets that store your private keys on a device that does not connect to the internet.

Your Bitcoin wallet is empty, however, with your actual bitcoins stored at your wallet address on the blockchain rather than in your wallet.

Choosing the Right Crypto Wallet

Consider your use case and risk profile when choosing a Bitcoin wallet. Most software wallets are free to use, but if the private keys are stored on your computer or mobile device with internet access, these may not offer the most protection, particularly for larger balances.

Cold Storage vs. Hot Wallets

Bitcoin wallets generally fall into two categories: cold wallets and hot wallets.

- Cold wallets, sometimes referred to as cold storage, utilize a separate device to generate and store the private keys for your wallet. Often, these devices connect via USB, resembling a thumb drive. Popular options include Ledger and Trezor hardware wallets.

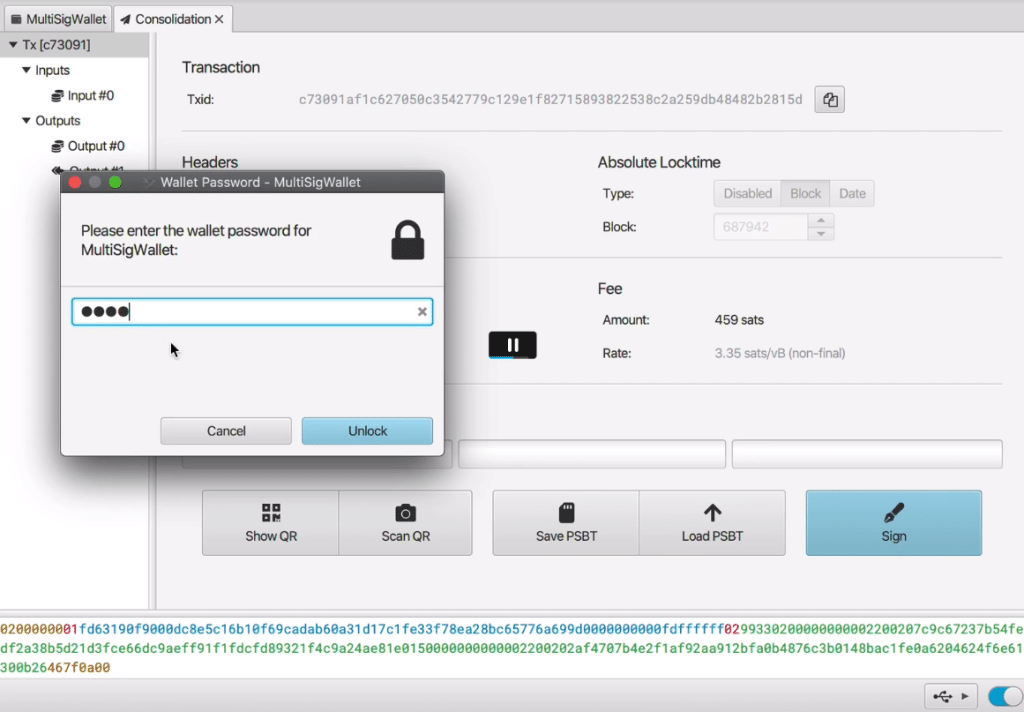

- Hot wallets are software apps, including the time-tested Electrum wallet as well as newer apps like the Sparrow Bitcoin wallet, shown below.

While hot wallets offer greater convenience, cold wallets offer more security, acting like two-factor authentication. To authenticate a transaction, you must approve it on a device in your possession.

Best Practices for Secure Storage

Some basic safety practices can help keep your Bitcoin secure.

- Protect your private keys: Your wallet’s private keys control your bitcoins on the blockchain. Anyone who has the private keys can easily restore your wallet on a remote computer and transfer your bitcoins to another wallet they control. Most wallets also use a recovery phrase, a human-readable version of your private keys. Write down your recovery phrase, store it securely (not online), and never share your recovery phrase.

- Use multiple wallets: Consider using multiple wallets to store your bitcoins. For example, you can keep a smaller amount of spending money in a hot wallet while securing larger balances with a hardware wallet. This also helps protect your privacy.

- Use different receiving addresses for transactions: Popular Bitcoin wallets like Electrum allow you to generate new addresses easily using the same private keys. Using different addresses can help protect your privacy on the blockchain.

- Avoid brain wallets: A brain wallet uses easy-to-remember words or phrases. They are also notoriously easy to crack, revealing the private keys to the wallet.

- Consider open-source wallets: Wallets with open-source firmware or software allow coders and security experts to crawl through the code, looking for errors or unwanted “features.” Trezor wallets, for example, use open-source firmware and software.

- Don’t buy a used hardware wallet: A used wallet may seem like a bargain, but there’s no way to know if the firmware or hardware has been modified. A used wallet could be a trojan horse that sends your private keys to a third party.

Safely Buying and Investing in Bitcoin

If you decide that Bitcoin fits your investment goals, some basic principles can help make your investing experience safer.

Selecting Trustworthy Exchanges

Crypto exchanges like Coinbase and MEXC offer a convenient way to buy BTC with USD or other fiat currencies. However, the industry has seen several exchanges fail in Bitcoin’s short history. Research any exchange you’re considering carefully before investing or connecting your bank account or funding source.

Criteria to weigh before when choosing an exchange may include:

- Customer service: Check the user reviews on a site like Trustpilot. Some crypto exchanges like Binance has a 2.1 TrustScore.

- Proof of reserves: If possible, look for an exchange that offers proof of reserves, which is a third-party audited method of proving adequate reserves. For instance, Kraken provides proof of reserves.

- Trading costs: Look into trading fees, but also deposit fees, withdrawal fees, and inactivity fees when applicable. In many cases, you can save a significant amount on trading fees by learning how to use an advanced platform, which works much like a stock trading platform.

Verifying Authenticity and Avoiding Scams

Use discernment when investing in crypto. Emails that appear to be from an exchange may instead be coming from scammers. Rather than following links in emails or untrustworthy websites, navigate directly to the site in question.

Read the URL carefully; scammers sometimes use deceptive domain names on websites that masquerade as the official site for a crypto exchange or app.

Diversification and Responsible Investing

Earlier, we discussed diversification, which refers to spreading your investment capital across multiple investments and possibly multiple sectors. If you invest 100% in Bitcoin, expect a bumpy ride. However, if you invest 5% or 10% of your investment capital in cryptocurrency, the rest of your diversified portfolio can act as a counterbalance, smoothing volatility.

However, it’s also important to view cryptocurrency like Bitcoin as speculative. Market sentiment or government actions can impact your investment. Never invest more than you can afford to lose.

Taxation and Bitcoin

Even though Bitcoin isn’t legal tender in most jurisdictions, it’s still legal to invest in or use Bitcoin in most of the world. However, you’ll need to consider the tax implications.

Generally speaking, governments see Bitcoin as property rather than a currency for tax purposes. This means your transactions may be subject to capital gains taxes.

Understanding Capital Gains Taxes

Capital gains refer to the difference between the price of an asset when purchased compared to the price of the asset at “disposition,” which may be when you sell — or when you spend your bitcoins.

In the US, capital gains tax rates can vary but typically fall into short-term or long-term tax rate schedules.

- Short-term gains refer to assets held less than a year. In most cases, short-term capital gains are taxed as ordinary income.

- Long-term capital gains refer to assets held for a year or longer. Typically, long-term capital gains are taxed at a lower rate.

Reporting and Compliance for Bitcoin Transactions

In the US, you must report cryptocurrency transactions, regardless of value, using Form 8949 and Schedule D.

Cost basis plays a role in calculating gains (or losses), and reporting must be made in USD value. For example, if you spend bitcoin to buy a laptop from a retailer, you have to account for the disposition in Bitcoin’s USD value at the time of the purchase.

Several crypto tax accounting services now make reporting easier by pulling transaction data from the blockchain.

How Can You Mitigate the Risks?

Bitcoin investing comes with price risks, regulatory risks, and storage risks. However, there are ways to mitigate risks, many of which revolve around education.

- Informed Decision-Making: Many Bitcoin investors don’t fully understand the technology but instead invest because of prior price performance. Take the time to read the nine-page Bitcoin Whitepaper to better understand how Bitcoin works and the context of when it was invented. You may decide not to invest at all — or you might find yourself more committed to investing on a regular schedule.

- Utilizing Secure and Updated Technology: Secure storage of your bitcoins relies on updated wallets. If you want a hot wallet, look for apps with large user bases and frequent updates. For instance, both Sparrow Wallet and Electrum have recent updates on Github, an open-source repository.

- Continuous Learning and Market Research: Bitcoin has been with us for 15-plus years, but the crypto industry changes quickly — even for Bitcoin. New developments include improvements to Bitcoin itself as well as layer 2 networks that add more functionality, like the Lightning Network, which allows nearly instantaneous (and nearly free) Bitcoin transactions. Stay informed on new developments that may affect your investment decisions.

The Future of Bitcoin and Cryptocurrency

Blockchain technology paves the way for a decentralized future that reduces the influence of financial gatekeepers. But the tech also provides a way to streamline existing financial markets and even the way we document ownership.

Bitcoin’s primary value is as a store of value and medium of exchange. However, through layer 2 networks or other blockchain networks, we could see a world in which traditional assets move onto the blockchain, creating permissionless transactions of nearly any asset.

As the market continues to evolve and tech improves, more investment capital will likely move into crypto. Some even speculate that Bitcoin could become a world reserve currency, not unlike the gold-backed dollar of years past, which ended in 1971.

What Bitcoin’s price looks like in ten years or 20 years is fuel for conjecture, but many “guesses” put Bitcoin’s value well above today’s prices. For instance, Cathie Wood of ARK Invest sees Bitcoin trading at $1.5 million by 2030. Our own (more conservative) Bitcoin price predictions put the world’s leading digital currency as high as $150,000 by 2030.

The Bottom Line on Bitcoin Safety

Bitcoin is one of the most exciting innovations of a generation, and the future still looks bright. However, the newness of the technology brings price risk in the form of volatility and regulatory uncertainty. Safe storage creates another concern.

To safely invest in Bitcoin, you’ll need to invest some time in learning about how the blockchain works and what sets Bitcoin apart from the 10,000-plus other cryptocurrencies currently available. Start with the Bitcoin Whitepaper and then seek out trusted sources of information to learn which of today’s financial challenges Bitcoin can solve.

If you decide Bitcoin fits your portfolio, invest in a measured way, balancing risk against opportunity. As always, never invest more than you can afford to lose.

FAQs

Is transferring cryptocurrency to my bank safe?

Currently, most banks don’t support cryptocurrencies or provide custody services for retail investors. As an alternative, you can transfer your cryptocurrency to a self-custody wallet rather than store your crypto on a crypto exchange.

Is it safe to trade cryptocurrency on my phone?

Crypto apps from trusted exchanges like Coinbase or MEXC are generally considered safer to use. However, it may be wisest to use a Virtual Private Network (VPN) provider rather than conduct financial transactions over public networks. Also, be sure to maintain good security practices for your mobile devices, including locking your device.

How does Bitcoin compare to other cryptocurrencies in terms of safety?

Bitcoin is among the safer cryptocurrencies you can choose as an investment due to its recognition and worldwide usage. Bitcoin also enjoys the good graces of regulators, who see Bitcoin as a commodity rather than a security.

References

- When a Bank Fails – Facts for Depositors, Creditors, and Borrowers (fdic.gov)

- Global Bitcoin Nodes (bitnodes.io)

- What is a Bitcoin Futures ETF? (cftc.gov)

- All about Satoshi, bitcoin’s smallest unit (cnbctv18.com)

- Bitcoin Is a Clear Winner of the U.S. Banking Crisis (coindesk.com)

- Timeline of the FTX exchange’s epic collapse and Bankman-Fried’s prosecution (thestreet.com)

- How are bitcoins created? (bitcoin.org)

- 2024 Halving Event Set to Drive Bitcoin Price Past $69,000 All-Time High (thestreet.com)

- What To Know About Cryptocurrency and Scams (ftc.gov)

- Crypto’s string of bankruptcies (reuters.com)

- Gary Gensler “Bitcoin doesn’t pass the Howey test” (youtube.com)

- Researchers Describe an Easy Way to Crack Bitcoin Brain Wallet Passwords (ccn.com)

- Binance Reviews (trustpilot.com)

- Proof of Reserves (kraken.com)

- Topic no. 409, Capital gains and losses (irs.gov)

- Frequently Asked Questions on Virtual Currency Transactions (irs.gov)

- About Form 8949, Sales and other Dispositions of Capital Assets (irs.gov)

- About Schedule D (Form 1040), Capital Gains and Losses (irs.gov)

- Bitcoin: A Peer-to-Peer Electronic Cash System (bitcoin.org)

- GitHub Sparrow Wallet (github.com)

- GitHub Electrum Wallet (github.com)

- Lightning Network (lightning.network)

- Nixon and the End of the Bretton Woods System, 1971–1973 (history.state.gov)

- Bitcoin Price Could Reach $1.5 Million By 2030, Predicts ARK Invest CEO Cathie Wood (finance.yahoo.com)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell

Kane Pepi

Kane Pepi