Decentralized Exchanges Set To Accelerate in 2021

Scaling solutions, improved AMM models, and atomic swaps are among expected innovations. The current transaction costs are a big barrier for a DEX user. The GME saga “opened more people’s eyes to the ethos and potential of decentralization.”

Cryptocurrencies are decentralized forms of electronic money, yet for the most part, the places where you obtain cryptoassets — exchanges — are thoroughly centralized. This centralization has a practical and a political downside, since not only does it introduce single points of failure in which precious funds might be lost, but it’s likely to lead to concentrations of power and influence.

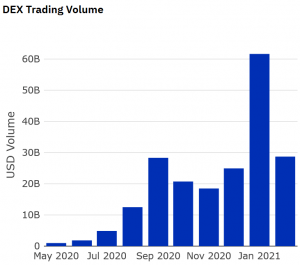

Decentralized exchanges (DEXes) are a solution to this quandary, and while they remain relatively niche compared to centralized exchanges (CEXes) (in terms of volumes), much of the industry seems to be confident that they’ll witness significant growth in 2021. This will be helped by the introduction of new innovations, from layer two scaling solutions, improved automated market maker (AMM) models, and atomic swaps.

This process of improvement and growth might be slower than the market would like to, but even major centralized crypto exchange Binance told Cryptonews.com that it expects DEXes to ultimately overtake their centralized equivalents somewhere down the line.

Niche, but growing

While industry figures are generally in agreement that DEXes will witness growth in 2021, opinion is mixed as to how strong and fast such growth will be.

“DEXes have quite a high entry threshold, and expensive transactions. Until this changes we can’t expect true mass adoption, and the shift to decentralized domination,” said Alexi Lane, the project spokesman at Ethplorer, an Ethereum (ETH) tokens explorer.

This is also the view at Binance, which runs a centralized exchange and is developing a DEX of its own.

“Centralized exchanges provide the convenience needed for mass adoption […] DEXes are a niche segment for a niche market, there’s a thick layer of awareness that needs to be penetrated via consumer-friendly interfaces,” a spokesperson for the company told Cryptonews.com.

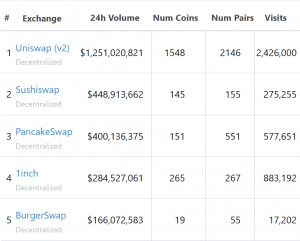

If you look at trading volumes, it becomes fairly apparent that DEXes are still some way off CEXes in terms of market share. The biggest DEX — Uniswap — currently has a daily volume of USD 1.25bn (according to CoinGecko), while Binance’s daily volume is USD 27bn.

Top 5 DEXes by trading volume:

In fact, at the time of writing, 74 centralized exchanges boast bigger daily volumes than Uniswap, which is the only DEX in the top 75 exchanges by trading volume. However, while trading is undeniably concentrated mostly around CEXes, many figures working within the DEX sector claim that this is changing significantly.

“I certainly think decentralized exchanges will gain significant traction in 2021,” said Kadan Stadelmann, Komodo (KMD) Chief Technology Officer (CTO) and lead developer at Komodo’s decentralized exchange solution, AtomicDEX.

He acknowledged that “DEXes don’t compare to CEXes at the moment” in terms of volumes. Nevertheless, he added that we need to look at how people are starting to value DEXes and their role in the market.

“One indicator of this is the recent rise of DEX tokens in the market cap rankings. UNI, 1INCH, and CAKE are all currently inside the top 100 market cap, and none of them even existed just 6 months ago,” the CTO said.

Aided by innovation

For Stadelmann, a number of technological developments and innovation will facilitate the rise of DEXes in 2021.

“There are a few projects in the space like Komodo focused on creating interoperable solutions that support not only ETH and ERC-20 tokens but also BTC, LTC, and other assets on decentralized exchanges,” he said, referring to the fact that most DEXes today currently limit trading to the Ethereum blockchain and ERC tokens.

Likewise, Martin Köppelmann, CEO of Gnosis (GNO), a developer of market mechanisms for decentralized finance, also said that technology will help DEXes grow this year.

“I think 2021 will bring a lot of surprises in terms of how much decentralized exchanges grow in comparison to centralized exchanges,” he told Cryptonews.com.

One area that is estimated to receive considerable attention is automated market maker (AMM) algorithms, which DEXes use to price assets instead of the kind of traditional order books used by CEXes.

“In 2021, we expect DEXes to continue to innovate on AMM models for more efficient markets and come up with new ways to generate yield to attract liquidity providers,” said Binance’s spokesperson.

Binance also expects a growth in sophisticated derivative products (e.g. options, futures, contracts for difference) and instruments common in traditional finance. “One emerging trend is the popularity of synthetics that represent assets in traditional finance,” they added.

For Martin Köppelmann, scalability will be an important area of improvement, with Gnosis expecting 2021 to be the year DEXes start rolling out solutions on ‘Layer 2.’

“This means applications that build on Ethereum that improve upon lower level technical features, such as lowering the currently high transaction costs. The current transaction costs (‘gas prices’) are a big barrier for many people that want to use these types of services,” he said.

In the particular case of Gnosis, it aims to roll out new solutions and products focused specifically on increasing affordability and accessibility, so as to draw in retail investors who can’t really afford current gas prices.

“We have already deployed several of our products to one such solution, the Ethereum sidechain xDai, which is already proving a popular and effective antidote,” he said.

As noted above, most DEXes limit trading to ERC tokens, even though CEXes allow for easy trading for assets from any chain via an IOU-like system. Kadan Stadelmann said that this weakness will be increasingly addressed from this year onwards.

“ERC20 DEXes use wrapped tokens for representing value across chains, which ultimately requires trust in a centralized third-party custodian […] For DEXes to surpass CEXes, solutions like atomic swap technology are crucial for providing trustless cross-protocol trading where users are always in control of their funds,” he said.

Security and freedom

Another trend we may see in 2021 is that security and custody concerns drive more traders to turn to DEXes, since these inherently involve retaining control of your own crypto while trading. This transition may be sped new cases of large exchange hacks, thereby underlining the risks of trusting a centralized party with your funds.

“DEXes are more secure than CEXes for the most part. They are generally safer because the user has sole access to their private keys, but that doesn’t mean there aren’t security challenges to consider,” said Stadelmann.

He noted that liquidity pools that interact with an AMM protocol bring an element of centralization to DEX trading, while insecure smart contracts are another potential risk for decentralized exchanges.

“To gain wider adoption, DEXes need to either improve upon AMM technology or remove AMMs entirely from their models. As new solutions arise that combine liquidity provider incentives with better overall security, we will see a noticeable market capture shift from CEXes to DEXes,” he added.

Another, recently emerging issue relates to the whole GameStop saga, which resulted in various trading platforms suspending trading in shares of the game retailer, other companies, and even cryptocurrencies.

“We have found that more and more people are turning to DEXes as a viable alternative to centralized options. This trend seems poised to continue with the events unfolding around Robinhood and stocks like GME and AMC, which have demonstrated to retail investors that using centralized providers comes with the price of being at the mercy of their policies,” said Köppelmann.

He added that such fears are largely removed when trading on DEXes.

“This recent incident and the wave of public opinion following it has already begun to open more people’s eyes to the ethos and potential of decentralization: fair marketplaces for a free market,” he said.

How big?

While circumstances are certainly moving in favor of decentralized exchanges, it will be a while before it really begins to rival the big centralized exchanges. However, for Binance, it will end up being even bigger.

Its spokesperson concluded, “Like any other emerging technology, DEXes will take time to dominate the market. We don’t expect this to happen in 2021, but DEXes are bound to take over CEXes a few years down the line.”

___

Learn more:

Crypto Exchanges to Spend 2021 Focusing on DeFi, UX, and New Services

Decentralized Exchange on Ethereum Is Not Sustainable – FTX CEO

Regulators May ‘Disallow Trading on DEXs Entirely,’ Investor Warns

Don’t Have a Fast Bot? Beware of Initial DEX Offerings, Researchers Warn

A Reddit Army Blurs The Line Between Crypto and Traditional Finance

___