What’s Happening In Crypto Today? Daily Crypto News Digest

Get your daily, bite-sized digest of blockchain and crypto news today – investigating the stories flying under the radar of today’s news.

In crypto news today:

- Why is crypto up today?

- Hector DAO Files US Bankruptcy to Halt a Lawsuit

- Token Recovery Launches End-to-End Digital Asset Recovery Service

- Bybit Launches Copy Trading Pro for Collective and Synchronized Investing

__________

Why is crypto up today?

The global cryptocurrency market capitalization is largely unchanged today. It’s up 0.3% to $2.51 trillion.

Most top 100 coins are green today. The top two coins have double-digit increases.

Fetch.ai (FET) is the best performer in this category. It’s up 33% to $1.71.

SingularityNET (AGIX) is next, having risen 27.4%, trading at $0.6815.

The rest of the list is up around 6% and less.

At the same time, the reddest coin is JasmyCoin (JASMY), which is up 6.9% to $0.03063.

Ethena (ENA) is next, with a 4.6% rise to $0.6338.

Other red coins are down less than 4%.

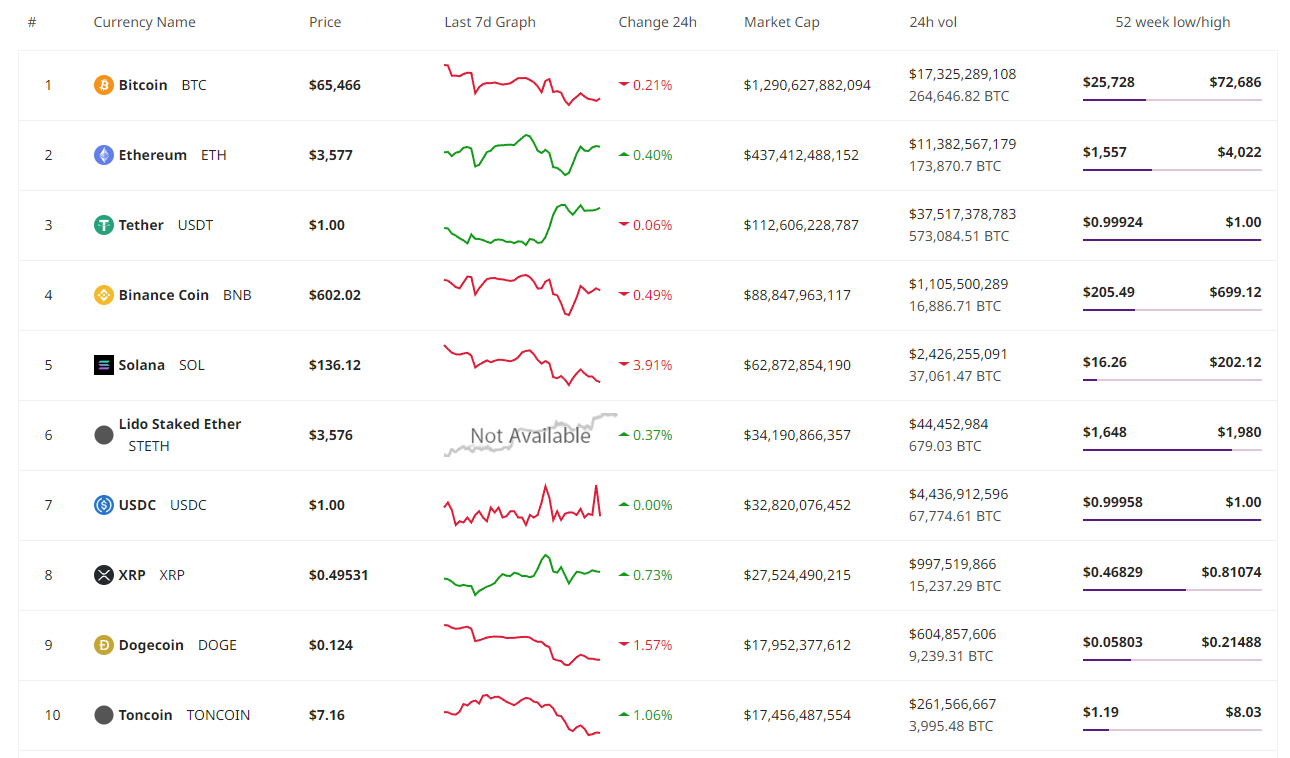

When it comes to the top 10 coins per market capitalization, four coins are up and four are down.

Solana (SOL) fell the most: nearly 4% to $136.

Dogecoin (DOGE) is next, having dropped 1.6% to the price of $0.124.

Binance Coin (BNB) and Bitcoin (BTC) fell less than 0.5% each to $602 and $65,466, respectively.

On the other hand, Toncoin (TON) is the winner in this category. It’s up 1% to $7.2.

XRP, Ethereum (ETH), and Lido Staked Ether (STETH) appreciated less than 1% each. ETH is currently changing hands at $3,577.

Hector DAO Files US Bankruptcy to Halt a Lawsuit

In crypto news today, Hector DAO has filed for bankruptcy protection in the US after token holders accused it of breaching its duties to users, the WSJ reported.

The aim is to halt a lawsuit filed in February by “a small number” of token holders who claimed breaches of contract and fiduciary duty.

James Drury, a Hector receiver, claimed that the lawsuit was obstructing efforts to save Hector’s assets and would delay the distribution of assets to token holders.

The receivers also argued that US proceedings will improve their chances of getting information from centralized US platforms about the January hack. At the time, the DAO lost $2.7 million.

Speaking of losses, the Terra collapse in May 2022 led to a $16.4 million loss for Hector.

Meanwhile, the DAO was placed under receivership, provided by Interpath, in the British Virgin Islands in February.

“The duty of the Receivers is to act in respect of the interests of the HEC Tokenholders collectively and the Receivers and will be seeking to create an open and transparent dialogue with the community,” the Hector website says.

“The Receivers intend to provide clear details as to a collective distribution process and strategy as well as conducting investigations into the recent hacks that need to be undertaken with a view to effecting asset recoveries for the benefit of Tokenholders.”

If its bankruptcy relief petition is recognized, the organization will gain the rights and benefits guaranteed by US bankruptcy law, including an automatic stay on lawsuits and preventing creditors from seizing assets.

Hector posted its last tweet in October 2023.

LIQUIDATION UPDATE

A new update, including information about holding tokens, the Wallet Registration dApp upgrade, TOR redemption, treasury assets, and FAQs Update #4, is now accessible at https://t.co/0mLfVSIM4H.

Further updates will be provided as they become available. Your…— Hector Network (@Hector_Network) October 26, 2023

Token Recovery Launches End-to-End Digital Asset Recovery Service

Token Recovery has launched its end-to-end digital asset recovery service, aiming to “establish itself as the premier service for lost or stolen digital assets.”

According to the press release, the team offers expert-led and innovative technology solutions to ensure the recovery of digital assets.

“Helping them reclaim what’s rightfully theirs” helps restore customer trust and confidence in the digital asset industry, they added.

Token Recovery’s services include:

- in-house expertise in blockchain investigations and crypto-asset recovery, having established relationships with various law firms, legal professionals for cross-jurisdictional cases, and market players;

- targeted analysis of multiple blockchain protocols, decentralized applications as well as obfuscation services, including mixers and tumblers;

- successful tracing through anonymization services like Tornado Cash and Chip Mixer;

- no limitations in the tools used for asset recovery;

- expert witness services provided in courts globally with high-quality reports.

Marcin Zarakowski, CEO of Token Recovery commented that “by bringing compliance and safety into the digital asset industry, Token Recovery helps to fulfil the blockchain’s promise of a fully realised digital economy, where fast peer-to-peer payments are possible, and assets of all kinds can be securely and efficiently tokenised.”

Token Recovery is a member of the Crypto Valley Association and the Global Blockchain Business Council.

We work discreetly and efficiently to recover lost or stolen digital assets, ensuring a prompt and discrete resolution. Our team of experts empowers legal professionals to give their clients peace of mind.

Start your recovery now. Visit. https://t.co/lSj7jljLNK. pic.twitter.com/AG1dk1n4eq

— Token Recovery (@tokenrecovery_) June 18, 2024

Bybit Launches Copy Trading Pro for Collective and Synchronized Investing

In other crypto news today, major crypto exchange Bybit has announced the launch of Copy Trading Pro.

According to the press release, it is “an advanced platform that connects investors with meticulously vetted expert traders known as Pro Masters.”

To maximize potential returns, the Pro Masters have a proven track record and employ diverse investment strategies, including Spot and Derivatives trading.

Investors can mirror the strategies of these Pro Masters, aligning their investment goals with those of experienced traders, the exchange said.

🔥 Last call to join Bybit Copy Trading Pro and be the first winner!

Maximize passive income with expert traders' strategies – no trading skills needed.

💫 Discover More: https://t.co/QwxxOD469O#TheCryptoArk #BybitTrading pic.twitter.com/gnxC8ehrRs

— Bybit (@Bybit_Official) June 20, 2024

The benefits of Copy Trading Pro for investors include the curated expertise and seamless alignment that enable a safe investment environment, eliminating slippages, position gaps, and missed opportunities.

Additionally, the platform incorporates safeguards such as 10x leverage limits and risk management tools.

For Pro Masters, the benefits include diversified strategies, an uninterrupted execution, and a higher profit share. Pro Masters can earn up to 30% of the profits generated.

__________

For the latest crypto news updates, bookmark this page and subscribe to our newsletter!