DeFi Unlocked: How to Earn Crypto Investment Income on Uniswap

DeFi has continued to hold the crypto community’s attention, cementing its position as the hottest crypto trend this year. The booming decentralized finance market unlocked a new milestone on September 1 when amounts locked in its protocols surpassed the USD 9bn, before correcting lower.

In this installment of our new “DeFi Unlocked” series, we will delve into Uniswap to understand how it works and how you can make money using this popular decentralized exchange.

What is Uniswap

Uniswap is a decentralized, open-source protocol designed to provide immediate, automated liquidity for ERC-20 tokens without the need for an order book.

While centralized exchanges have been instrumental to the growth of the crypto sector, they are no doubt imperfect. On the other hand, decentralized exchanges have faced significant challenges, reducing their effectiveness and negatively affecting adoption. Liquidity, or lack of thereof, is one such challenge.

Uniswap was designed to address the liquidity challenge on decentralized markets running on the Ethereum (ETH) blockchain. While the idea behind the protocol was inspired by a description provided by ETH Co-founder Vitalik Buterin, Uniswap was launched by Hayden Adams on November 2, 2018. Uniswap leverages the older Buterin-originated Automated Market Maker (AMM) in its design. (Learn more: DEX Volumes Receive Automated Market Makers Boost)

In 2017, Buterin described a smart contract protocol through which liquidity reserves could be deployed to support a decentralized trading ecosystem. He called the protocol the Automated Market Maker. The funds held in the reserves can be provided by any party. In exchange, liquidity providers receive a share of the fees charged to traders. The share they are entitled to is proportionate to their contribution to the total amount in the reserve.

Uniswap is effectively a set of codes that provides the infrastructure for a decentralized pricing mechanism through which different parties can provide liquidity at will. Traders can exchange any ERC-20 tokens so long as there is a liquidity pool available to support the trade. Additionally, due to its decentralized nature, there is no listing process.

Uniswap is a powerful tool as it provides automated liquidity for a large number of applications on the Ethereum blockchain. It provides much needed infrastructural support for the open, censorship-resistant, and accessible financial markets which are the goal for the blockchain.

Additionally, its fee system provides an incentive for participation from the community. As a result of these factors, Uniswap continues to grow in popularity.

How it works

Uniswap works by leveraging liquidity providers. They provide a market by depositing an equivalent value of two tokens. These tokens can either be ETH or ERC-20 tokens.

Following their contribution, liquidity providers receive liquidity tokens. These tokens represent their share of the total reserved pool and thus what share of the fees they are entitled to. They can redeem these tokens at any time and unlock their funds.

The underlying software supporting Uniswap leverages a mathematical equation that dictates that the total liquidity in a reserve pool must always stay constant.

Thus, when a party makes a trade that affects the ratio of one token, the protocol directs the other token to respond in a manner that ensures the total reserve funds remain constant. It is this mechanism that determines the price of tokens and support trades.

How to make money on Uniswap

If you would like to participate in the Uniswap ecosystem as a liquidity provider and earn income on your digital assets, here’s is how to do it.

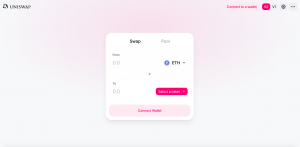

Access Uniswap

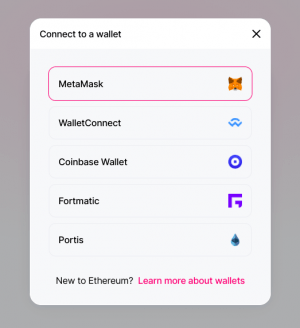

Connect your Ethereum wallet

Choose a pool, and approve the deposit of your chosen token into that pool using your Ethereum wallet.

- Supply the token, and that’s it!

The transaction fee paid out to liquidity providers is typically 0.3% for each trade. These fees are added to the reserve pool automatically but liquidity providers are free to redeem them at any time.

Fees are meted out in proportion to each liquidity provider’s share of the total funds in the pool thus the more you provide, the more you can earn.

Disadvantages & risks

Due to its mathematical design, reserve pools on Uniswap can support larger trades when they are large as well. Moreover, larger orders are much more expensive than smaller ones as they affect the ratio more. On Uniswap, slippage increases with the size of the order, which can be a disadvantage for traders.

For those looking to earn a profit by participating as liquidity providers, it is important to be aware of the phenomenon known as impermanent loss. This refers to the opportunity cost which a liquidity provider chooses to shoulder when they participate in Uniswap. The token may appreciate in price, which means they could make a loss.

Conversely, the price could depreciate leading to profit. It is called impermanent, though, because the losses or profits are likely to be even out over time due to the mathematical design of the protocol.

___

Learn more: How to Earn Crypto Investment Income on Compound