10 Best Crypto Savings Accounts in 2024

Crypto staking and lending platforms often provide higher yields than bank accounts, allowing you to build your own high-interest crypto savings account. Some platforms offer a simple setup: deposit and earn. Others, particularly staking platforms, may require a few more mouse clicks.

In this guide, we examine the best crypto savings accounts to help you grow your crypto stack with passive income. We’ll also compare centralized platforms, like exchanges, to decentralized options that live on the blockchain. Let’s find out what’s out there for investors looking for the best crypto yield.

List of the Top Crypto Savings Accounts in 2024

Below you’ll find a list of the best crypto savings accounts, along with a brief description of what makes them stand out.

- MEXC – Staking opportunities with yields up to 50%

- OKX – High-yield promotional interest rates up to 40%

- Kraken – Earn up to 22% without lending

- Kucoin – Up to 18% interest on USDT

- Uphold – Stake top cryptos to earn up to 16%

- Nexo – Earn up to 16% on Nexo’s easy-to-use platform

- YouHodler – Up to 15% yield with 50+ supported cryptos

- Crypto.com – Earn up to 12% on the go with Crypto.com’s mobile app

- Ledn – Earn up to 10% on BTC, ETH, USDT, or USDC

- Coinbase – Newbie-friendly staking, earn up to 9.22%

The Best Crypto Savings Accounts Reviewed

Yields for crypto savings and staking programs can far outperform traditional financial products, but there’s more to consider, such as lockup periods and safety. We review top crypto interest accounts, comparing yields and types of yield products, as well as the pros and cons of each.

1. MEXC – Earn up to 50% Yields, 17 Cryptos Supported

The MEXC exchange has become a trader favorite due in part to its low fees, typically 0.1% or lower, and its massive selection of cryptocurrencies, now at nearly 2,000. But MEXC also provides several ways to earn a yield on your crypto, including USDT, BTC, ETH, and more.

The highest APY crypto rate currently available is for staking Core DAO (CORE), which pays up to 50% yields. However, less is more — at least in regard to yields. MEXC uses a tiered yield system, and you’ll earn the highest rate with smaller deposits for most savings products on MEXC. The source of yields isn’t spelled out in many cases, so perhaps smaller deposits are safer. As MEXC also offers margin trading and futures, lending is likely the source of yield for some assets, with a mix of proof-of-stake rewards in the mix, such as Core DAO.

MEXC also offers ETH staking, which pays ETH staking rewards as well as MX tokens. The process requires a 1:1 exchange of ETH for BETH, the interest-bearing token.

| Coin or Token | Yield Type | Interest Rate |

| USDT | Undisclosed | Up to 8.8% |

| XRP | Undisclosed | Up to 6% |

| CORE | Staking | Up to 50% |

| BTC | Undisclosed | Up to 1.8% |

Pros

- High yields available

- Earn interest on USDT in between trades

- Low trading fees

- No identity verification required; limitations apply

Cons

- Lack of clarity regarding yield source

- Best suited for experienced users

- Third-party or crypto deposits only

2. OKX – Earn up to 40% on USDT, Earn in More Than 100 Tokens

Known for its low fees and advanced trading features, OKX also offers several ways to put your crypto to work. Simple Earn, OKX’s largest offering, lives up to its name. Just deposit and start earning. Other options include structured products, largely focused on trade-based yields, and on-chain earnings, such as ETH staking.

OKX offers something for everyone when it comes to yields, although simple earn assets provide healthy returns without the complexity. For example, you can currently earn 40% with USDT through a bonus. However, you can also use your USDT in a Sushiswap liquidity pool to earn 39%. In short, you have several options to earn outsized yields and build your own crypto savings account.

More complex structured yield strategies can pay triple-digit returns but may introduce more risk. The lower end of yield estimates is also lower than you’ll find with some simple earn choices. In addition to simple earn and structured products, OKX also offers on-chain earnings for ETH and 27 other cryptocurrencies.

| Coin or Token | Yield Type | Interest Rate |

| USDT | Undisclosed | Up to 40% |

| IOST | Staking | Up to 21.46% |

| ETH | Undisclosed | 5% |

| BTC | Undisclosed | 5% |

Pros

- Advanced yield strategies available

- Up to 40% on USDT

- Low trading fees

- On-chain yields for 28 cryptos

Cons

- Yield source is sometimes unclear

- Best suited for experienced users

- Not available in the US

3. Kraken – Enjoy Staking Rewards of up to 22%

The Kraken exchange is known for its transparency, making it a favorite for crypto investors. However, the platform also offers yields on 20 cryptocurrencies, including Bitcoin. Choosing a lockup period can double interest earnings on several of Kraken’s offerings.

Of note, Kraken agreed to end staking services to the US following an SEC lawsuit. Availability varies by region, with the US, Canada, Australia, and the UK unable to access opt-in rewards, which include Kraken’s USDC interest rates paying up to 6.5%. Most other countries can enjoy yields of up to 22%.

Kraken uses both flexible and bonded staking. Flexible staking allows you to withdraw your staked assets as needed. Bonded staking requires a lockup period, typically 30 days, in exchange for higher yields. Most staking products pay yields twice weekly, and the majority utilize blockchain staking rewards to pay interest. However, some assets, such as Bitcoin, may use lending to generate yields.

| Coin or Token | Yield Type | Interest Rate |

| USDC | Promotional | Up to 6.5% |

| KSM | Staking | Up to 22% |

| ETH | Staking | Up to 6% |

| SOL | Staking | Up to 8% |

Pros

- Proof of reserves to verify assets at the account level

- Earn yields on 20 assets

- Low trading fees on Kraken Pro

- Twice weekly payouts on most assets

Cons

- Not available in the US and several other major markets

- 30-day lockup for best rates

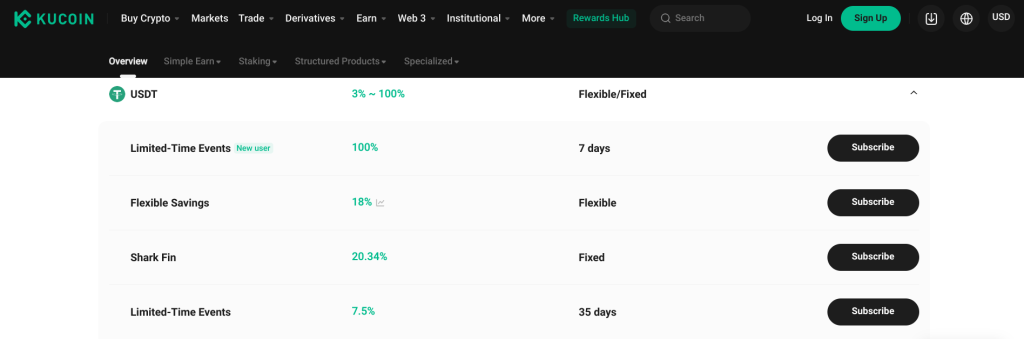

4. Kucoin – 18% USDT Yields With Flexible Savings

The Kucoin exchange is a favorite of advanced traders around the world and also offers three categories of earn products: balanced, advanced, and aggressive. The latter two can provide higher yields, although they may also bring additional risk. For many investors, Kucoin’s balanced yield products offer adequate yields while minimizing market risk. This category includes flexible savings (lending) and staking rewards, as well as one-time promotions.

In total, Kucoin’s balanced yield products provide returns on more than 100 cryptocurrencies. Simple Earn yields on BTC and ETH are lower than those of some competitors, at 0.04% and 0.08%, respectively. However, ETH staking pays 3.7%, and Kucoin’s own KCS token pays 16.2% in staking rewards. In addition, Kucoin offers scores of altcoins to buy and stake that aren’t yet available on Coinbase and other well-known exchanges.

Kucoin serves more than 200 countries worldwide and boasts nearly 800 available cryptocurrencies. However, the platform is not available to US traders.

| Coin or Token | Yield Type | Interest Rate |

| USDT | Savings | 18% |

| USDC | Savings | 6% |

| APE | Staking | 14% |

| BTC | Savings | 0.04% |

Pros

- Easy subscriptions for Simple Earn

- Over 100 balance yield products

- Flexible time commitments

Cons

- Riskier structured products

- Not available in the US

5. Uphold – Stake Cryptocurrencies to Earn up to 16% in Rewards

Unlike several other platforms, Uphold does not offer crypto lending or invest assets in decentralized finance strategies. This makes the platform’s yield products straightforward: Uphold offers staking services for 17 cryptocurrencies, including ETH, SOL, and ADA, as well as several up-and-coming assets.

Uphold’s highest yields center on Cosmos (ATOM) and Polkadot (DOT), with 16% and 14% yields, respectively. Popular cryptos also pay healthy yields. ETH currently earns 4.25% APY, and SOL pays 5.5%.

To get started, you’ll need to deposit a minimum amount, which varies by cryptocurrency. However, these amounts are well within reach for most investors and lower than the minimum deposit on YouHoldler, for example, which requires a $100 deposit. The minimum amount to stake or unstake for Ethereum is just 0.01 ETH, whereas Avalanche has a 0.1 AVAX minimum.

| Coin or Token | Yield Type | Interest Rate |

| ATOM | Staking | 16% |

| DOT | Staking | 14% |

| INJ | Staking | 6.5% |

| ETH | Staking | 4.25% |

Pros

- Easy staking for in-demand assets

- Earn up to 16% without qualifying levels

- Low minimum staking amounts

Cons

- Staking not supported in the US

- Higher-than-average trading fees

6. Nexo – Earn Up to 16% With Daily Payouts

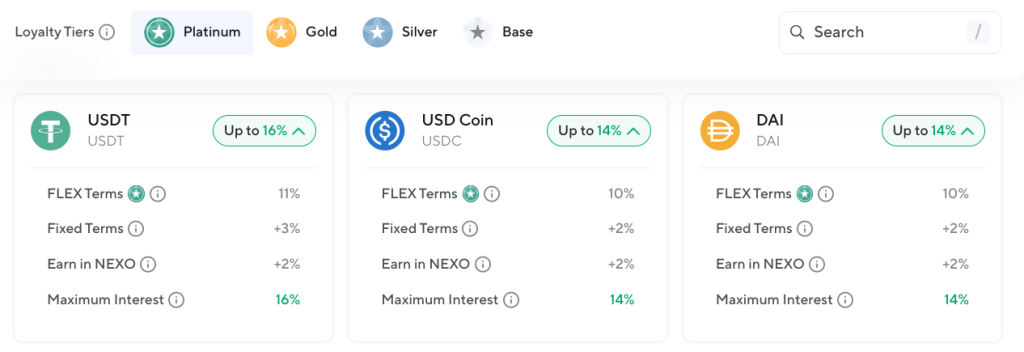

As one of the best-known crypto lending platforms, Nexo enjoys a loyal customer base and outstanding Trustpilot customer ratings (4.7 out of 5). This Swiss-based crypto platform offers both an exchange and crypto-backed lending service. Borrowers can choose a crypto payout or switch their Nexo Mastercard to “credit mode” to instantly borrow against their assets. Deposits are automatically assigned to lending pools, earning yields of up to 16%.

Nexo supports lending and borrowing for more than 40 cryptocurrencies, including BTC, ETH, DOGE, and more. However, to earn the highest rates, you’ll need to invest in NEXO tokens (or earn them). The highest yields go to accounts that meet tier thresholds based on the amount of NEXO held. For example, the Platinum Loyalty Tier, which pays the highest yields, requires more than 10% of your Nexo portfolio in NEXO tokens.

You’ll also earn higher yields if you opt to lock your funds for three months (3% bonus) and earn yields in NEXO tokens (2%). Yields can also vary based on your deposit balance. For instance, BTC earns a base rate of 3% up to $25,000 in value, with amounts above that threshold earning a 1.5% base rate. You can boost this base rate with time locks or NEXO payouts.

| Coin or Token | Yield Type | Interest Rate |

| USDT | Lending | Up to 16% |

| ETH | Lending | Up to 8% |

| BTC | Lending | Up to 7% |

| USDC | Lending | Up to 14% |

Pros

- High yields on top crypto assets

- Easy-to-use app

- Nexo Card for instant access to crypto funds

Cons

- Not available in the US

- Best rates require holding NEXO tokens

7. YouHodler – Enjoy up to 15% Yields on Top Crypto Assets

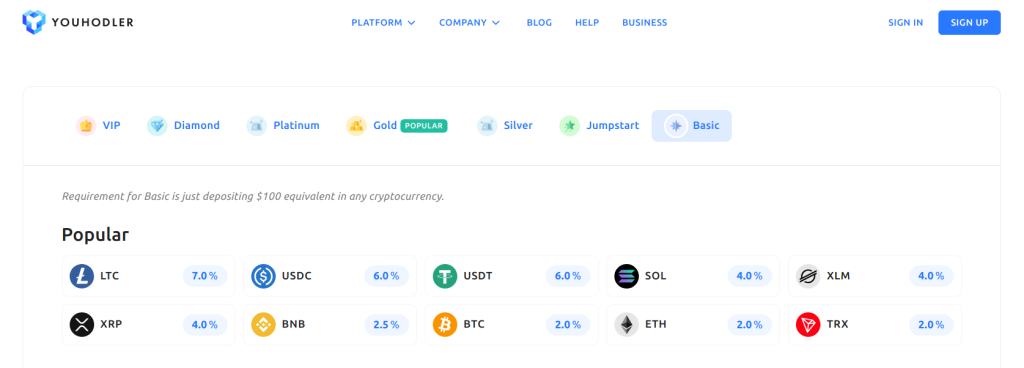

The YouHodler platform combines a crypto exchange with crypto lending and borrowing features so you can earn interest on 50+ crypto assets like BTC, ETH, LTC, and SOL. The platform uses tiers that determine your interest rate, with various qualifications to reach each tier. The first step up requires opening a Multi HODL trading position, whereas others use trading volume or leveraged trades.

The basic level provides an easy entry point for most crypto investors, allowing you to start a crypto savings account with a $100 deposit. Interest rates for the basic tier top out at 7%, currently available for LTC and DOT. Interest rates gradually increase with each level, reaching a peak of 15% for LTC and DOT at the VIP level ($5 million per month trading volume).

Compared to some platforms, YouHodler provides a newbie-friendly onramp to crypto yields. However, the platform is not available to US residents. In fairness, that’s a common theme. In the US, interest-bearing products may deemed as securities by the SEC, similar to the enforcement action taken against BlockFi, a crypto lending platform undergoing restructuring.

| Coin or Token | Yield Type | Interest Rate |

| LTC | Lending | 7% (Basic) |

| USDC | Lending | 6% (Basic) |

| SOL | Lending | 4% (Basic) |

| BTC | Lending | 2% |

Pros

- $100 requirement for Basic yields

- Earn on 51 crypto assets

- Weekly payouts

Cons

- Complicated tier system

- Not available in the US

8. Crypto.com – Yields Up to 12% with Weekly Payouts

The Crypto.com platform pays strong yields on 21 cryptocurrencies but may be best suited to experienced users or those with capital to invest in CRO tokens. The exchange has its own blockchain, Chronos, which uses the CRO token for staking. You’ll earn the highest rates by staking $40,000 or more worth of CRO with a six-month lockup. A mid-tier requires $4,000 tokens, halving the interest rate compared to the top tier. The base tier (less than $4,000 in staked CRO) earns the lowest rates at about 40% of the mid-tier.

For those who can afford the entry price of staking, Crypto.com pays 10% on USDC with a three-month lockup. Cosmos earns 12% with the same lockup period for “private members” who stake $40,000 worth of CRO and hold a Frosted Rose Gold, Icy White, or Obsidian Crypto.com Visa Card. This yield includes a 2% bonus paid in CRO.

Crypto.com offers some of the highest yields available for blue-chip cryptos like BTC and ETH. As a caveat, the platform is optimized around the CRO token, which may bring additional price risk on its own.

| Coin or Token | Yield Type | Interest Rate |

| USDC | Not disclosed | Up to 10% |

| BTC | Not disclosed | Up to 7% |

| ETH | Not disclosed | Up to 7.5% |

Pros

- Earn yields on 21 crypto assets

- Up to 7% interest on Bitcoin

- Designed for mobile users

Cons

- Top yields require a $40,000 investment and a six-month staking commitment

- Lack of clarity regarding yield sources

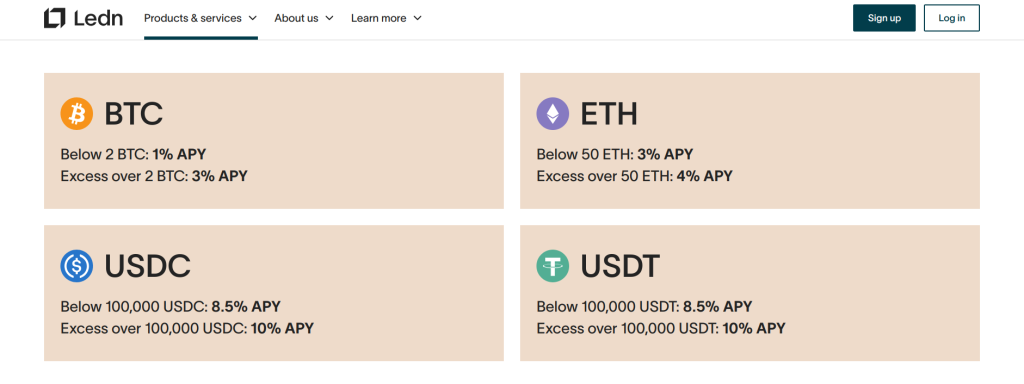

9. Ledn – Up to 10% Yields on Blue-Chip Cryptos

Ledn (not a typo) has been in the crypto lending business since 2018, drawing which time other crypto lenders have come and gone. Part of the reason for the platform’s staying power revolves around its supported cryptos. You can lend or borrow anything you want as long as it’s BTC, ETH, USDC, or UDST. The first two represent the world’s largest cryptocurrencies, with the latter being the biggest stablecoins.

Both USDC and USDT stablecoins pay 10% if your balance exceeds $100,000 in value. But even for smaller accounts, yields are strong at 8.5%. ETH pays 3% or 4%, depending on your balance, which is on par with ETH staking yields found elsewhere. Tiers apply, however, with deposits above defined tiers earning the best crypto interest rates.

Ledn crypto savings accounts are easy to use. Just transfer from your Transaction account on the platform to your interest-earning Growth account to start earning crypto. To ensure safety, Ledn links Growth accounts to the counterparties that generate the yield, fencing off other risks, including bankruptcy. Ledn also prides itself on transparency, publishing a monthly “Open Book Report” that details yield sources.

| Coin or Token | Yield Type | Interest Rate |

| BTC | Lending | Up to 3% |

| ETH | Lending | Up to 4% |

| USDC | Lending | Up to 10% |

| USDT | Lending | Up to 10% |

Pros

- Focused on top-tier assets

- Transparent reporting on counterparties

- Higher-than-average yields on top stablecoins

Cons

- Not available in the US

- 48-hour transfers between Transaction and Growth accounts

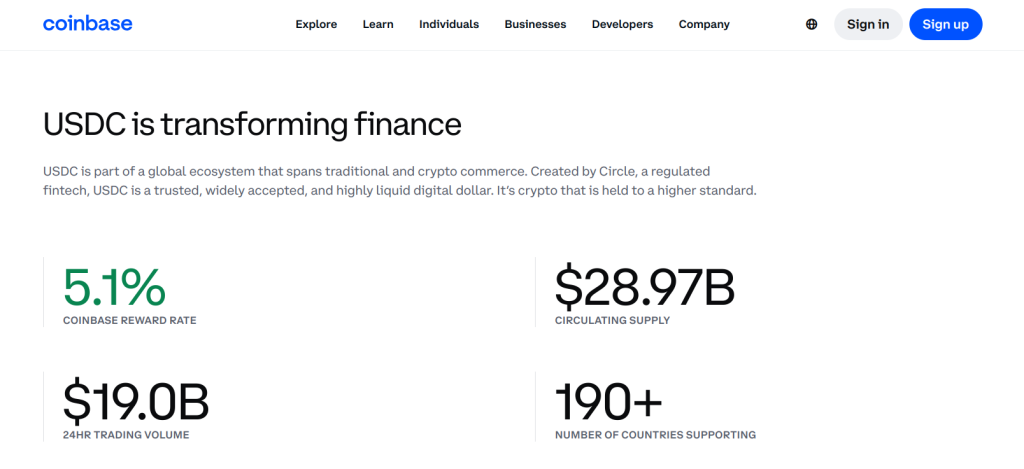

10. Coinbase – Earn Up to 9.22% With Easy-To-Use Staking

Coinbase is the largest publicly traded crypto exchange in the world and offers two ways to earn yields, one of which integrates with the Coinbase Visa card, which also pays rewards.

The easiest way to earn a yield with Coinbase is to buy USDC, a leading stablecoin pegged to the US dollar’s value, and hold USDC in your trading account. This promotional yield varies based on location and is available in over 100 countries worldwide. If your account qualifies for the Coinbase Visa debit card, you can access your USDC as needed while earning crypto rewards for your purchases.

Coinbase’s other yield product uses crypto staking, which allows you to earn up to 9% at current rates by using your crypto to help secure blockchain transactions. By far, ETH staking is the most popular choice, allowing you to hold the second-largest crypto while earning a yield — currently 2.91%. Coinbase also offers a liquid staking token, cbETH, which lets you earn a yield with a token that you can easily sell if you need to adjust your portfolio.

| Coin or Token | Yield Type | Interest Rate |

| USDC | Promotional | 5.1% |

| ATOM | Staking | 9.22% |

| ETH | Staking | 2.91% |

| USDT | Staking | 5.01% |

Pros

- Registered or licensed with leading regulatory agencies

- Integration with Coinbase debit card

- Choice of seven staking options, plus USDC

- Available to US residents

Cons

- Higher trading fees compared to some exchanges

- Promotional rates can change without notice

What is a Crypto Savings Account?

A crypto savings account can resemble a traditional savings account, although instead of traditional currencies, you deposit and earn crypto. A handful of crypto savings accounts offer easy onboarding with automatic interest earning. Other crypto savings accounts may require you to choose the best yield option for your needs and risk tolerance.

For example, Nexo automatically pays interest on crypto deposits. You don’t need to take any additional steps. However, you can earn higher yields by opting to earn interest in NEXO tokens rather than the cryptocurrency you deposit, i.e., Bitcoin, or by choosing a longer lockup period.

By contrast, a platform like MEXC requires you to choose a staking program that matches your goals. Because the source of yields may vary, it’s also important to research how each option works, including lockup periods.

Crypto savings accounts work by one of three things usually happening in the background to generate a yield: lending, staking, or DeFi.

- Lending: Many of the best crypto savings accounts are really lending platforms, meaning that the platform is paying a portion of the interest paid by borrowers. This structure roughly parallels bank savings accounts in which the bank lends your deposited funds and pays you a portion of the interest.

- Staking: While many crypto interest programs use the term staking, the term can take on different meanings. In some cases, staking really means lending your funds to DeFi protocols, discussed next. In other cases, staking refers to using your crypto to help secure a proof-of-stake blockchain, like Ethereum.

- DeFi: Crypto interest platforms may also use your funds in various decentralized finance protocols to earn a yield, paying you a portion of the interest earned.

Which Cryptocurrencies Can You Earn Interest on?

You can earn interest on a vast number of cryptocurrencies but expect to find more yield options for the most popular digital assets. Want a Bitcoin savings account? That’s easy to find. But if you’re holding a more obscure cryptocurrency, you may need to swap out to a supported asset to earn a yield.

Most platforms offer a way to earn interest in top stablecoins as well. A stablecoin is a token that’s pegged to the value of another currency. For example, Tether (USDT) is pegged to the US dollar. This makes Tether’s value stable and puts it in higher demand for crypto savings accounts and similar interest-bearing products.

So, which is the best crypto to earn interest? We list some common choices below and the available interest rates. However, you should also consider price volatility. A 20% yield on an asset that loses 30% of its value is a losing proposition. Stablecoins like USDT and USDC offer stability and high yields on many platforms.

- BTC: up to 7%

- ETH: up to 7.5%

- USDT: up to 40%

- USDC: up to 14%

- SOL: up to 8%

- KSM: up to 22%

- APE: up to 14%

- ATOM: up to 16%

- CORE: up to 50%

- IOST: up to 22%

Crypto Savings Accounts vs DeFi Protocols

Crypto savings accounts like Nexo or Youhodler offer a user-friendly interface suitable for beginners or experienced crypto investors. However, decentralized finance platforms like Aave or Seamless Protocol provide another way to earn interest. Each has its pros and cons, but DeFi may be the best route to high yields if you’re in the US, where many of the interest-bearing products from centralized platforms are not available.

Crypto Savings on Centralized Exchanges

A centralized exchange resembles traditional finance in many ways. There’s a management team to guide the platform’s policies. There’s also a trust element: users have to trust the platform to pay out interest as advertised and, most importantly, not lose the user’s deposits to hacks, fraud, or mismanagement. We’ll explore some of the risks in a later section covering crypto savings account safety.

On a platform like Nexo, standard yields come from the interest paid by borrowers on the platform. If you deposit Bitcoin, for instance, your bitcoins become part of a lending pool for BTC. Borrowers on the platform can dip into the lending pool, using their own crypto assets as collateral for the loan. You earn part of the interest.

Another source of yield could be staking for a proof-of-stake blockchain. For example, Both Coinbase and Nexo offer staking for ETH. In this case, the platform handles the technical details required to set up a staking validator and takes a percentage of the staking rewards, paying out the balance.

In other cases, a crypto savings account may not be as forthcoming regarding how yields are generated. You might just see a table of yields and lockup options without knowing how or where your crypto will be used. Possibilities include lending or deploying your capital in DeFi protocols.

Pros

- Most crypto savings accounts and interest platforms are newbie-friendly

- Easy access to staking to earn a yield

- Simple transfers from trading accounts to savings accounts or staking products

Cons

- Often unclear regarding the source of yields

- Locked funds on the platform may be at risk in the case of insolvency

- Often not available everywhere

Yield Farming on DeFi Protocol

By contrast to centralized platforms, a DeFi platform is run entirely by smart contracts, which are computer programs that run on the blockchain. These contracts use conditional statements to manage transactions: If X condition exists, do Y. Many consider the decentralized nature of blockchain-based apps to be safer than trusting humans, but DeFi also brings risk. On the other hand, decentralization brings freedom to interact with the contracts from anywhere in the world and without permission.

Crypto yield farming is a broad term, encompassing simpler lending and borrowing protocols to complex schemes to earn additional tokens. We’ll focus on the easier — and likely safer — types of protocols and how they work. As a prerequisite, you’ll need a compatible crypto wallet and compatible cryptocurrencies to get started.

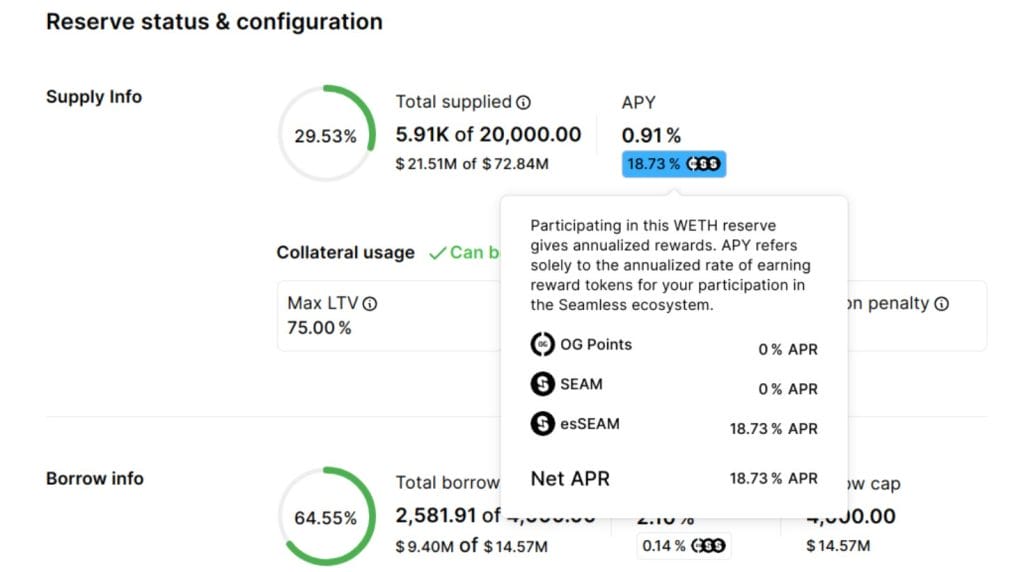

For example, to connect to the Seamless Protocol, a leading decentralized money market on the Base network, you can use the MetaMask wallet. For funding, you can use ETH, cbETH (Coinbase staked ETH), USDC, or other supported digital assets.

Seamless provides the best of both worlds with a simple interface. Earn interest on your crypto while also earning Seamless (esSEAM) tokens, which also have value.

In the example below, ETH deposits earn 0.91% interest plus nearly 19% in esSEAM, which are time-locked SEAM tokens.

Pros

- Available from anywhere in the world

- Often offer higher yields through incentive tokens

- No identity verification required

Cons

- Requires knowledge of crypto wallets

- May be vulnerable to exploits

Understanding Lockup Periods for Crypto Savings

Many times, you can earn higher yields by locking your funds for a longer duration, similar to how certificates of deposit (CDs) work. If you’re planning to hold the assets for the long term and you’re comfortable with the stability of the platform you’ve chosen, this offers a way to get paid to wait.

To look at some examples, we can start with Nexo, which offers flexible withdrawal options but pays a bonus if you’re willing to lock up your funds for a specific period of time.

By committing to a three-month lockup period, you can earn a bonus of two to three percent, depending on the type of crypto you choose to lend.

As another example, Crypto.com offers two types of bonuses. You’ll earn a bonus for locking up your crypto, such as BTC, and another bonus for meeting eligibility requirements by locking up a qualifying amount of CRO tokens.

Are Crypto Savings Accounts Safe?

First, it’s important to understand that consumer programs like FDIC (Federal Deposit Insurance Corporation) insurance don’t cover crypto savings accounts and yield products. For example, Coinbase, which does offer pass-through FDIC insurance on cash balances, cannot offer the same protection for crypto balances. The platform, like many others, also carries coverage for breaches against their servers. However, that does not cover other risks, such as insolvency. The best crypto savings account will be upfront about how they handle risk on the platform, so always check this out when choosing.

Centralized Crypto Platform Risks

Crypto savings accounts and yield products bring four primary risks.

- Platform insolvency: It can be difficult to know whether a platform is financially sound and the stakes are high. Customers with interest-bearing products are slated to be among the last to be paid out following BlockFi’s bankruptcy. Bankruptcy filings revealed that Celsius, once a leading crypto lending and borrowing platform, had a $1.19 billion hole in its balance sheet.

- Price risk: Yield-bearing assets in locked contracts can ebb and flow in value. Top-tier assets like Bitcoin and Ethereum fell by nearly 80% from their highs in value during the last market crash. If these assets are locked in a contract, there’s no way to cut your losses.

- Counterparty risk: The Gemini Earn program was a popular crypto savings account option. However, Genesis, the provider for many of the yield products, filed for bankruptcy in 2023, leaving customer Earn balances in legal purgatory.

- Undisclosed yield sources: It’s not uncommon to see mystery yields offered with little or no explanation of where the yield comes from and no way to weigh the product’s safety.

Decentralized Crypto Platform Risks

DeFi yield farming brings some risks of its own.

- Smart contract risk: Smart contracts are just computer programs, meaning they may have bugs or undiscovered exploits. Look for code audits by trusted crypto audit firms to help ensure safer choices.

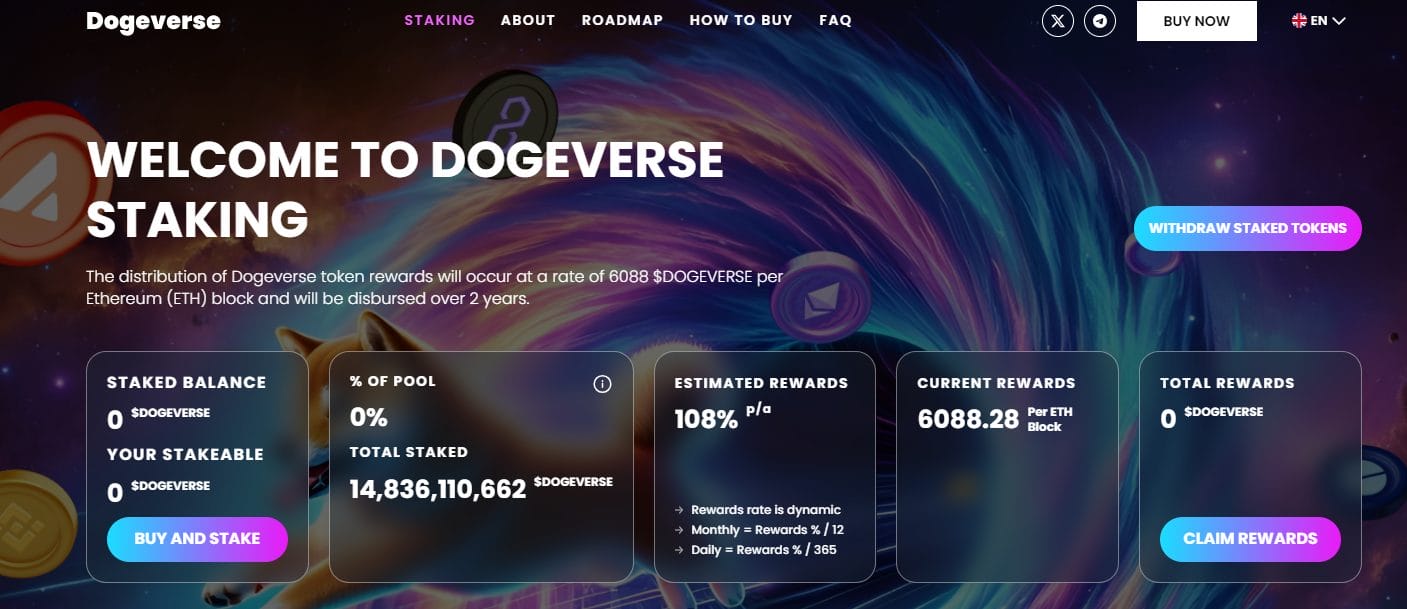

- Rug pulls: Just like in the analog world, crypto has its fly-by-night characters. In one infamous crypto ponzi, investors lost an estimated $4 billion to $15 billion on OneCoin, a blockchain that never existed.

- Price risk for farming tokens: Earlier, we looked at an example of the Seamless Protocol, which was paying less than 1% on interest but 19% in farming tokens. It’s possible that the tokens will increase in value. It’s also possible that they go to zero.

Conclusion

Crypto savings accounts and staking platforms can provide a lucrative alternative to traditional interest-bearing accounts. However, much like in the traditional finance space, it’s best to understand where your yield comes from and any risks associated with the yield. Unlike the traditional finance space, there are no safety nets for crypto yield products.

Promotional offers or staking can bring yields of up to 40% or more, and you may need to move your assets occasionally to find the best place to park your cryptocurrency. Consider lockup periods and how they might affect your ability to move your crypto or exit your position if needed. And, as always, never invest more than you can afford to lose.

FAQs

Does crypto have savings accounts?

Several crypto platforms offer yield programs that act like savings accounts. Platforms like Coinbase, Nexo, and Youholdler focus on making the onboarding process easy for new crypto investors.

Which crypto pays the highest interest?

Currently, staking CORE on MEXC pays up to 50%. OKX also offers a promotional yield of 40% on USDT. However, yields between 3% and 8% are more common.

Are crypto savings accounts insured?

No. Some platforms may carry insurance to cover breaches against their servers but expect consumer protections to be minimal and, in many cases, nonexistent.

What is the safest crypto savings account?

Coinbase may be the safest option for earning a yield on crypto assets. The exchange is regulated by several leading agencies worldwide and takes a more conservative approach to yield products, largely focused on crypto staking.

Which exchange pays the most interest on crypto?

Currently, MEXC and OKX offer the highest yield opportunities at 50% and 40%, respectively. However, yields can change, so it’s important to check rates and details before investing.

Is crypto interest taxed?

Yes. In jurisdictions like the US, crypto interest is considered income and is taxable based on its USD value when received.

References

- SEC Charges Kraken for Operating as an Unregistered Securities Exchange, Broker, Dealer, and Clearing Agency (sec.gov)

- Investor Bulletin: Crypto Asset Interest-bearing Accounts (sec.gov)

- Crypto lender BlockFi begins post-bankruptcy wind-down (reuters.com)

- Celsius Discloses $1.19 Billion Deficit in Bankruptcy Filing (bloomberg.com)

- Crypto lending unit of Genesis files for U.S. bankruptcy (reuters.com)

- The OneCoin Scam: the Dazzling Story of the Biggest Crypto Ponzi in History (coinmarketcap.com)

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell

Kane Pepi

Kane Pepi