Crypto in 2019: Main Challenges and Solutions for Ethereum

The Constantinople hard fork But what about Casper, Sharding, and Plasma? Will ICO regulations bring down Ethereum? Dapps might rescue Ethereum yet Adoption is imminent, ConsenSys believes Ethereum and macro trends

Throughout the year 2018, the price of Ethereum (ETH) slumped by more than 80%, and the coin ended the year on the third spot by market cap. The smart contract platform has run into its share of problems throughout the year, from the first release of Casper FFG (as many believe the Proof of Stake system to be inferior to Proof of Work), over network congestions, to co-founder Vitalik Buterin agreeing that Ethereum will collapse unless something drastically changes.

Throughout all this, the price continued to slump, down to a yearly low of around USD 85 – a far cry from its all time high at USD 1,448 in January 2018. Buterin himself has been increasingly the target of questioning, especially from traditionalists such as Wall Street veteran Nouriel Roubini, as Ethereum is often considered politically centralized due to Buterin’s frequent interactions with the community, which made him the best-recognized figurehead of the platform. Although he said that he would start fading into the background as “a necessary part of the growth of the community,” this was quickly taken to mean that he is leaving the project for good – which he quickly denied. While 2018 was a turbulent year for the project, will 2019 manage to bring some respite?

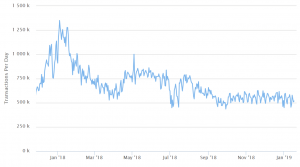

ETH price chart:

The Constantinople hard fork

The first thing on Ethereum’s roadmap is the upcoming Constantinople hard fork, which was set to happen on January 16th, but was postponed. Following a dev meeting on January 18th, it was decided that the upgrade would roll out on February 27th, with a fix for the problematic EIP. The upgrade was going to include 5 different Ethereum improvement proposals (EIPs), but one of them was removed due to security concerns which caused the postponement in the first place. Each of the EIPs will include changes to Ethereum’s code that induce better processing times for developers, fairer pricing structures, important scaling solutions, and changes to Ethereum’s economic policy.

Constantinople is a backwards-incompatible upgrade, which is why the Ethereum blockchain must undergo a hard fork. It is also a non-contentious hard fork, meaning that there is no debate over whether it should happen or not. Most notably, this hard fork reduces issuance of ETH by 33% from 3 ETH per block to 2 ETH per block, as well as a few other, more technical upgrades. Read more about it here.

But what about Casper, Sharding, and Plasma?

It must be noted that there is no correlation between Constantinople and a shift towards Proof of Stake from Proof of Work (PoW), as this hard fork deals with other issues. However, the Proof of Stake issue is a hotly debated one, but Vitalik Buterin remains firmly behind the decision to eventually shift Ethereum’s modus operandi towards this consensus mechanism. It estimated that PoS could make Ethereum safer and will let the team address some scalability problems more easily. Casper, the solution that will help Ethereum gradually move from PoW to PoS, should release its first layer this year, although the team refuses to give more concrete dates for this.

“I expect Casper to come this year, but don’t hold me on that. It’s a delicate issue to switch the main consensus of a USD 20 billion network. But it’s absolutely the right direction,” Ethereum developer Fabian Vogelsteller told Cryptonews.com.

But what’s the big deal about scalability? It comes down to a simple fact: Ethereum can currently process only around 15 transactions per second (still more than Bitcoin.) The drawbacks of this are best illustrated by the network congestion that Ethereum went through thanks to the CryptoKitties craze. Additionally, Ethereum has serious competitors among smart contract platforms that claim to be able to handle much larger transaction volumes. One of them is NEO, claiming in its whitepaper that it can handle up to 10,000 transactions per second.

Also, perhaps the most fashionable technical solution to scalability right now is sharding, which Ethereum (among others) is working on in the hopes of achieving somewhere in the region of 10,000+ transactions per second.

In contrast to the Ethereum blockchain as it operates now, sharding divides the blockchain’s nodes into smaller groups, known as ‘shards.’ Rather than validating the same transactions at the same time, different shards then validate different sets of transactions, thereby increasing the number of transactions that can be processed per second.

Ethereum transaction chart

Plasma is another scaling solution for Ethereum that many look forward to, which differs from the previous two by being a Layer 2 scaling solution, i.e. a solution that is off the chain, similar to Bitcoin’s Lightning Network. Plasma is a technique for conducting off-chain transactions while relying on the underlying Ethereum blockchain to ground its security. Plasma allows for the creation of “child” blockchains attached to the “main” Ethereum blockchain. These child-chains can even spawn their own child-chains, which can themselves have another set of child-chains etc. So Plasma is basically many branching blockchains linked to one root blockchain.

The importance of Plasma is not to be underestimated just because it is not an on-chain solution.

“Personally, I am excited about Layer 2 solutions on different blockchains, such as Lightning and Plasma, that address scalability, speed and transaction price. What remains to be seen is what sort of widespread impact this will have,” Lan Filipic, COO of cold storage cryptocurrency solution Sugi Card, told Cryptonews.com.

Will ICO regulations bring down Ethereum?

Ethereum owes most of its popularity to the fact that it can host initial coin offerings (ICOs), in that its blockchain can be used to make many different tokens for projects that need to raise money before they can develop their own blockchain. However, the increased scrutiny of the space, especially by authorities such as the US Securities and Exchange Commission (SEC) could hinder Ethereum’s progress.

Raising funds for your project may evolve beyond needing strictly ETH, as it was before, Filipic believes. “There are plenty of ways today to run a compliant crypto crowdfunding campaign. Most of these avenues were also available in 2016 and 2017. Hence, I expect the success rate of ICO campaigns to converge with traditional ‘kickstarter’ campaigns over time. So it will be irrelevant whether the project accepts USD or ETH. It is going to be the project and not the currency used that determines success,” he explained.

Ethereum network utilization

However, the stricter regulations might bode well for upcoming projects.

“Greater clarity of regulation for cryptocurrencies, in particular ICOs, will help raise the bar for quality projects and, at the same time, make it easier for them to reach their funding goals. We expect a decline in the number of utility tokens offered to investors and a move transition to Security Token Offerings. These not only offer better protections for investors, but are better for token issuers as well. Fewer will want to shoehorn a currency into a business that has no need for it,” explains Juan M. Villaverde, leader of the Weiss Cryptocurrency Ratings team.

There might be a middle ground, according to Vogelsteller.

“ICOs played a big role in the price rise of 2017, to a large degree probably due to the simplicity of my ERC20 standard [the ERC20 standard was proposed on November 19, 2015 by Fabian Vogelsteller] that allowed any project to issue their own tokens,” he said, adding, “Regulators feel the urge to react, but they don’t have the knowledge to make educated decisions. Therefore I think it’s important that we as a community show that we can better regulate on chain than in paper. For this reason I proposed the Reversible ICO (RICO) to show that we can create safety for investors by design.”

Dapps might rescue Ethereum yet

Although scalability is one big issue that has to be addressed before Ethereum-based dapps (decentralized applications) can gain widespread adoption, the possibilities behind them should not be underestimated. “Personally, I am really excited about seeing the emergence of the first usable dapps — particularly Kyber, Golem, and Dai. As an entrepreneur in the emerging tech space, I’m excited to watch the evolving applications of AI [Artificial Intelligence] technology and machine learning in consumer grade products, and how those developments will alter or impact the user experience,” said Marshall Hayner, CEO of peer-to-peer payment application Metal Pay.

“Thanks to the hard work of BUIDLers — developers, engineers, security professionals and entrepreneurs — along with maturing essential components and standards, the developmental landscape is now full of elements that can be composed into a powerful decentralized app, in a way previously not possible. These elements include browsers, tokens, wallets, swap protocols, and exchanges, data feeds, markets, IoT [Internet of Things] protocols, registries, name services, legally and automatically enforceable agreements, all functioning interoperably behind the scenes of a user experience. We will see this synergy manifest into a number of groundbreaking dapps in 2019,” said Andrew Keys, founder of ConsenSys Capital, a subsidiary of Consensys, a blockchain technology company.

He goes on to add, “Moreover, in 2019 we’ll start to see disparate projects begin to fit together, creating fully integrated stacks for industry verticals built on Ethereum. Take FinTech: The digital asset safeguarding solutions offered by Trustology, real-time fiat payment solutions of Adhara, and financial reporting systems of Balanc3, could create an integrated stack, starting the path for interoperability between blockchain platforms and business networks. In verticals from FinTech to music to healthcare, the “Legos” will start “stacking” into place.”

Adoption is imminent, ConsenSys believes

“Decentralized Finance is already working on public-permissionless Ethereum, and we’ll see a 10x increase in users,” Keys states. But dapps need a better user interface to be more widely used, and that’s what 2019 is all about:

“While so much development in the Ethereum ecosystem in 2018 has been focused on elements under the hood, it’s through user experience that audiences truly connect with dapps. With a few notable exceptions, design in blockchain has lagged behind the lofty aspirations of its protocol. No longer.”

He explains, “Following the lead of Rimble — an open source toolbox of beautifully designed, blockchain-compatible elements — design standards for decentralized apps will be raised in 2019. With better design and more seamless integration available, the next generation of dapps will be all about user experience or will be left behind. dapps will catch up to Coinbase — which provided the first non-horrible user experience as yet in blockchain.”

Vogelsteller also agrees with this sentiment. “I think 2019 will be the year of real world adoption where we see current industries starting to use public blockchains – the way it supposed to work,” he said.

Ethereum and macro trends

The current situation in the world of traditional finance – but also in world politics – could drive investors towards cryptocurrency, Keys believes. “In increased times of uncertainty, scarce commodities are often seen as a safe harbor. It’s one reason Bridgewater founder, Ray Dalio, structured his famous ‘All Weather’ fund to hold 7.5% commodities and 7.5% gold, to weather periods of accelerated volatility, and hedge against cyclical risks in equities or bonds. Between central banks interest rate hikes, an inverted yield curve, tweets from the U.S. president about a trade war with China, and fears the decade-long growth cycle which followed the Great Recession may finally slow, 2018 was certainly uncertain,” he explains.

“By November, 90% of the 70 asset classes tracked by Deutsche Bank posted negative total returns for the year, according to The Wall Street Journal. That’s compared to just 1% of asset classes delivering negative returns in 2017. Globally, stock market indexes closed the year with their worst annual performance since the financial crisis. During this tightening cycle, in which many fear a U.S. recession is imminent, I hope interest in digitally scarce crypto commodities as an underlying technology set to power the next wave of innovation, will surge. A contrarian view could be that in a global RISK-OFF state, investors could also de-lever from digital assets due to their volatility.”