Crypto Adoption in 2021: Bitcoin Rules, Ethereum Grows & Faces Rivals

The biggest main crypto adoption trends in 2021: The continuing institutional/corporate adoption of bitcoin, The growth of platforms that support blockchain interoperability and external communication, The increasing expansion of Ethereum and DeFi.

Crypto adoption will gain further steam in 2021, according to experts speaking with Cryptonews.com. To date, Bitcoin (BTC) and other cryptoassets have had a very good (yet turbulent) 2020, and with the global economy expected to continue stagnating into 2021 (and beyond), crypto might win additional converts with its promise of greater returns and independence from traditional finance.

2020: How accurate were predictions last year?

Industry players were pretty accurate when sharing their predictions with Cryptonews.com last year.

They predicted that Bitcoin’s May halving would increase demand for the cryptocurrency: this has generally been the case, with the price of bitcoin rising from a low of USD 5,000 to just under 9,000 in the weeks before May 11, and then rising steadily afterwards, briefly hitting USD 14,000 on some exchanges on October 31. However, it still can be argued what was the effect of the halving alone.

BTC price chart:

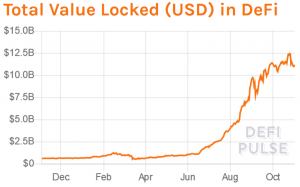

They also predicted the rise of DeFi (decentralized finance): from a total value locked in of USD 676m on January 1, the sector has grown to USD 11bn as of writing.

Central bank digital currencies (CBDC) were another thing they said “will gain traction as an idea.” This was also largely true: the People’s Bank of China completed a digital yuan trial in October, while a healthy number of other central banks — such as the European Central Bank and US Federal Reserve — are exploring their own alternatives, while Combodia and Bahamas have already launched their CBDCs.

Lastly, joining up with their prediction regarding Bitcoin’s halving, experts also suggested that the “coming years could speed up cryptocurrency ownership, particularly if regional and/or global recessions occur.” As reported, crypto usership is going up at an exponential rate, per researchers at the Cambridge Centre for Alternative Finance, with over 100 million people worldwide now making use of cryptoassets.

2021: More BTC adoption, more stablecoin adoption

The first prediction for 2021 is that we’ll see a continuation of the move towards BTC that we witnessed in the latter half of 2020.

“Bitcoin will still be the main focus. The institutional demand for bitcoin is increasing this year, and will continue to increase next year,” predicted Bendik Schei, the Head of Research at Arcane Crypto.

Schei suggested that bitcoin adoption next year will be facilitated by the “massive development in the infrastructure for BTC,” which has improved the accessibility of the cryptocurrency for institutional investors.

“Now, the data also shows that the institutions are coming. In 2020, we’ve seen new records and strong growth on CME and Bakkt, massive inflows for Grayscale and public companies buying bitcoin as a reserve asset.”

Most other industry figures and commentators agree with this analysis. Nick Cote, the Senior Analyst at crypto-trading platform Hxro Labs, is one of them.

“Bitcoin stands to gain substantially in 2021 due to further institutionalization of the space, as more custodial services and insurance offerings become available. Adoption can be reflected not only by price trending up, but also in the amount of unique wallet addresses, total dollar value transacted on-chain, and further global penetration of Bitcoin’s brand, which continues to benefit from its first-mover advantage,” he told Cryptonews.com.

Related to bitcoin’s use as a hedge against inflation will be the parallel growth of stablecoins such as tether (USDT), which serve to provide liquidity in markets where fiat-to-crypto trading isn’t easy.

“Stablecoin usage — and tether in particular — is especially high in East Asia, making up 33% of all value transacted on-chain in the region. That share has been rising steadily this year, beating out BTC as the most-received cryptocurrency in the region,” said Kim Grauer, the Head of Research at Chainalysis.

Grauer added that Chainalysis expects stablecoins to continue growing in popularity around the world, “especially in geographies where they offer a stable store of value and are effective in carrying out everyday transactions.”

Ethereum and DeFi

DeFi has witnessed spectacular growth this year, which in turn has boosted Ethereum (ETH) and solidified its position as the number-two cryptoasset/platform. This might continue next year, particularly as the low-interest rate environment drives investors towards DeFi.

“Ethereum is also positioned to see increased adoption,” said Jason Wu, the CEO and co-founder of DeFi network DeFiner.

“First, it is the network around which the vast majority of DeFi activity orbits. There are also massive numbers of transactions and trades involving stablecoins, and the largest ones all operate on the Ethereum network.”

Wu also suggested that 2021 will witness the rise of ERC-20-based non-fungible tokens, which “will see continued rise in the art, creative, and, eventually, the financial services space.”

Interoperability chains

As the major platforms and the wider ecosystem see greater use in 2021, we might also see the greater use of platforms which enable interoperability and communication with external data sources.

“Chainlink will enjoy the most adoption in 2021. The underlying technology solves real world problems and brings crypto closer to mass adoption,” said Luciano Nonnis, the CEO and co-founder of trading/research platform DXone.

Chainlink (LINK) provides a framework for building decentralized oracle networks so that smart contracts can access data inputs and outputs in the non-crypto world. Nonnis added that it will bridge “the gap between blockchain and industry.”

Aside from predicting growth for NEM (XEM) and its Symbol platform, NEM Group Chief Investment Officer Dave Hodgson agreed that interoperability blockchains will have a busy 2021.

“Other key players including Cosmos, Cardano and Polkadot are due to support several use cases, making it easy to migrate off Ethereum, while supporting similar kinds of contracts which may prove beneficial if Ethereum faces similar scalability and cost challenges,” he told Cryptonews.com.

Obstacles remain

Given that Bitcoin was created in response to an economic crisis and the world is facing new economic headwinds, 2021 may be another good year for crypto adoption. However, we shouldn’t get too ahead of ourselves, since crypto will also face a few obstacles that need to be overcome in order to maximize adoption.

“I personally think BTC as a means of payment needs improvement on the [user experience] side,” said Bendik Schei. “Lightning Network will be important in the coming years to enable instant payments and allow innovation in several sectors, but it is still early days.”

Likewise, Ethereum also has some of its own teething problems to overcome, at least according to Dave Hodgson.

“Ethereum is, of course, a project to watch, but seems to be suffering from project fatigue with increasing numbers speaking to other chains due, I suspect, to uncertainty on Ethereum 2.0 dates and scaling timescales.”

These qualifications aside, we can at least say one thing about 2021: if it’s even half as eventful as this year, it should be an interesting year for cryptocurrency adoption.

___

Learn more:

The US Election: Pullback Possible, But Neither Trump Nor Biden Won’t Stop Bitcoin

A Reality Check is Needed at This Stage of CBDC Development – Deutsche Bank

4 Reasons Bitcoin May Hit USD 1-5 Trillion Market Cap in 10 Years

Brace For More Bitcoin Flash Crashes In This Bull Market – Hut 8 Founder