MEV Bot Guide: Making an Ethereum Arbitrage Trading Bot

Maximal Extractable Value (MEV) bots are increasingly becoming popular – especially on the Ethereum network. Put simply, MEV bots are algorithms that determine which transactions should be prioritized. This enables validators and MEV bot creators to autonomously generate profits.

Other strategies are also utilized, such as front-running and liquidation mining. This beginner’s guide explains everything there is to know about MEV bots, including how they work, the different strategies used, and the required step-by-step process.

What is MEV in Crypto?

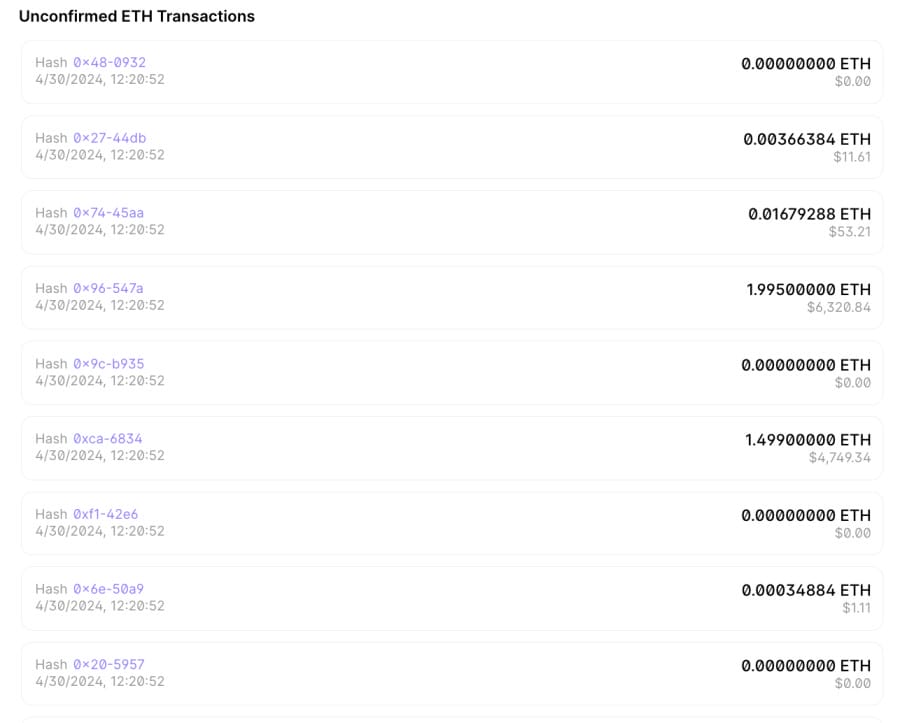

Let’s start with the absolute basics; What is a MEV bot? MEV – or Maximal Extractable Value, are automated crypto bots that make money for their creators. There are many different strategies employed, although most revolve around transaction reordering. So, when transactions are sent on the Ethereum blockchain, they initially sit pending in the ‘mempool’.

This is until the respective block of transactions is confirmed by the proof-of-stake validator. However, the order in which transactions are processed can be manipulated by the MEV bot. It’s a win-win situation for the bot creator and network validators. This is because MEV bots can prioritize transactions with the highest fees.

Meaning – the validator makes more money. In turn, the MEV bot creator will be paid a commission. Additionally, MEV bots also operate on decentralized exchanges. One of the most common strategies is front-running. This means bots secure a favorable entry price based on pending orders, allowing them to profit from the immediate price increase or decrease once executed.

Other common methods include back-running, liquidation, and arbitrage trading bot strategies. MEV bots are also increasingly being used to secure flash loans. Crucially, questions remain about the ethics of MEV bots. After all, they have an unfair advantage over regular market participants. This should be considered before you proceed.

How Do MEV Bots Work?

Let’s take a closer look at how MEV bots work. This will ensure you have a firm understanding of the fundamentals.

Transaction Monitoring

MEV bots operate 24 hours per day, 7 days per week. They monitor every single transaction that goes through the Ethereum network. As mentioned, pending transactions are initially sent to the mempool. Naturally, the mempool contains a significant number of transactions at any given time.

This covers the entire Ethereum ecosystem, meaning transactions could be associated with thousands of different projects. This could include smart contracts deployed from meme coins, play-to-earn games, decentralized finance platforms, and NFT transfers.

As such, MEV bots are designed with highly advanced algorithms. Unless you’re proficient in a suitable programming language, learning how to make a MEV bot in crypto will be challenging. More on this later.

MEV Opportunity Detection

Transaction monitoring is the first segment undertaken by the MEV bot. Simultaneously, the bot analyzes transaction blocks to find profit-making opportunities. For example, at their core, MEV bots were originally designed to profit from transaction reordering. This means prioritizing Ethereum transactions with the highest fees.

This is because the Ethereum network is limited in how many transactions it can process per block. Therefore, MEV bots exist to help network validators maximize their earning potential. And in doing so, MEV bots take a slice of the fees generated.

Similarly, you might notice that the best Ethereum wallets enable users to choose their fee structure. This is often a choice between slow, standard, or fast. The more you pay the quicker the transaction is confirmed. This mirrors the profit-making concept employed by MEV bots. However, there are many other ways for MEV bots to make money, which we’ll cover later.

Automatic Trade Execution

Once a MEV bot has identified a profitable arbitrage opportunity, it will execute a position accordingly. This happens in real-time, considering that a new Ethereum block is confirmed approximately every 12 seconds. This highlights just how advanced and sophisticated MEV bots need to be to successfully make money.

In addition, the MEV bot needs to optimize the GAS fees it pays to execute its order. This ensures the order makes the next Ethereum block. The submitted GAS fee is a variable cost for MEV bots, so it must find the ideal balance between viability and order prioritization.

5 Ways to Make Money with MEV Bots

This section explores five different ways that MEV bots make money, as well as the sophisticated MEV arbitrage bot built to take advantage of price discrepancies across DEXs. We’ll discuss front and back-running strategies, not to mention various arbitrage opportunities, flash loans, and liquidation systems. Read on to discover the best profit-making opportunities available in 2024.

Front-Running Bots

One of the most common strategies employed by MEV bots is front-running. In a nutshell, the bot detects large orders that have been placed, but not executed by the network. This means the order is pending, which MEV bots can view in real-time via the mempool. The bot will front-run a market order to benefit from the eventual price increase or decrease.

For instance:

- Let’s say the MEV bot detects a $100,000 buy order on an ERC-20 token. The buy order is priced at $1.

- The ERC-20 project has a small market capitalization, so the MEV bot knows the pending order will have a high impact on the token’s price.

- Therefore, the MEV bot enters a buy order just below $1 – say at $0.999.

- The MEV bot’s order is executed first, as it was placed just below the $100,000 pending order.

- Once the opening order is executed, the token’s price increases.

- The MEV bot automatically closes the position, making a quick profit.

Now, it’s crucial to note that, as per the SEC, front-running is illegal in the traditional trading markets. This covers financial securities like stocks and ETFs – but not crypto assets. However, this doesn’t mean that front-running is ethical. Far from it. After all, front-running bots not only have an unfair advantage but they frequently manipulate market prices.

Back-Running Bots

Back-running bots operate similarly to front-running strategies. But there’s one key differential; back-running bots capitalize on orders that have already been executed by the Ethereum network. In contrast, front-running bots focus on pending orders.

Nonetheless, the back-running bot will typically enter positions after a large market order has been confirmed. The bot will then enter a buy or sell position accordingly.

For instance:

- Suppose a trader places a $50,000 sell order on one of the best utility tokens. This results in a rapid price decline.

- Within milliseconds of the order being placed, the MEV bot places a buy order – long before human traders notice.

- This takes advantage of the low entry price, with the MEV bot expecting an immediate recovery once new buy orders are executed.

Back-running is often a higher-risk strategy, as calculated assumptions need to be made.

MEV Arbitrage Bots

MEV bots are increasingly leveraging arbitrage systems. This is one of the lowest-risk strategies deployed, as the crypto arbitrage bot simply takes advantage of price discrepancies.

An Example of the MEV Arbitrage Strategy

- Let’s say the MEV bot scans market prices on the best decentralized exchanges.

- The bot notices that MANA tokens are trading at two different prices.

- On Uniswap, it trades for $0.43.

- On SushiSwap, it trades for $0.42.

- So, the MEV bot buys MANA on SushiSwap, taking advantage of the lower token price.

- Simultaneously, the MEV bot sells MANA on Uniswap.

- This means for every MANA token traded, a $0.01 arbitrate profit is made.

Now, for the Ethereum arbitrage bot strategy to work effectively, MEV bots must optimize GAS prices. This ensures the buy and sell orders are executed in real-time. What’s more, the GAS price should ensure a viable profit margin.

Flash Loans

MEV bots also leverage flash loans to maximize profitable opportunities. In simple terms, flash loans enable users (or MEV bots) to borrow cryptocurrencies without collateral. However, there’s one stipulation; the borrowed funds must be repaid before the next confirmed block. In Ethereum’s case, that’s about 12 seconds.

Naturally, human traders are unable to open and close profitable positions in this time frame. MEV bots, on the other hand, operate on highly advanced algorithms. This means they can monitor transactions, find a suitable opportunity, take out a flash loan, close the position, and repay the funds – all in the space of one Ethereum block.

Liquidation Bots

Even the best crypto leverage trading platforms come with liquidation risks. This means the trader’s position is closed when it declines by a certain percentage. The more leverage deployed the more chance there is of being liquidated. Now, you’ll often hear about significant liquidations in the crypto industry – often amounting to billions of dollars.

- For example, suppose over $1 billion worth of long positions will be liquidated if Bitcoin decreases to $65,000.

- This will result in a rapid price decline.

- However, there’s almost always an immediate rebound – this is where MEV bots come in.

- The MOV bot will buy the liquidation dip and sell once the price rebounds.

In addition, MEV bots also take advantage of undercollateralized loans on crypto lending platforms.

Here’s how:

- Users are required to put up collateral when borrowing funds. For instance, the user might deposit $1,000 worth of Bitcoin to borrow 500 USDT.

- If the price of Bitcoin declines by a certain percentage, the user needs to add more collateral. Otherwise, the loan will be liquidated, meaning the user loses their Bitcoin.

- Now, MEV bots continuously scan the best crypto lending platforms for loans that are close to liquidation.

- Within milliseconds of the loan being liquidated, the MEV bot will purchase the collateral at a discounted rate.

- The MEV bot can then sell the Bitcoin at standard market prices on another platform.

What Skills Do You Need to Make an MEV Bot?

If the MEV bot strategies discussed above sound too good to be true, in many ways they are. This is because MEV bots are developed by highly skilled programmers.

And, once profitable strategies and systems have been deployed, developers aren’t going to share their ‘Secret Sauce’. With this in mind, the only way to make money from MEV bots is by creating one yourself. This is easier said than done.

Advanced Blockchain Knowledge

The first minimum requirement is to have an intimate understanding of blockchain technology. More specifically, the Ethereum blockchain – as this is the most commonly used network for decentralized finance – which is where MEV bots excel.

Key specialisms should include:

- Smart Contracts: At the heart of the Ethereum ecosystem are smart contracts. MEV bot developers should understand how smart contracts are created, triggered, and executed.

- GAS: All Ethereum transactions, including smart contracts, require GAS. This is the transaction fee paid to network validators and it’s settled in ETH. MEV bot creators must understand how to optimize GAS fees. This ensures bot orders are executed in a speedy and viable manner.

- Mempool: Equally as important is knowing how the Ethereum mempool works. This is where pending transactions are stored until they’re added to the next block. MEV bots constantly monitor the mempool to find profitable opportunities.

Expert-Level Programming Skills

In addition to blockchain knowledge, you’ll also need expert-level programming skills. After all, you’ll be building a MEV bot from the ground up. This requires advanced algorithms with highly sophisticated trigger points. This ensures the MEV bot makes consistent profits.

- Solidity: At a minimum, you’ll need to learn Solidity. This is the programming language used by the Ethereum network.

- Modern Programming Language: MEV bot developers should also have a firm understanding of a modern programming language. Python and JavaScript are commonly used, as these languages enable bots to ‘script’ to the Ethereum blockchain.

It can take many years to become proficient in these programming skills.

Familiarity with Ethereum Development

The most successful MEV bot developers have advanced knowledge of Ethereum development tools.

For example, most developers use Truffle when building smart contracts on Ethereum. Truffle comes packed with features, such as smart contract management, automated testing, and inter-network communication.

What’s more, you should have a solid understanding of scripting tools like Web3.js or ethers.js. This enables MEV bots to directly interact with Ethereum nodes.

Data Analysis Skills

MEV bots need to analyze an unprecedented amount of data. As mentioned, bots monitor thousands of mempool transactions at any given time. Simultaneously, the bot must interpret the data in real-time and assess ways to generate risk-averse gains.

Crucially, the MEV bot won’t be proficient in data analysis unless it’s programmed accordingly. This means you, as the MEV bot developer, should be skilled in key fields like statistical analysis, information visualization, and data manipulation. Without these skills, the bot won’t have the capacity to handle large data sets.

Understanding of Risk Management

Even the most advanced MEV strategies operate in a high-risk marketplace. All MEV bots and MEV traders encounter losing trades, just like seasoned day traders. This is just the nature of the industry. Not only are MEV bots competing with human traders – but also other bots. As such, having an advanced understanding of risk management is crucial.

At a minimum, the MEV bot should always have an exit strategy; whether that’s locking in profitable trades or closing losing ones. Bankroll management is also important. This means entering appropriately sized trades, ensuring that the bot avoids risking too much on any single position. While at the same time, ensuring that risk-averse positions are maximized.

How to Make an MEV Trading Bot: 5 Steps to Follow

In this section, you’ll learn how to get a MEV bot in five steps. Each step requires a commitment to learn and perfect a new skill, so don’t expect to have a profitable MEV bot running overnight.

1) Get a Strong Understanding of MEV

The first step is to become an expert in Maximal Extractable Value. A good starting point is to review the MEV documentation provided by the Ethereum Foundation.

This explains key strategies like front-running, flash loans, and ‘GAS golfing’. Each MEV concept comes with additional reading sources; you’ll need to go through all of them.

2) Choose a Programming Language and Tools

You’ll also need to become proficient in programming. This includes Solidity, the required language to build and deploy Ethereum smart contracts. A modern programming language is also needed; Python or JavaScript are good options.

In addition, you’ll need to learn how to use the Truffle suite. This is the most developer-friendly tool to engage with the Ethereum blockchain.

How to Learn Solidity?

- Many online courses teach the Solidity language.

- Some are aimed at complete beginners without prior coding skills.

- While others demand knowledge of at least one modern programming language.

- Some Solidity courses are free. A good starting point is the Ethereum website.

3) Develop a Strategy and Algorithm

Having suitable programming skills is just half the battle. In addition, you also need to develop a MEV bot strategy. The strategy should not only have the capacity to make money but in a risk-averse way. Scroll back up for a recap on the most effective MEV strategies.

After choosing a strategy it needs to be built into a functional algorithm.

- This will be similar to the ‘if-then’ concept.

- Put otherwise, the algorithm should instruct the bot what to do when a certain condition is triggered.

- For example, buy a micro-cap ERC-20 token (then) if a buy order of $100,000 or more is entered (if).

This is a simplified example to illustrate the process – MEV bots are considerably more advanced than this.

4) Build and Test the Bot

After converting the strategy into a working algorithm, the MEV bot should enter the testing phase. This should initially consist of backtesting. This means testing the bot’s performance in historical trading conditions. This will require a significant amount of data, potentially requiring millions of smart contract transactions.

This reverts to our earlier point, where we explained the importance of having an analytical mindset. Additionally, your MEV bot should also be tested in live market conditions. This means using virtual funds. In doing so, any potential issues won’t be financially damaging. You can then make the required adjustments and return to the testing phase accordingly.

5) Deploy and Monitor

After an extensive testing phase, the MEV bot can be fully deployed. Just remember that a successful testing phase doesn’t guarantee future profits.

The crypto markets evolve rapidly, so constant monitoring is crucial. This means analyzing all trades made by the bot. Assess whether the bot could have done things better. And if so, adjustments should be made.

Advantages of MEV Bots

The main advantage of MEV bots is the ability to perform tasks that are above human capabilities. This means analyzing data in real-time and making second-by-second decisions. MEV bots offer a fully automated service, meaning they scan the markets 24/7.

What’s more, MEV bots have the potential to make consistent gains based on risk-averse metrics. This removes emotions from the investment process.

Let’s take a closer look at the key benefits of MEV bots.

Fully Automated Trading

Although the development and testing processes can be tedious, once deployed – MEV bots are autonomous. This means you can passively trade the crypto markets.

The bot never sleeps – so it’s constantly looking for profit-making opportunities.

Excellent Profit Potential

The most sophisticated MEV bots in crypto generate considerable returns. For example, Flashbots – which researches the negative effects of MEV, claims that MEV bots have made over $2.4 million in the prior 30 days.

Before the Ethereum Merge, the total MEV returns were over $675 million. Considering that MEV bots have since expanded to other networks – such as Solana and BNB Chain, the returns are considerably greater.

Data-Driven Decision Making

Crypto MEV bots remove a common risk from the trading process; emotions. Put simply, MEV bots make data-driven decisions. This is based on the underlying algorithm the bot has been programmed to follow.

As mentioned, bots can only buy or sell cryptocurrencies once specific conditions are triggered.

Disadvantages of MEV Bots

MEV bots also come with drawbacks. For a start, advanced technical knowledge is required. Not only in blockchain concepts but also in programming and building algorithms. What’s more, MEV bots operate in a high-risk market; profits are far from guaranteed.

Let’s take a closer look at the key risks of using MEV bots.

High Technical Complexity

The reality is that unless you’re a seasoned blockchain developer with at least one modern programming language, making a profitable MEV bot is a tall order. You’d also need an intimate understanding of smart contracts, GAS fee optimization, and network mempools. Not to mention risk management and high-level data analytics.

While there are third-party MEV tools aimed at beginners, they’re unlikely to be profitable. After all, it doesn’t make sense for successful MEV strategies to be shared in the public domain; even if a fee is charged.

Significant Market Risks

Even the most profitable MEV bots are at risk of significant losses.

Consider a case study from 2022, where a MEV bot reportedly made over 800 ETH through arbitrage strategies. However, just one hour later the MEV bot was hacked due to a vulnerability in its underlying code. The MEV bot’s entire wallet was hacked, amounting to over 1,100 ETH.

In addition, MEV bots often execute unsuccessful trades. Nobody can predict the markets with any certainty; no matter how advanced the bot is. For example, back-running strategies rely on calculated risks. Similarly, arbitrage strategies can fail if the bot doesn’t correctly optimize GAS fees.

Intense Competition

One of the biggest risks facing MEV bots is other MEV bots. Put otherwise, a significant number of bots operate in the same marketplace. This could mean front-running a position that’s already been front-run.

Or missing out on the second segment of an arbitrage position. Either way, the most advanced and sophisticated MEV bots will supersede the rest of the market. This means your bot could be inferior to other market participants.

Conclusion: Are MEV Bots Profitable in 2024?

In summary, MEV bots continue to make significant gains. Whether that’s through front/back-running, arbitrage trading, or flash loans – MEV bots are considerably more advanced than human capabilities. However, consider the ethical side of MEV.

Not only do MEV bots have an unfair advantage but they often engage in market manipulation. If you do proceed with a MEV strategy, avoid using third-party providers – these are rarely profitable. Instead, learn the skills to create your own MEV bot from the ground up.

FAQs

What is a MEV bot?

MEV (Maximal Extractable Value) bots use various automated strategies to capitalize on smart contract transactions. Some of the most profitable methods include front-running, back-running, and arbitraging.

Are MEV bots legal?

While potentially unethical, MEV bots are generally legal in the crypto industry. However, certain strategies – such as front-running, are illegal in the traditional securities markets. This covers stocks and ETFs but not crypto.

What are the risks of MEV?

MEV bots come with many risks, including a failure to optimize GAS fees. Another risk is that MEV bots can enter unsuccessful trades, meaning financial losses. An oversaturated MEV market can lead to network congestion, making it increasingly difficult to execute profitable positions.

Is it difficult to make a MEV bot?

Yes, making a MEV bot – let alone a profitable one, is difficult. Some of the required skills include smart contract development, an understanding of a modern programming language, and data analytics.

What is a MEV slippage bot?

MEV slippage bots capitalize on sharp price movements on decentralized exchanges. This happens when a large buy or sell order has a high price impact. The bot will analyze pending orders from the Ethereum mempool and enter a position accordingly.

References

- Detecting Personal Trading Abuses (SEC)

- What Are Flash Loans? (Chainlink)

- Bitcoin halving could drive $5 billion liquidations, research firm warns (The Street)

- Maximal Extractable Value (MEV) (Ethereum Foundation)

- Cumulative Extracted MEV – Gross Profit (Flashbots)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Eric Huffman

Eric Huffman

Nick Pappas

Nick Pappas

Sergio Zammit

Sergio Zammit