USD 1.9B Liquidated As Overexuberant Crypto Traders Get Overleveraged

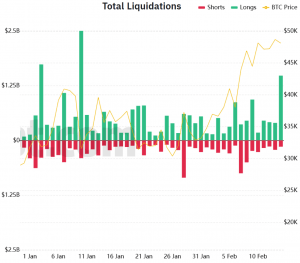

Around USD 1.9bn in 281,000 trading positions have been liquidated in a day as the market corrected sharply, per bybt.com data. Around 90% of the liquidations were of long positions, suggesting that overly optimistic traders were using margin trading to open large positions in the hope of bitcoin (BTC) hitting USD 50,000 (and beyond).

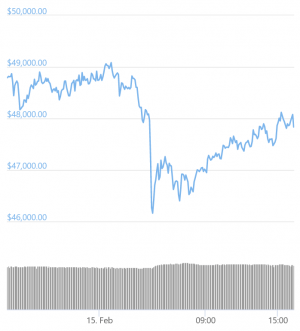

The liquidations are largely responsible for bitcoin’s 3% fall over the past 24 hours, when its price dropped from around USD 49,500 to nearly USD 46,000 (before recovering to the USD 48,000 level). This correction also initiated a chain reaction in altcoins-related positions and accelerating their sell-off.

February’s crypto liquidation record

As things stand, USD 1.9bn in trading positions have been liquidated over the past day. This is the highest amount since January 10, when around USD 2.5bn in positions were wound down.

USD 1.7bn of these positions were long, with Binance alone accounting for nearly a billion of them. Likewise, bitcoin was the most liquidated position, with positions worth around USD 550m being liquidated.

Looking at bitcoin’s price chart, a drop over the past 24 hours — particularly at 02:00 UTC — indicates that these liquidations have only accelerated the crypto’s slide down from its latest all-time high.

And for many analysts and commentators, there was really only one major cause for this surge in long-position liquidations. Namely, overleveraged traders, who were unable to afford the margin calls which came after the price of bitcoin dropped below USD 48,000, and who (as a result) had to liquidate their positions.

Some analysts blamed the liquidation wave in particular on inexperienced and overly bullish traders who naively assumed bitcoin’s price was heading in a straight line upwards.

Overleveraged problem

While traders who don’t use leverage can sit back and laugh at the misfortune of their peers who were ‘rekt’ in the latest cascade, its occurrence signals an increasingly serious problem within the cryptocurrency market.

Looking at the bybt.com chart above, it becomes apparent that long liquidations have become more numerous over the past month or so. With bitcoin (and other coins) breaking all-time highs nearly every passing week, some traders may feel unable to gain significant exposure without margin trading.

However, it’s clear that a growing number of traders can’t afford to maintain their leveraged positions in the event of dips. Hence, the growing frequency of big liquidations.

While the rising price of bitcoin may make leverage more tempting, more sober analysts advise traders — particularly inexperienced traders — to not “take the bait” and to simply build up a long spot position over time with your own funds.

As reported, leveraged trading is the biggest risk to the crypto market in terms of what could cause “something to pop down the line,” according to Joey Krug, Co-chief Investment Officer at US-based major crypto investment company Pantera Capital.

He warned that some people get complacent when they realize crypto is here to stay. As a result, they lever up on it, thinking it can’t go down that much because institutions will swoop in and buy, saving the day. But eventually, when the lid blows off and bids are not there, liquidations of levered longs will drive the price down as just happened again.

Leveraged trading refers to borrowing funds so that you can take a larger position than you would be able to with your existing funds so that you can potentially generate a higher profit. However, while margin trading enables traders to amplify their returns, it can also lead to increased losses and liquidations, which is why experienced traders tend to advise newcomers to stay away from leveraged trading.

At the time of writing (14:21 PM UTC), BTC trades at USD 47,877 and is down by 2% in a day after it reached its new all-time high of USD 49,532 yesterday. The price is up by 23% in a week and 30% in a month.

___

Learn more:

What Are Leveraged Tokens And Should You Trade Them?

Cryptoasset Margin Trading: How Safe is it?

7 Ways to Short Crypto

Crypto Traders Warn Newbies About New & Super Risky Binance Feature