Trading Indicators: What You Need to Know

Disclaimer: The following article is part of Cryptonews Deals Series and was written as a promotional article in collaboration with the sponsor of this offer. If your company has an exclusive promotion that you would like to share with our readers, we invite you to reach out to us. Let’s build together.

You’re ready to start trading seriously and want to keep track of how the market behaves, maybe use it to try and predict future movements, or just analyze the patterns of an asset’s price movements. However, it may turn out that it is harder than expected to get started. All the different names may be confusing, not to mention that you’d require a basic understanding of market movements to stay in touch with new developments.

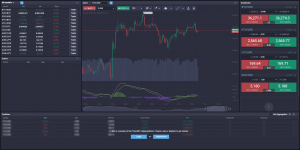

Luckily for you, we’ve developed a short but handy guide on what indicators are, the most common ones, and all you need to know. Looking for a place to implement all that new knowledge? Try PrimeXBT, a derivatives trading platform that can meet all your trading needs.

Technical Indicators: A Primer

Trading indicators, or more specifically known as technical indicators, are signals produced by the price, volume, and open interest in an asset. Users who follow technical analysis will keep a close eye on these signals and their patterns in order to predict future price movements. It is by no means an exact science, but it goes a long way towards helping you make an informed choice.

There are quite a few indicators, but here are those you should know about:

- Moving average: this indicator shows the direction that the price is moving without taking into account short-term price spikes, and is usually done over a few months.

- Exponential moving average: places greater weight on recent price points, making it more receptive to new information.

- Stochastic oscillator: compares a specific closing price to the range of an asset’s prices over time to show momentum and trend strength.

- Bollinger bands: provide a range within which the price of an asset usually trades—the narrower the bands, the lower the asset’s price volatility.

- Fibonacci retracement: this indicator can pinpoint the degree to which a market will move against its current trend—a retracement is also known as a pullback or a temporary dip.

- Standard deviation: helps traders figure out the size of price moves to estimate the effect volatility on price movements.

- Moving average convergence divergence (MACD): combines two moving averages to detect changes in momentum.

Of course, this is far from an exhaustive list. Maybe you will never need any other indicators than the ones listed, or maybe you will find your favorite among those not mentioned here. Important to note, however, is that you can’t use just one indicator and expect failsafe results—but you also shouldn’t use too many as it can lead to incredible confusion (not to mention potential headaches).

When it comes to cryptocurrencies, making the right trade at just the right time can be difficult with all the confirmation times. This is why derivatives trading is the most common choice for those who keep careful track of the markets, as they allow for much more flexibility with the same effect. As the platform with the widest spread of assets on offer—aside from crypto, you can find indices and commodities here as well—PrimeXBT is almost certainly the perfect choice to start your trades based on technical analysis.

PrimeXBT has prepared a special offer for their new customers: they will get 50% of their first deposit credited to their account as a bonus that can be used as additional collateral to open positions!

Don’t forget to join PrimeXBT / Covesting telegram community to find more information about the Trading terminal, Copy trading module and how to save up to 25% of your commission with COV token and other token utilities!

{no_ads}