Tax Deadline Looms for UK Crypto Investors

The deadline for submitting tax returns in the UK is January 31st, 2019. Any crypto holders with residence in the UK will owe either corporation tax, income tax, or capital gains tax, although the majority of crypto traders benefit from the Capital Gains Tax (CGT) annual exemption, which means investors can make gains of up to GBP 11,300 (USD 14,625) in the 2017/18 tax year before any CGT is due.

One of the systems used in the UK by Her Majesty’s Revenue and Customs (HMRC) to collect tax is called self-assessment. Tax is usually deducted automatically from wages, pensions and savings. People and businesses with other income, such as cryptocurrency earnings, must report it in a tax return, and should they fail to do so, it could amount to tax evasion.

The HMRC has also published a detailed guide for cryptocurrency assets and the way they are taxed. A calculation is made for each “disposal” or transaction to establish where the disposal gave rise to a gain or a loss. At the end of the tax year, which runs from April 5, 2017 to April 5, 2018 in the case of personal taxes, the taxpayer must add together all of their chargeable gains and then subtract any in-year allowable losses. Any losses will be looked at on a case-by-case basis.

For those who do not qualify for the CGT annual exemption, there is a CGT charge of 10% or 20%, depending on whether the investor is a basic or higher rate taxpayer. But even if you do qualify for the exemption, the HRMC will require you to submit a tax return if the total amount sold was more than GBP 45,200 (i.e. four times the annual exemption).

Of course, to do any of this, you will need to keep a record of every single transaction. In case you lost more than you gained, this so-called allowable loss (i.e. a loss that you report to reduce your total taxable gains) can be carried over to future tax years to set against chargeable gains.

According to the HMRC, a tax liability could be due to anyone who is selling crypto assets for fiat, exchanging crypto assets for a different type of crypto asset, using crypto assets to pay for goods or services, or giving away crypto assets to another person. This means that even a trade between two cryptocurrencies, where fiat does not even enter the picture, is still taxable.

“It requires the investor to try to ascertain the sterling equivalent of their cryptocurrencies sold and acquired, not an easy task and one which may sometimes be impossible to find out as no official sterling prices are published. For complex transactions like these, seeking professional advice is likely to be the most sensible route,” George Bull, senior tax partner at fifth largest accountancy professional services network in the world RSM, told the Financial Times.

______

Example

Victoria bought 100 token A for GBP 1,000. A year later Victoria bought a further 50 token A for GBP 125,000. Victoria is treated as having a single pool of 150 of token A and total allowable costs of GBP 126,000.

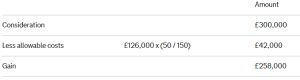

A few years later Victoria sells 50 of her token A for GBP 300,000. Victoria will be allowed to deduct a proportion of the pooled allowable costs when working out her gain:

Victoria will have a gain of GBP 258,000 and she will need to pay Capital Gains Tax on this. After the sale, Victoria will be treated as having a single pool of 100 token A and total allowable costs of GBP 84,000.

If Victoria then sold all 100 of her remaining token A then she can deduct all GBP 84,000 of allowable costs when working out her gain.

Source: HMRC

______

Meanwhile, in the US, investors have lost billions trading cryptocurrencies last year, but they don’t seem to intend to report that even though they could claim a deduction, as reported by Cryptonews.com.