Stablecoins Don’t Inflate Crypto Markets – Researchers

Contrary to popular belief, cryptocurrency prices may not be as dependent on the issuance of the most popular stablecoin, tether (USDT) as many people have thought, according to two researchers.

Stablecoins act more like a safe haven within the crypto ecosystem that investors seek refuge in during periods of strong volatility, Chief Innovation & Entrepreneurship Officer at UC Berkeley, Richard K. Lyons, and Assistant Finance Professor at Warwick Business School, Ganesh Viswanath-Natraj, argued in a recent commentary on VoxEU.org.

As proof of this, the pair pointed to premiums seen on the exchange rates of stablecoins during sharp crypto market sell-off on March 12 and 13.

“During the period of collapse in bitcoin markets in January and February of 2018, the price of tether traded up to USD 1.05, a premium of 500 basis points (5 cents) in the secondary market, and data on trading in the bitcoin-yether market suggests a significant rebalancing of portfolios away from bitcoin and towards tether during this period. We also find quantitatively similar premiums in Tether and other stable coins during the COVID-19 panic of March 2020,” they said.

However, the researchers added that they cannot rule out the possibility that price manipulation has occurred, only that the issuance of stablecoins has “no systematic effect” on cryptocurrency prices in the open market.

“Rather, our evidence supports alternative views, namely, that stablecoin issuance endogenously responds to deviations of the secondary market rate from the pegged rate, and stablecoins consistently perform a safe-haven role in the digital economy,” the pair concluded by saying.

They also pointed out that although the use of stablecoins has “risen dramatically in the last two years,” this is consistent with their “raison d’etre,” – their overall reason for existence – which is to act as a safe and US dollar-pegged store of value for crypto users.

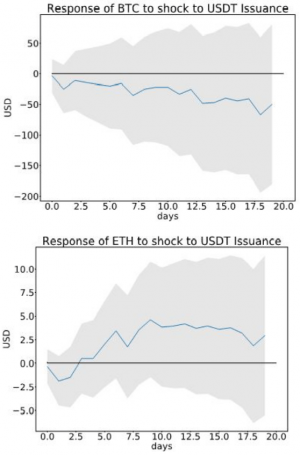

“Using our more precise measure of tether flow to the secondary market, we find no significant effect on prices of major non-stable crypto currencies. This result is robust to the choice of sample period – including the late 2017 period in which bitcoin prices surged – and holds for other major stable coins as well.”

____

Learn more:

Crypto Industry Players Dismiss Reports of Manipulated Bitcoin Rally

Stablecoins Will Have to Adapt to Survive Coronavirus Recession

Stablecoins Challenge Ethereum’s Claim To Become Money