Number of Bitcoin ATMs Passes 6K Mark…But the Taxman Is Taking Note

There are now more than 6,000 Bitcoin ATMs in the world – but as the devices become more widespread, it seems tax authorities are also starting to pay closer attention to the devices.

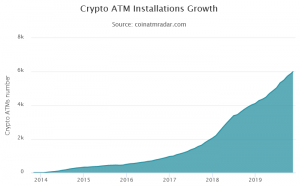

Per data from monitoring site Coin ATM Radar, there are currently 6,003 Bitcoin ATMs in operation now – with a whopping 3,923 of that number in the United States, followed by just over 700 in Canada.

More than 100 new devices have been installed globally in November 2019, and the website data shows that the rate of new Bitcoin ATMs installation now stands at 9.3 per day.

However, the growth rate has slowed down in 2019, in both absolute numbers and percentage terms. In twelve months from November 2017, 2,115 new Bitcoin ATMs were installed, compared to 1,982 devices, installed in twelve months before November 2019. The annual growth rate slowed down from 117% to 51%.

However, Bloomberg Tax reports that the top American tax authority, the Internal Revenue Service (IRS) is now working with the police to block Bitcoin ATM-related “illicit activity.” The media outlet quotes IRS Criminal Investigation Chief John Fort as saying his team is “very focused” on tax-related Bitcoin ATM issues.

Fort stated,

“We’re looking at Bitcoin ATMs, and the ones that may or may not be connected to bank accounts. In other words, if you can walk in, put cash in and get Bitcoin out, we’re interested potentially in the person using the kiosk and what the source of the funds is, but also in the operators of the kiosks.”

Fort added, “They’re required to abide by the same know-your-customer, anti-money laundering regulations, and we believe some have varying levels of adherence to those regulations.”

As previously reported, the IRS has announced it will be cracking down on cryptocurrency-related tax policing in recent months, with some (often confusing) new guidelines now in place. And the agency now appears to have warned American citizens that moving their crypto to overseas exchanges will not help would-be tax avoiders.

Fort stated,

“We have concerns that as things tighten up here in the United States, that we are pushing people to foreign exchanges. We have to focus on that as well.”