NFT Insider Trading On OpenSea Highlights Benefits of Decentralization

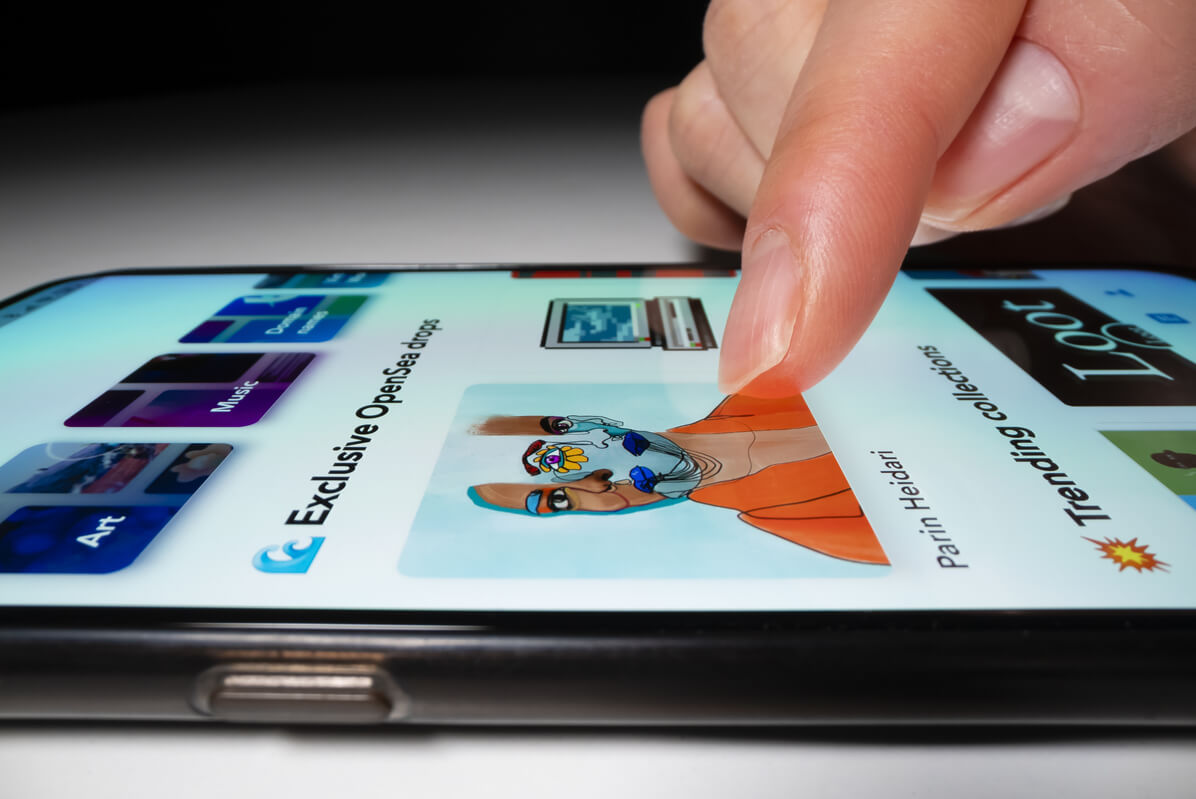

Accusations of insider trading on the popular OpenSea marketplace prompted talks about the need for a decentralized non-fungible tokens (NFT) trading platform.

It all started with an anonymous thread on Twitter that alleged that the Head of Product at OpenSea, Nate Chastain, appears to have several secret wallets that buy the marketplace’s drops before they are listed, “then sells them shortly after the front-page-hype spike for profits, and then tumbles them back to his main wallet with his [Crypto]punk on it.”

OpenSea confirmed that yesterday they learned that one their employees purchased items that they knew were set to display on the front page before they appeared there publicly.

“We are taking this very seriously and are conducting an immediate and thorough review of this incident so that we have a full understanding of the facts and additional steps we need to take,” the NFT unicorn said.

OpenSea added that they have also implemented several policies that forbid its team members from trading collections that are featured or promoted by the company, among other restrictions.

In either case, as soon as this caught the Cryptoverse’s eye, the discussions started on whether this is illegal or just unethical in the physical art world, but also on how useful NFTs are to insiders – with some saying quite a lot, comparing them to fiat.

And a major debate popped up again – that of decentralization within the space.

“Whether or not there is truth to the accusations of insider trading—OpenSea needs to use this as a catalyst to build a more decentralized platform,” opined Compound Finance co-founder Robert Leshner. “Centralized systems and their users are vulnerable to bad decisions by humans.”

Bullish on decentralized NFT marketplaces, few

— ChainLinkGod.eth (@ChainLinkGod) September 15, 2021

As for whether such platforms exist, Alex Gausman, Founder of NFTX, tweeted that this is a decentralized marketplace, and that it’s the direction NFTX will be moving as they complete features for automated liquidity. “Our [decentalized autonomous organization] treasury also has [USD] 71m net worth. All managed 100% onchain through Aragon. All votes requiring > 80% consensus to pass,” Gausman said.

Matthew Graham of Sino Global Capital chimed in, saying that if the rumors are true, Chastain should be fired, and law enforcement should be involved, while Maya Zehavi, a Founding Board Member of the Israeli Blockchain Industry Forum, argued that this is something the US Securities and Exchanges Commission (SEC) should be dealing with.

This is the kind of market manipulation the industry should be denouncing & the SEC should be pursuing. Guess the SEC not going after the CB employees who did the exact same thing back in 2018 gave the wrong signal. Who would have thought? https://t.co/i7U54x4us4

— Maya Zehavi (@mayazi) September 15, 2021

____

Learn more:

– Decentralization in Crypto Is a Hard to Measure Ideal

– Crypto-Gaming Is Exploding Into the Playful Future

– NFT Market Gets A USD 100M Boost As OpenSea Turns Into Unicorn

– NFT Market Sales, Interest Slide Down This Month