Miners Lower Bitcoin Supply, Start Hoarding More

Bitcoin (BTC) miners have started to hodl more of the newly generated BTC at the time when BTC is still failing to breach the psychologically important level of USD 10,000 per coin and when BTC mining set to become even more difficult.

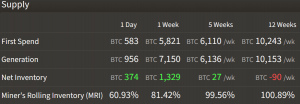

While in the past 12 weeks miners still sold more BTC than they produced, this trend has changed in the past few weeks. In the past week, they kept BTC 1,329 (09:03 UTC), after mining BTC 7,150 and selling BTC 5,821, data from ByteTree shows. At the same time, the miner’s rolling inventory (MRI), a metric that measures how much of a particular asset miners are spending compared to how much they are generating in a period of time, fell below 100%.

As reported, prior to the market downturn in March, the MRI (more than 100% back then) reflected the fact miners appeared conformable to sell. When the market stabilized, after bitcoin crashed to the USD 4,000 level, the daily MRI dropped below 100%, before increasing again.

Though there are theories that miners increasing their inventory may indicate a bull run, as they’d want to sell at a high price, it’s not necessarily the case.

“Miners typically build their inventory during market weakness and sell into strength. MRI has been falling the last 10 days, including prior to the fall from USD 9,800 to around USD 9,00 on Friday last week,” James Bennet, CEO at ByteTree, told Cryptonews.com.

According to him, as the price recovers, miners might start offloading their inventory again.

“I do not think that their holding implies a bull run, on the contrary. Miners want to get the best price for their bitcoins but still need to cover operational expenses. They are generally not long-bitcoin, but are market savvy,” he added.

Meanwhile, today, Bitcoin mining difficulty (a measure showing how hard it is to compete for mining rewards) is expected to increase by more than 15%, according to major Bitcoin mining pool BTC.com. If this prediction comes true, it would be the largest increase in difficulty since January 2018.

At the time of writing, BTC trades at USD 9,528 and is up by 4% in a day, trimming its weekly losses to 1.5%. The price is almost unchanged in a month, while it increased by 3% in a year.

___

Learn more:

Bitcoin Demand Already Outpacing Supply – CoinShares’ Demirors

Bitcoin Halving and Competitors Boost Pressure on Bitmain & Canaan