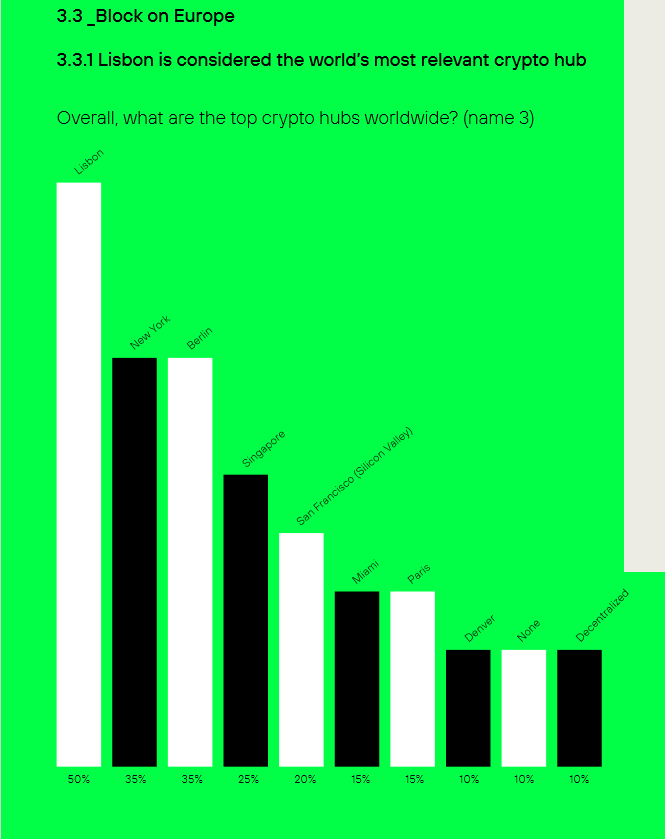

Lisbon Leads the Way as the World’s Premier Crypto Hub, Outranking New York and Berlin: Report

Lisbon, the Portuguese capital, has emerged as the premier destination for crypto enthusiasts worldwide, topping the likes of New York, Berlin, and Paris, according to a report by European crypto investment firm Greenfield.

In a bid to fill the gap left by the absence of regional reports on global crypto development, Greenfield surveyed 68 founders of projects with a deep European footprint from January 31 to March 20 this year.

The result of the study crowned Lisbon as “the Capital of Crypto Europe – and beyond.”

Europe has three metropolises in the top 10, with Paris taking seventh place.

Singapore, taking fourth place, is the only Asian hub in the top 10.

In the US, Silicon Valley, Miami, and Denver also ranked highly.

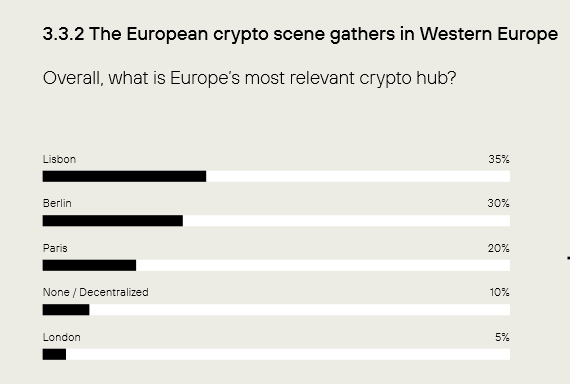

In another question, the founders were allowed only one nomination for the most important European crypto hub.

Lisbon won with 35% of the votes, followed by Berlin (30%), and Paris (20%).

London (5%) joined the top 5 list.

Notably, however, 20% of the respondents were skeptical about the crypto hub concept. These were placed in the ‘none/decentralized’ category.

One founder said:

“Crypto is distributed all over the globe. There are maybe ~15-25 places that are big, each with slightly different focus/strengths.”

Many respondents assigned different focuses and advantages to different hubs.

For example, Lisbon has a strong decentralized finance (DeFi) scene, and it’s attractive to companies for tax reasons, the report said.

There is a ‘crypto brain drain’ both in Europe and the US, and Lisbon benefits from both.

“Lots of American crypto migrants here in Lisbon,” it said.

New York offers good access to venture capital and Tier 1 conferences.

Berlin has a strong “European startup culture, a remarkable crypto track record, and one of the world’s finest and most active developer pools.”

Paris is known for its crypto-summit scene, as well as Web3 and non-fungible token (NFT) ecosystems.

Confidence in Crypto Remains High

Greenfield’s survey made several other notable findings.

Though 2022 was “challenging”, it said, the surveyed founders are still confident when looking to 2023 and the future of crypto Europe.

“A comeback is expected for 2023 and, in the long term (until 2030), nothing less than the “ubiquity of crypto”,” it said.

Regulation is seen as the most influential topic of this year. The founders argued that Europe is leading the way, particularly the EU with its Markets in Crypto-Assets (MiCA) framework.

User experience, relevant use cases, and regulation are the biggest challenges for mass adoption.

Despite its setback in market share, said the report, crypto Europe continues building.

As more European crypto projects mature, there are shortages in commercial talent.

The report concluded that European universities are creating dedicated crypto master’s degrees and that university crypto hubs are forming foremost in the UK, Ireland, and Spain.

____

Learn more:

– ‘Beautiful Bitcoin Heaven’ Portugal’s 0% Crypto Tax Lures In Bitcoin Family

– Cybercrime, Crypto Scams on the Rise in Portugal, Say Prosecutors

– Portuguese Banks Stop Offering Services to Crypto Exchanges, Citing ‘Risk’ as Rationale

– Portugal Makes U-Turn On Crypto-Friendly Taxes

– 9 Reasons Why Your Business Should Accept Bitcoin

– The Most Popular Cryptocurrency Terms