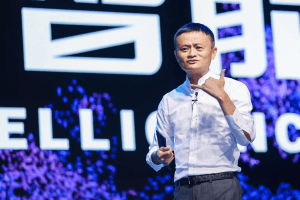

Jack Ma Goes for Blockchain, But Bitcoin Is “Still a Bubble”

The founder and chairman of a China’s giant Alibaba Group, one of the China’s richest men, Jack Ma, has declared Bitcoin a bubble once again, just as his Ant Financial launched blockchain-based money transfers between Hong Kong and the Philippines today.

This service, designed to compete with banks and traditional remittance services, is currently available only for transfers between Hong Kong and the Philippines, according to Ant Financial.

The billionaire said he wants to make it possible for people to remit even 1 cent at almost no cost, compared with the high fees charged by traditional remittances services like MoneyGram, which Ant tried to buy last year. “Due to reasons from the US our deal with MoneyGram did not succeed, so I said, ‘Let’s make one better [than MoneyGram]’ that uses the most advanced technology,” Ma said at the launch in Hong Kong, adding that the impact of blockchain on people and society will be “greater than we can ever imagine,” according to the report in the South China Morning Post, which is owned by Alibaba.

“Bitcoin, however, could be a bubble,” he added, Bloomberg reports. “Blockchain should not be a tech to get rich overnight […] There are still 1.7 billion people in the world who have no bank accounts, but most of them have mobile phones.”

This is not the first time Ma expressed his skepticism towards the cryptocurrency. “Blockchain is not a bubble, but Bitcoin is,” is his opinion, as he shared it multiple times. “It’s just not for me,” remains his opinion, first said in December 2017.

Ant Financial, an affiliate of Alibaba’s backed by some of the biggest names in global finance and investment, has explored blockchain technology for years.

Now, users of AlipayHK – the Hong Kong version of Ant’s Alipay wallet – should be able to transfer money within seconds to users of GCash. The first three months are a trial period during which transaction fees will be waived. The disadvantages of traditional remittance outlets include long waiting times, lack of transparency, high transaction costs, and unfavourable exchange rates.

This is among the problems for Filipinos working overseas, for whom sending money to their families’ GCash mobile wallets will “soon be the norm,” says Anthony Thomas, president of Mynt, the operator of GCash.

Eric Jing, chief executive of Ant Financial, said in a statement, “This is a new starting point and significant step forward in accelerating Alipay’s pace to promote tech for good and financial inclusion globally.”

A banking giant Standard Chartered will act as the settlement bank for both AlipayHK and GCash for the blockchain transactions

Hong Kong financial technology company TNG Wallet already provides mobile remittances via digital wallets, but it does not use blockchain.