Interest in Bitcoin Futures Trading Rise Sharply as BTC Breaches USD 57K

Derivatives traders are more active again, with open interest in bitcoin (BTC) futures going up significantly in recent days as BTC is testing the USD 57,000 level for the first time since May.

At 13:37 UTC, bitcoin was trading at USD 57,053 and was up by 3% in a day, 18% in a week and 27% in a month. The rise made bitcoin today’s best performer among the top 10 cryptoassets by market capitalization.

Moreover, the number one cryptocurrency also outperformed the majority of altcoins in the top 100 by market capitalization today, with the exception of only the recently hot meme coin shiba inu (SHIB) and a few other smaller capitalization tokens.

BTC price chart:

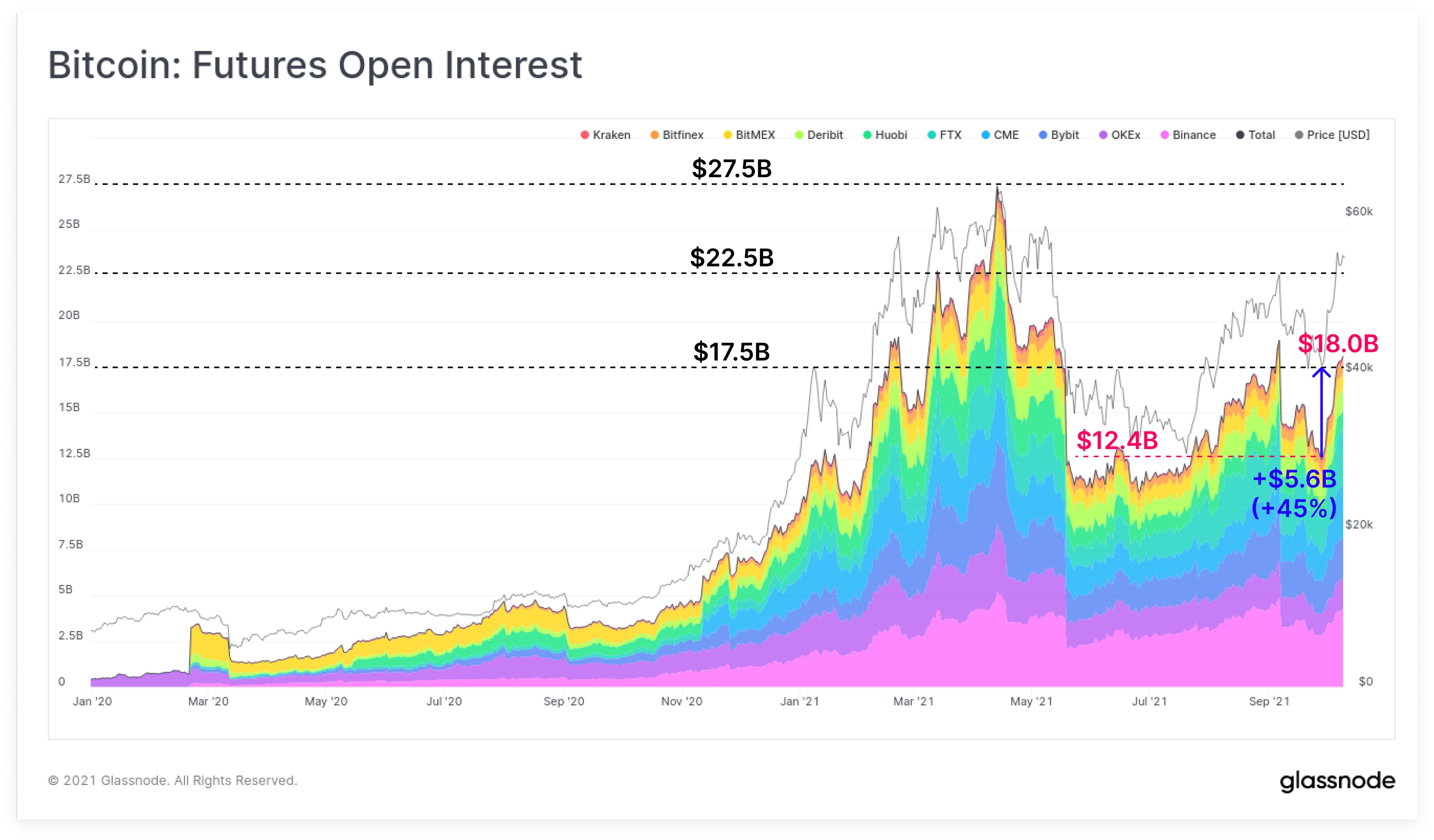

The latest gains today come as interest in bitcoin trading also picked up among futures traders. According to data from the crypto market analytics firm Glassnode, BTC futures open interest – a measure of the value of futures contracts that are open at any given time – has risen 45% since a low point in September, to USD 17.6bn as of today.

But although the figure is currently elevated, Glassnode also pointed out that it is still well below the interest from the last time bitcoin traded at 56,000 in May. Back then, open interest stood at USD 22.5bn, almost USD 5bn higher than today.

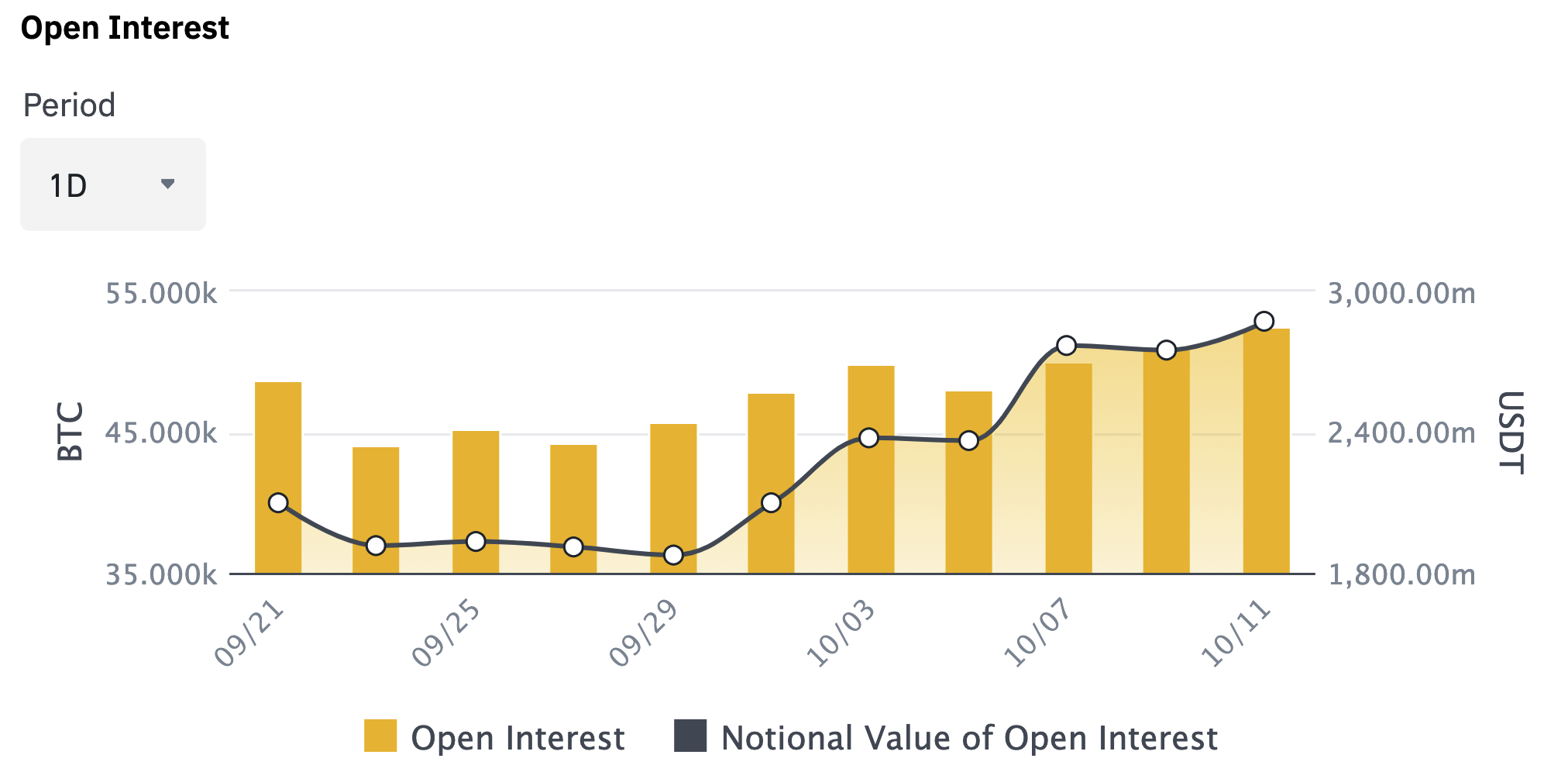

Similarly, data from crypto exchange Binance, the largest bitcoin futures exchange by open interest, also showed open interest in its BTC/USDT perpetual futures market at its highest level in a month when looking at the USDT notional value.

Worth noting from Binance is also that the BTC/USDT perpetual futures long/short ratio has moved higher over the weekend, currently sitting at 1.22. The figure means that more traders are long – meaning they are betting on higher prices – compared to those that are short, hence betting on lower prices.

Like before the weekend, futures traders on Binance were somewhat more bullish on the number one cryptocurrency than those on the competing exchange OKEx, which had a more bearish long/short ratio of 0.84 as of today.

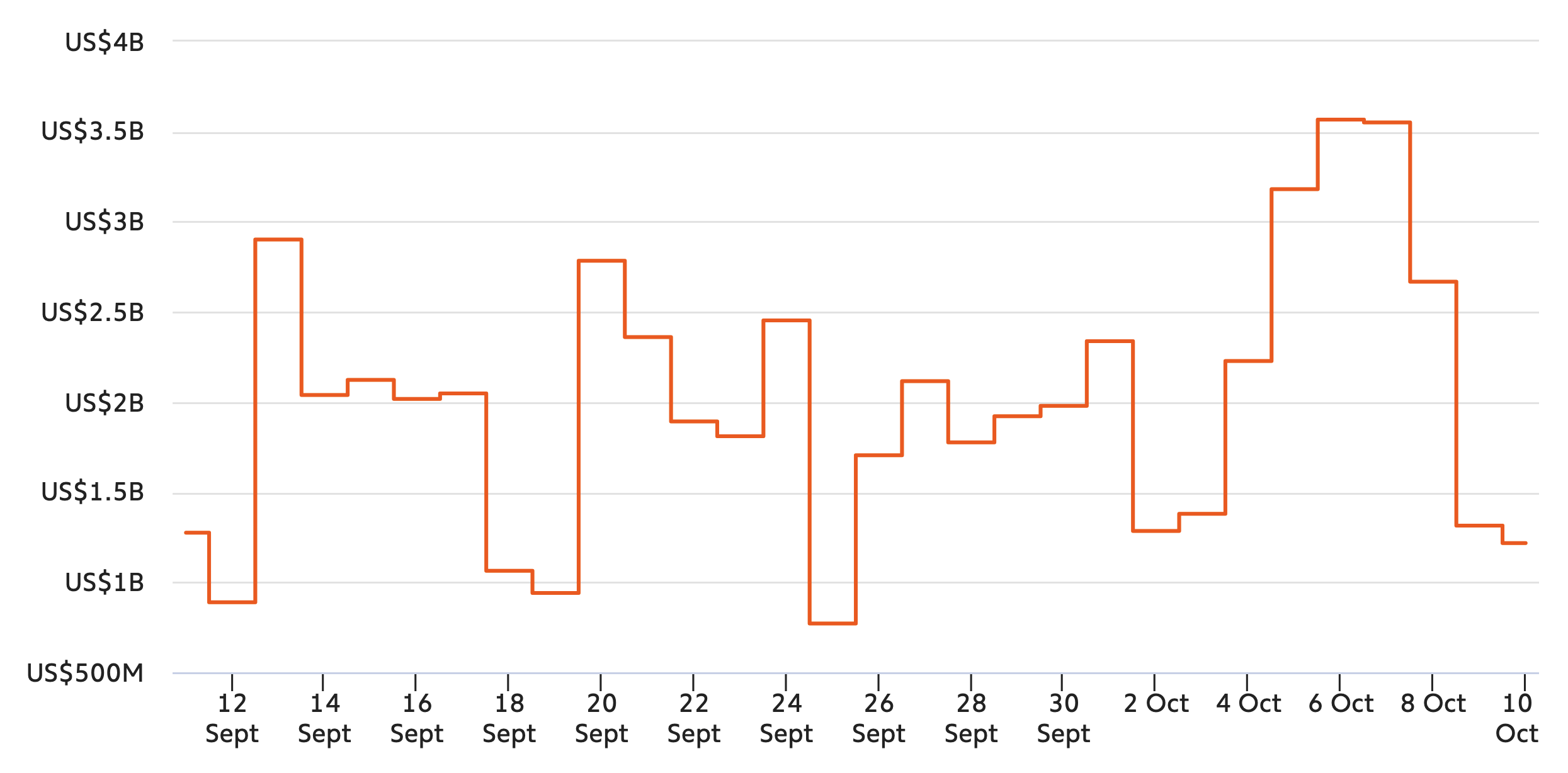

Meanwhile, data from the on-chain analytics provider Chainalysis today showed that bitcoin inflows to exchanges have reached its lowest level since September 25, in US dollar terms. At USD 1.22bn on Sunday, the value of bitcoin flowing to exchanges is down significantly from Thursday last week, when more than USD 3.55bn worth of bitcoin were sent to exchanges.

Low bitcoin inflows to exchanges are generally seen as a bullish sign, as traders take this to mean that more bitcoin users are holding their coins in cold storage rather than looking to sell.

Commenting on the latest price moves, Philip Gradwell, Chief Economist at Chainalysis, wrote in its pre-weekend market intel report that the rising prices are a result of “tight supply” in the bitcoin market.

Institutional investors and traders have taken advantage of the low prices over the past three months to stock up on bitcoin, Chainalysis wrote, while adding that demand stemming from “a clearer-eyed view on regulation and rising concerns over fiat inflation” is also contributing to the demand side.

____

Learn more:

– Bitcoin Breaks USD 55K Resistance, Returns to USD 1 Trillion Market Cap

– Bitcoin Decouples from Stocks as Bullish Sentiment Returns

– Bitcoin Futures Traders Cautious As BTC Up 25% in a Week

– Institutions Turning from Bitcoin to Ethereum Futures, JPMorgan Claims

– As Crypto Derivatives Market Grows, Analysts Asses Their Impact On Prices

– ‘Extreme Volatility’ Expected as Bitcoin Investors Learn to Value It

– Are Bitcoin Futures A Top “Risk-Free” Trade?

– Obsessed Amateur Crypto Traders Are ‘Disproportionately Liquidated’