US Fed Fires Another 75 Basis Points Rate Hike at Record Inflation, Bitcoin & Ethereum Jump

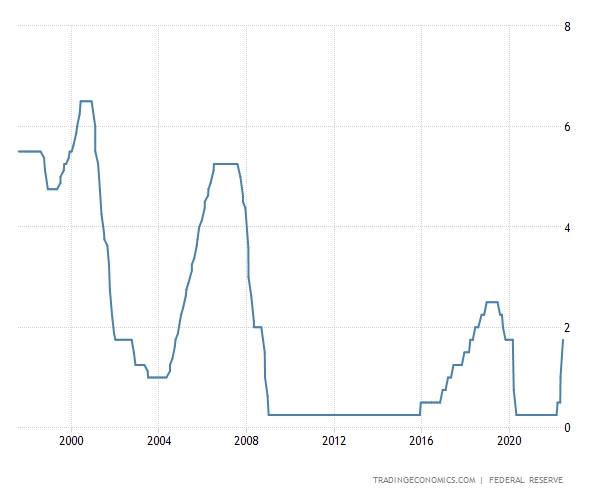

The US Federal Reserve (Fed) has hiked interest rates by 75-basis points, to the interval 2.25 to 2.5%, in line with what most analysts expected.

“Recent indicators of spending and production have softened. Nonetheless, job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures,” the Fed wrote in its announcement of the rate hike.

Prices of both bitcoin (BTC) and ethereum (ETH) immediately rose following the announcement. One hour into the announcement, BTC had gained 4.5% to USD 22,590, while ETH was up 5.5% to USD 1,580. Stocks also rose, with the broad S&P 500 index up 1% since the announcement and up 2.2% for the day to trade just above the key 4,000 level.

In his press conference, Fed Chair Jerome Powell said that “another unusually large increase could be appropriate at the next meeting” in September. However, he added that as rates become more restrictive, it will likely be appropriate to “slow the pace of increases.” Powell also repeatedly made it clear that the Fed’s decisions going forward will be “data-driven,” and said the central bank is “strongly committed to returning inflation to its 2% objective.”

Federal Funds rate ahead of Wednesday’s hike:

Still, some, including a chief economist at investment bank JPMorgan Chase, have floated the idea that the Fed could hike rates by a full percentage point, the largest rate increase in modern Fed history. The argument given for that is that it would be helpful in taming inflation, which last month reached 9.1% annually in the US.

And although inflation is sky-high, economic growth in the US is cooling, putting the Fed in a difficult situation as it raises interest rates. According to a survey of economists by the Wall Street Journal, the chance of a recession in the US in the next 12 months is now 49%.

The latest survey results mean economists have turned markedly more bearish on the economy in recent months. In June, 44% of the surveyed economists said a recession is likely in the next 12 months, while only 18% said the same in January.

Judging from a commonly accepted definition of a recession (two quarters of negative GDP growth in a row), the US could already be in one, although we will have to wait until quarterly GDP numbers are released on Thursday to know for sure.

Commenting before today’s announcement, Marcus Sotiriou, an analyst at crypto broker GlobalBlock, attributed the selling seen in the crypto market on Monday and Tuesday this week to fear of what the Fed might do.

“Selling in anticipation of this event has been typical throughout this bear market, as many market participants choose not to buy when there is uncertainty on what course of action the Federal Reserve plans to take,” Sotiriou said in an emailed commentary.

He added that we “could see” a rally in the crypto market if the Fed hikes rates in line with expectations, as bitcoin in particular has tended to reverse course after rate announcements this year whenever the announcement was as expected.

Also commenting ahead of today’s hike, the Singapore-based crypto trading firm QCP Capital said in an update that a 100-basis point hike has now been “priced out by the market.”

“Every [Fed] meeting this year has seen a positive immediate market reaction to the rate decision. We expect the same for this one,” the firm wrote. It added that there’s “a good chance” Fed Chair Jerome Powell could indicate that the central bank will revert to a 50-point hike at its next meeting if growth slows and inflation eases.

“Markets will react positively to this,” they said, while pointing to the lows for BTC and ETH during this bear market as “a base” that will now act as support.

____

Reactions:

People celebrating 75bps hike as if it’s bullish, twitter completely lost its mind lol

— Psycho (@AltcoinPsycho) July 27, 2022

https://www.twitter.com/laughingmantwit/status/1552363351484899329It's possible we could see a new Goldilocks regime, in which everything is just right. But if not: Either the economy and inflation stay too hot, requiring tightening liquidity conditions that force the P/E down, or the economy gets too cold and the “E” in the P/E is at risk. pic.twitter.com/pqcAueq7Su

— Jurrien Timmer (@TimmerFidelity) July 27, 2022

Needless to say, #markets love that statement.

— Mohamed A. El-Erian (@elerianm) July 27, 2022

This August shall be bear hunting season. In particular crypto investors who learned about macro in 2022 remain way too bearish. Will we trade new lows later on? Maybe. Could be a bad winter. Who cares now. First pump forcing those in the sidelines to buy late and in anger.

— Alex Krüger (@krugermacro) July 27, 2022

_____

Learn more:

– Inflation Is 2022’s Boogeyman

– European Central Bank Raises Rates for the First Time in 11 Years

– Pandemic is the Biggest Threat to Markets in the Next Decade – FTX CEO

– We Now Understand How Little We Understand About Inflation – Fed’s Powell

– Surveyed Central Bank Reserves Managers Say Inflation is Not ‘Transitory’, Likely to Remain High

– Bitcoin Better at Tackling Rate Hikes than Ethereum, Stocks – Report

– As inflation ‘Mellows Out’, a Bottom in Crypto is Likely in ‘The Back Half of 2022’ – VC Investor