Ethereum Address Activity Approached Bitcoin’s Level In June

In June, the biggest smart contract network, Ethereum (ETH), has started to challenge the network of the most popular cryptocurrency, Bitcoin (BTC), in another metric, briefly surpassing it by the number of active addresses, mostly because activity on BTC dropped sharply before rebounding again.

On-chain analysis firm Santiment and crypto intelligence firm Coin Metrics provide different data – it shows that there was at least one flippening in June.

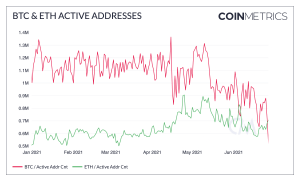

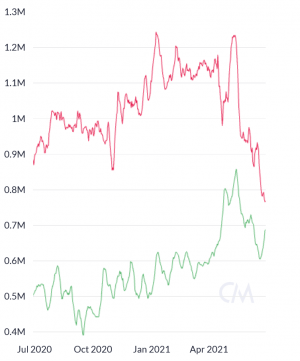

Per Santiment, on June 28, there were 655,360 active ETH addresses and 606,580 active BTC addresses. The next day, on June 29, BTC surpassed ETH again (808,660 vs. 705,350). Meanwhile, Coin Metrics said that, on June 27, ETH had some 200,000 more daily active addresses than BTC – and this was actually the third time in history the flippening happened, the first two being June 5 and 6 of this year.

Looking at the 7-day moving average, BTC (the red line) is still leading even after a sharp drop this month. However, this gap is narrowing.

Also, Coin Metrics noted that while BTC’s market capitalization dropped less in the past week, compared to ETH, BTC active addresses dropped 8.5% week-over-week, while ETH active addresses increased by 9.2%.

High address activity with low deposits is a good sign that prices can naturally grow, Santiment said in their June 29 report. “We also want to see address activity in general moving up, even if that means deposits are moving up along with it,” they added.

And while many Ethereum supporters find the news of ETH active addresses momentarily surpassing that of BTC long-term bullish for the project and the coin’s price, especially with Ethereum 2.0 starting its rollout in phases, some are not quite so sure about the comparison between the two projects, and others argue that comparing these addresses directly is difficult given that they function differently.

In either case, according to Quantum Economics‘ Mati Greenspan, “the average number of transactions per day on the Bitcoin blockchain has dropped to levels not seen since the darkest days of crypto winter.” However, there is a silver lining to this – the fees have dropped too.

Yesterday, BTC median transaction fee reached USD 4.5, compared with USD 28 in April. ETH median fee dropped from almost USD 38, registered in May, to USD 1.85 yesterday, per Bitinfocharts data.

“Now that the hype bubble has popped, we’re seeing a most welcome period of relaxation, which traditionally has been very good for builders to work on actually growing the industry,” Greenspan concluded.

At 13:05 UTC, BTC trades at USD 34,694 and is down by 3.5% in a day, trimming its weekly gains to less than 7%. ETH dropped by almost 2% in a day and is still up by almost 15% in a week, trading at USD 2,145. However, this month, BTC outperformed ETH (-3% vs -11%).

____

Learn more:

– Bitcoin and Ethereum Can Coexist With DeFi Bridging the Two

– How Bitcoin and DeFi are Completely Different Phenomena

– Ethereum Starts Testing London Upgrade – but ‘Adjust Your Expectations’

– Bitcoin vs. Ethereum Fight Escalates amid Fresh Capital Entering the Space