Ether Firesale Sale Risk Comes From Small ICOs – Research

Smaller initial coin offering (ICO) projects present a higher risk for panic selling of their ether (ETH) holdings, however, these holdings are limited and shouldn’t impact the ETH price significantly, according to a new research.

“Among this year’s ICOs, there are at least 150 of them who currently have less than USD 3 million of ether and might be good candidates for firesale in case they didn’t hedge properly. The total amount held by these projects amounts between USD 150 million to USD 250 million,” the research done by D2 Capital, a crypto assets portfolio manager, showed.

According to the company, the firesale of such amount shouldn’t impact the price too much, if ETH demand doesn’t weaken and there is no sudden rush “on the ask side of the order book”.

“Again, our estimates are done by assuming no hedging was done by these projects prior to ether slump and are most probably lower in reality,” the researchers stressed.

They claim that since the beginning of the year, smaller projects from the 2017 ICO sample sold 62.8% of the ETH they raised in 2017, while bigger projects sold only 18.7% of their 2017 ETH stack: “This confirms obvious thesis that smaller projects are more aggressive when it comes to ETH liquidation.”

Meanwhile, this year, ICOs raised money at an average weighted price of USD 670 per ETH, which means a lot of projects are under water, losing more than 50% of their treasury value — not considering fiat or other crypto hedging projects they might have done, according to the research. It gives a “very, very cautious guesstimate” that currently around 10% of total ETH supply locked in projects that raised funds through an ICO this year alone.

Also, D2 Capital doesn’t agree with recent claims that ICOs are increasingly selling their ETH and driving the price down.

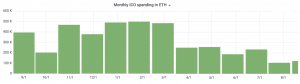

“This was not confirmed by our research, which shows that 100,000 of sold ETH in the past month is just one-third of this year’s average monthly selling of ETH. We measured the average to be at 312,000 ETH per month,” they said, stressing that not every ETH transfer from ICO wallets equates to selling, but 70% of transacted ETH is actually transferred to exchanges.

In either case, this data clearly shows high ETH selling activity even prior to recent price decrease, particularly among smaller ICOs, the researchers concluded.

“We believe that the current sell-off is mostly sentiment driven and due to weaker ETH demand. ICOs are cooling off, consequently providing less demand for ETH, accompanied by Ethereum scepticism about dapps and blockchain use for certain services, utility token use and regulatory uncertainties. On a positive side, most of ETH held in wallets is still held by large ICOs which don’t expect to sell their holdings anytime soon, as they hedged during the year and have enough firepower to last them for a while,” the research said. It added that ether miners selling their coins, introduction of ether futures by the BitMEX exchange also helped to push the prices of ETH down.

____

Ether price chart: