Disappointing IEOs, Up To USD 150M IPO, Bitcoin ETF Battles + More News

Crypto Briefs is your daily, bite-sized digest of cryptocurrency and blockchain-related news – investigating the stories flying under the radar of today’s crypto news.

Investing news

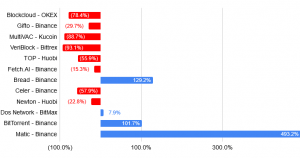

BitMEX Research says that all 11 Initial Exchange Offerings (IEOs) they looked into in their May report have seen significant declines in price since, despite bitcoin appreciating in value. The update to the May report published today shows that nine tokens are down between 80% and 98%, one is down 71% and another 42%, with the exception of Matic, a Binance IEO, which was ongoing at the time of the previous report and which has appreciated in value since it listed, but has recently suffered a dramatic crash. Meanwhile, comparing returns and offering price, the picture is somewhat more positive.

IEO Investment Return vs Offering Price

Source: BitMEX Research

- INX Limited, a Gibraltar-based crypto trading company, will be launching the roadshow for the initial public offering (IPO) of its security tokens in January 2020. The announcement says that INX plans to offer 130 million INX Security Tokens, with the IPO price currently expected to be between USD 0.65 and USD 1.15 per token, meaning they could potentially raise between USD 84.5 million and USD 149.5 million. INX said that the proceeds will fund regulated platforms that would trade blockchain-related assets, including cryptocurrencies, security tokens and their derivatives, as well as the establishment of a cash reserve fund, and working capital and other corporate purposes.

Adoption news

- The National Assembly of Venezuela says that it intends to develop a blockchain-powered voting system for MPs. Per an official release, the parliament says it is working on the solution with Citizenz, the Organization of American States and the Westminster Foundation. The National Assembly hopes the platform will feature remote voting functions, allowing MPs to vote in absentia via their mobile phones if necessary.

- The top Brazilian financial regulator is looking into the possibility of creating a blockchain-powered investor registry platform. The Securities and Exchange Commission of Brazil, known locally as the CVM, also polices cryptocurrency platforms in the country. And per an official statement, the regulator says that it will work with one of the country’s top tech universities. The CVM says that blockchain technology could be of particular help with Know Your Customer (KYC) compliance-related matters.

- The Busan Port Authority, in Busan, South Korea, says that it will invest some USD 1 million in a blockchain-powered logistics platform, per Gn News The port is the country’s biggest and has already been involved in blockchain-powered shipping pilots. The city is also home to a blockchain regulation-free zone.

- Some 100 South Korean middle- and high-school students and their teachers have taken part in intensive blockchain training courses, reports Kyeongin. The students and educators were given the option of taking two-, three- or five-week courses in a program co-organized by the Yeonsu-gu district of Incheon, the country’s third-largest city.

- JCB, Japan’s largest credit card company, is set to launch a B2B payment solution that makes use of blockchain technology, per CoinOtaku. The card company signed an MOU deal with blockchain-powered payments platform operator Paystand. The companies said they intended to co-create a digital payment platform for business clients.

- Kazakhstan’s biggest telecoms company will launch a BaaS (Blockchain as a Service) offering, per a T Adviser report. Kazakhtelecom says its offering will be based on the Hyperledger Fabric blockchain and will make use of Kazakhtelecom’s data center infrastructure.

- Blockchain growth is on the up in Argentina, said speakers at the recent Latin American Bitcoin & Blockchain Conference. Speakers said there had been a 10% rise in the number of blockchain companies in Argentina during 2019, and added that there are now more blockchain companies in Argentina than in any other Latin American nation, ahead of second-placed Mexico.

- The total Ethereum (ETH) locked in DeFi (decentralized finance) hit a new all-time high with ETH 2.9 million (USD 390 million), according to DeFi Pulse. ETH locked in DeFi had been rising from early 2018 until April 2019, when it started dropping. In July, it rallied again, reaching and surpassing the April all-time high of 2.3 million ETH, and rising steadily since late October.

Regulation news

- The new two-page letter signed by eight members of the U.S. Congress is asking the Internal Revenue Service (IRS) to address the issues and questions raised by the latest crypto tax guidelines “as soon as possible,” in particular when it comes to forks and airdrops, in order to make the guidance clear, accurate and easy to follow. The letter says that the hypothetical fact patterns concerning forks and airdrops as presented in the guidance are not how actual forks and airdrops occur in the crypto ecosystem.

- Crypto asset manager Bitwise has written a new letter to the U.S. Securities and Exchange Commission (SEC) as a response to the SEC’s October disapproval order of the firm’s bitcoin ETF (exchange-traded fund). The letter addresses the concerns of market manipulation and surveillance sharing for approving a bitcoin ETF, explaining why a bitcoin ETF matters, and saying that Bitwise is committed to creating it. Bitcoin’s price is set in the open market, which makes it uniquely resistant to the kind of market manipulation scandals that have occurred in markets that rely on coordinated fix pricing, the firm said, adding that the U.S. electronic securities exchange NYSE Arca (that filed the bitcoin ETF proposal for Bitwise) has a surveillance sharing agreement with the financial derivatives giant CME through its participation in the Intermarket Surveillance Group.

- The SEC has postponed making a decision on a bitcoin and U.S. Treasury bond ETF proposal filed by Wilshire Phoenix. Per the document published by the SEC, the regulator will continue evaluating the proposal until February 26, 2020, by which deadline it should approve or reject it. With NYSE Arca applying to the SEC for a rule change that would allow it to list shares in a proposed BTC investment trust, the United States Bitcoin and Treasury Investment Trust, managed by Wilshire Phoenix Funds, would invest only in BTC and short-term U.S. Treasury securities, as the filing made in May states.

Crime news

- An account belonging to the blockchain platform Nuls’ team was attacked by hackers and has lost almost USD 480,000 worth of NULS tokens. The security update from December 22 states that 2 million NULS were transferred, among which 548354.34696095 NULS entered the trading market and couldn’t be traced. This happened due to a security vulnerability in NULS 2.2 version, which has been fixed, says the team. The network has decided to conduct a hard fork, whereby the NULS that haven’t entered the trading market will be destroyed in a permanent freeze to prevent continued flow into the market and losses to the community members.

Legal news

- The entertainment giant Disney has blocked three attempts by Justin Sun and his blockchain platform Tron from trademarking the name ‘Tron’ and its variations with the U.S. Patent and Trademark Office, allegedly claiming to own that trademark due to the same-named sci-fi franchise. Per Sun’s tweets, this will not affect Tron’s core trademarks, which the network will continue to use.