Digital Euro Receives Widespread Acceptance In Germany: Survey Shows

A June 4 survey revealed that Germans are receptive to the concept of a digital euro. However, the study also uncovered significant knowledge gaps among the general public regarding this proposed alternative payment method.

This knowledge deficit underscores the need for more education and awareness.

50% of Respondents Are Open to Using “Digital Euro”

A representative survey of 2,012 people conducted by forsa, a market research and opinion polling company, on behalf of the Deutsche Bundesbank revealed that 50% of respondents are open to using it as an additional payment option.

🇩🇪 Bundesbank survey says there is widespread acceptance of the digital euro among the general public

BUT: maybe acceptance would not appear that significant if the sample were more representative and the fundamental "misunderstandings" that people have were taken into account… pic.twitter.com/zaFJJwfqDT

— Nikolay Kolarov, CFA (@libertniko) June 4, 2024

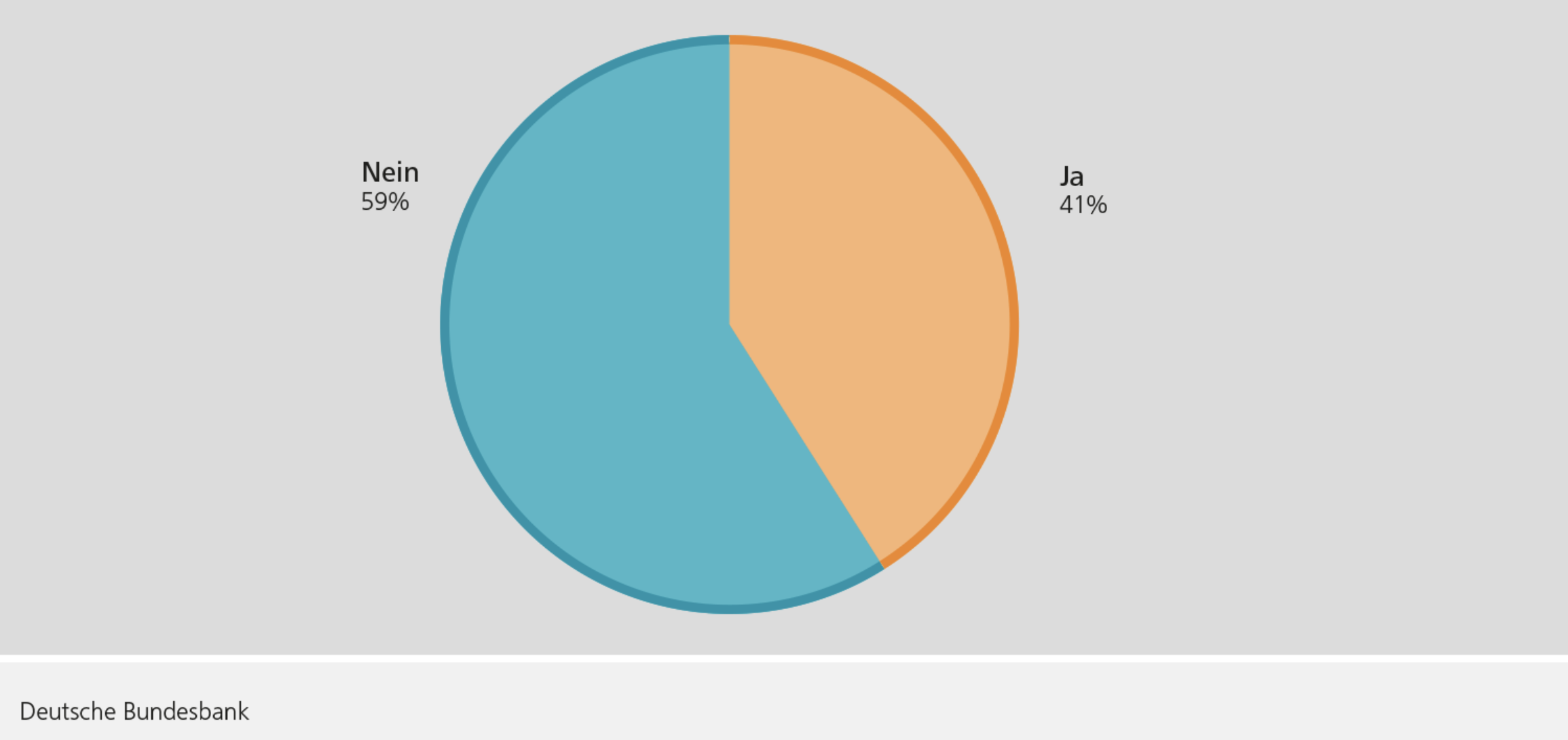

The survey indicated that even those previously unfamiliar with the digital euro were open to this new means of payment. However, it also highlighted that only 41% of respondents had encountered information about it, while a majority (59%) remained unaware.

One major concern that the respondents raised was privacy issues. This is similar to the issues plaguing China’s digital yuan (e-CNY), where Chinese workers convert CBDC to cash immediately after receiving them.

More than three-quarters of the respondents view privacy protection as a top priority in the digital euro.

Additionally, 59% emphasized the importance of the planned offline version of it, which aims to offer privacy protection similar to cash.

However, privacy protection is a key focus in the current preparatory phase for the EU Central Bank Digital Currency (CBDC), scheduled until October 2025, when the governing council will decide whether to continue the euro project with further preparations.

Deutsche Bundesbank President Joachim Nagel has stated that the digital euro will likely launch by 2028 or 2029. He has also reassured future users about optimal privacy protection.

He stated,

“Eurosystem central banks have no interest in users’ data. The digital euro would protect people’s privacy far better, far more effectively than current commercial payment solutions.”

Meanwhile, many respondents (72%) felt it was important for it to be based on a European infrastructure, ensuring independence from global political events or decisions.

15% Respondents Thought the Digital Euro Will Replace Cash

The Deutsche Bundesbank survey found that some respondents who knew about the CBDC had wrong ideas about its use case.

15% of respondents thought the digital euro would replace cash, while 12% thought cash would be phased out with the introduction of it.

However, Burkhard Balz, a member of the central bank’s Executive Board, debunked these notions, explaining that cash is a “fundamental” product of the bank and the Eurosystem central banks and will not be removed.

It could be recalled that the European Central Bank (ECB) first introduced the digital euro in July 2021, aiming to develop a fast and secure electronic payment instrument that would complement the euro in its current forms, both as physical cash and in bank accounts.

(THREAD) We have decided to launch a project to prepare for possibly issuing a digital euro. We will look at how a digital euro could be designed and distributed to everyone in the euro area, as well as the impact it would have https://t.co/KCf73qHOZ8 1/3 pic.twitter.com/eHvpFlH8sq

— European Central Bank (@ecb) July 14, 2021

After a thorough two-year research into the design and distribution models for the digital euro, the ECB took a step forward on October 18, 2023, by entering the next phase to prepare for the issuance of it.