Dapps in 2020, Where Are We Heading

The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

This article has been brought to you by DappRadar, a dapp data aggregator and analysis firm.

______

To many blockchain enthusiasts, decentralized apps (dapps) are the future of the internet. This level of enthusiasm over the invention is, however, waning outside of the crypto-verse. Many proponents of centralized apps describe the multi-million dapp market as a sinkhole.

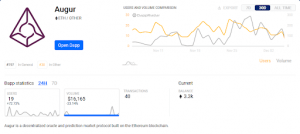

The reason is that these apps cost tremendous amounts of money to develop yet have poor user interfaces and, consequently, very few users. While blockchain enthusiasts maintain that dapps such as

Augur are the perfect uses cases for the future web, critics call them impractical and worse, theories destined for failure judging from past performance records.

Indeed, there are currently many reasons that, to the ordinary person, make dapps unattractive. While millions have been poured into the most popular of dapps such as Crypto Kitties and Augur, their user numbers are below par. Augur, for instance, has a $311 million market cap but attract less than 60 users a day.

It does seem that while there are many blockchain enthusiasts out there praising these dapps, few do use them. Are these problems really the teething issues of a nascent technology or real signals of a failed “fad” invention? It is also possible that critics are only disappointed at temporary growth curve dips, and dapps are the future.

Given, decentralized applications are based on an already proven technology that will free the world from the clutch of a few third-party controlling powers like banks or data service providers. Through the proliferation of dapps, businesses that thrive as third party beneficiaries of a flawed capitalist economic system will relinquish their profit lines back to the people that deserve the income the most.

Reason? In its pure form, a dapp is an open-source application that is not centrally controlled because they operate from a secure, highly reliable network. That is, the back end of their code runs from a peer-to-peer network like Ethereum, Waves or Loom for example. They work autonomously on launch, and all data relating to the project are cryptographically secured on the hosting chain.

The future looks bright

So, what’s in store for dapps in 2020? Due to the nascent nature of the undergirding technology, it is difficult to envision what a world running on blockchain will look like, just as it was with the coming of the internet. Nevertheless, it is clear that dapps will take automation to an entirely new level.

In the future, decentralized applications will handle many aspects of day-to-day living, slashing costs and eliminating third parties. These inventions will make peer-to-peer interactions feasible and cut out monopolistic goods and service providers.

Nevertheless, before this decentralized utopia becomes a reality, in 2020, we should expect to see more dapps released that will fuel the growing resistance towards web censorship. These blockchain innovations do not have static IP addresses, so they cannot easily be blocked. There also will be better-designed dapps to enhance user experience and seamless, easier to navigate functions.

While it is true that most dapps had a lackluster performance this year, the DeFi sector has been the shining glory, thrusting dapps into the limelight for all the good reasons. The success of DeFi is the reason why critics cannot easily sweep these inventions’ achievements under the carpet.

This new financial ecosystem devoid of third parties runs on trusted, immutable, and distributed networks that allow anyone, anywhere in the world to access a wide range of financial products. People can, for instance, access lending, payments, investing, portfolio management, or borrowing services with fewer barriers and more autonomy than what the traditional finance sector has to offer.

DeFi is Disrupting Finance

DeFi apps are blockchain-powered solutions that eliminate the need for financial intermediaries. These applications are part of the decentralized applications (dapps) system, meaning that a single authority cannot control them. Using smart contracts– irreversible agreements can be forged between two parties, a transparent, new age and resilient financial system is being built.

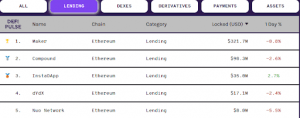

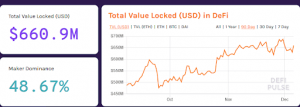

It, therefore, does not come as a surprise that the DeFi protocols are proliferating the dapps market. They are so popular with users and investors alike that over $660 million is locked. This is clear proof that DeFi apps have a use case in the world’s financial system, and the world has yet to enjoy the many benefits of dapps.

The release of the DeFix index (DEFX) by Nasdaq, and the entry of decentralized finance (DeFi) assets into the mainstream has pushed them into the limelight. The New York-based stock exchange firm, in partnership with EXANTE, a brokerage firm based in London, is now streaming real-time data of these promising blockchain projects.

The DEFX includes leading projects in DeFi such as MakerDAO, a stable coin platform, and Augur, Gnosis, and Numerai in the predictions market. The DeFix Index also tracks Amoveo, a DeFi solution, and DEX protocol, 0x.

Therefore, while Bitcoin promised the world to free it from the controlling power of banks, Ethereum, the home of dapps, might, if statistics is anything to go by, be the blockchain that accomplishes this feat. Consequently, one of the most prominent predictions for the dapp sector in 2020 could be an explosion of DeFi apps. DeFi is helping turn cryptocurrencies, mostly ETH and other alternatives, into fungible assets as collateral in the lending space.

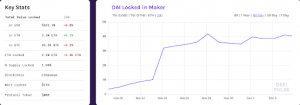

Much of the ETH locked in DeFi is held by MakerDAO (MKR). This platform supports the stable coin, DAI. Its users lock ETH as collateral in exchange for loans denominated in DAI. Lending is, now, the top use case for DeFi, with more and more users preferring to lock their crypto assets in them rather than deposit them in exchanges or staking platforms.

The movement to build censorship resistant and decentralized financial products will make DeFi a winner in the coming year. Payment networks based on blockchain are already enjoying increased attention as Facebook prepares to launch Libra next year.

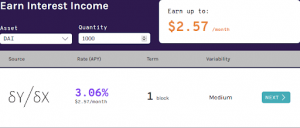

Through these dapps, it is much easier for users to lend, borrow, and save money since they eliminate tasking requirements. These dapps also do not require personal or sensitive information neither do they charge excess fees to handle user funds, unlike banks.

More evidence

Recently, dapp analytics tracking and aggregation service, DappRadar revealed huge quantities of previously unseen token volume within the dapp ecosystem after tracking non-native ERC-20 tokens on Ethereum. Based on Nov 10-17, 2019 data, it was shown that DeFi dapps are leading the way, posting a massive $73 million in extra volume per day.

So, while under the old methodology gaming was a close second, with new data it is not even close. Moreover, while many consider DEXs to be the source of Ethereum’s on-chain activity, adding token data reveals that staking-based DeFi applications deserve just as much credit.

Conclusion

The growth predictions of the DeFi dapp space in 2020 are amongst other factors pegged to the diversification of the stable coin sector. Stablecoins perfectly facilitate cross border trades and are therefore getting mass adoption worldwide. Exchange tokens will continue to strengthen as more traders adopt them. This environment will further accelerate the DeFi innovation pace, and more mainstream players will jump in to capitalize on the platform’s cost savings, disintermediation, and operational efficiencies features.