What Are Meme Coins and How Do They Work?

Well-established cryptocurrencies like Bitcoin lead the market cap charts, but meme coins have become popular trading assets, minting millionaires for those who timed their trades right. But what are meme coins, and why do they exist? In this guide, we’ll answer the question, “What is a meme coin?” and explore the growing meme coin market.

Meme coins are fun, meme-based cryptocurrency coins or tokens, such as Dogecoin, which features an impish Shiba Inu dog as the project’s mascot. When Dogecoin launched in 2013, it changed the crypto scene forever, building a community around fun-loving crypto assets. Today, Dogecoin and other select coins can even be used for online purchases.

Key Takeaways

- Meme coins often have no utility, instead they are usually intended to be fun projects.

- Meme projects like DOGE and SHIB have seen parabolic growth in value.

- Volatility and a lack of utility can make meme coins much riskier investments.

What are Meme Coins?

Meme coins are either coins (using their own blockchain) or tokens (used on another blockchain) that feature a meme as their mascot or logo. The most famous of these, Dogecoin (DOGE), features a Shiba Inu dog, which other dog meme coins like Shiba Inu, BONK, and Floki have since mimicked.

In some cases, meme coins may have utility of their own, such as DOGE, which is accepted at retailers like Newegg and Tesla and which also has its own blockchain. However, many other meme assets have no intrinsic value on any blockchain. Often, the latest meme cryptocurrency is simply a trading asset, a tool to make money if you time the market right.

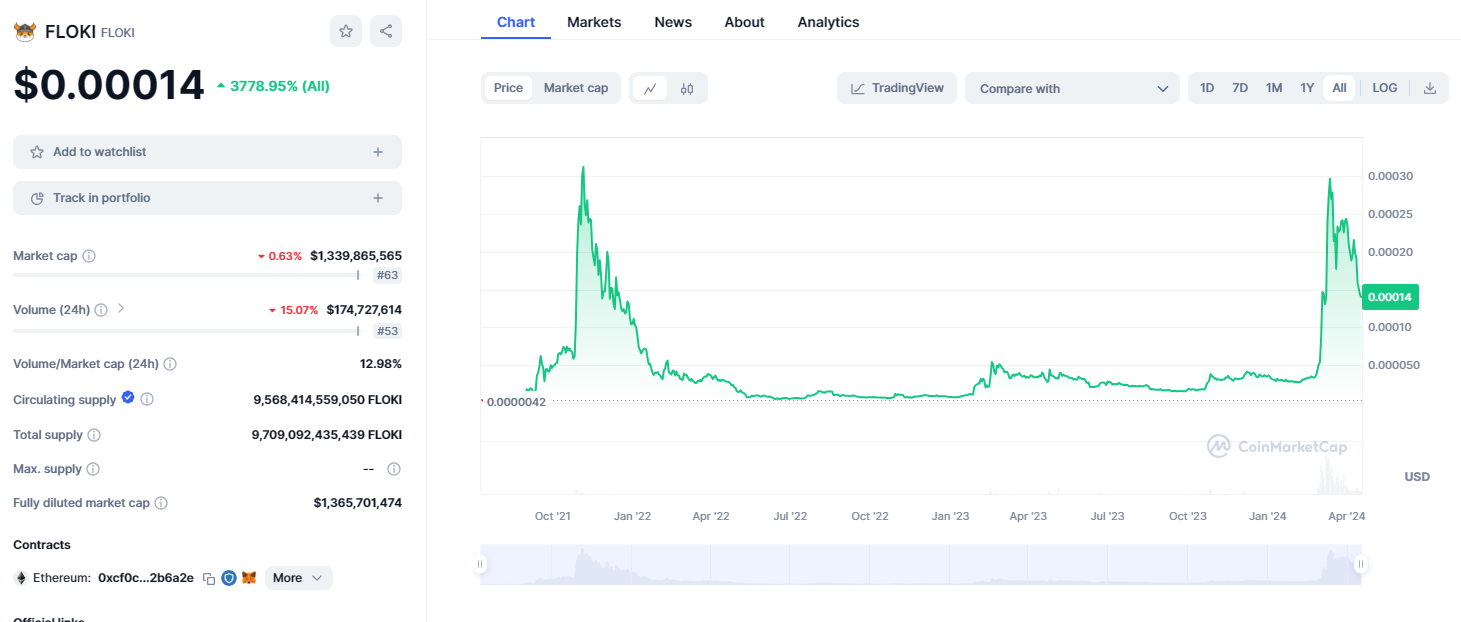

For example, Floki (FLOKI), a meme coin named after Elon Musk’s Shiba Inu dog (a Shiba Inu), launched in May 2023. Less than a year after launch, the token skyrocketed in price and popularity, gifting early investors with stunning returns.

However, it’s crucial to note that the following months demonstrated the flip side of the coin, as FLOKI lost nearly all its value. In 2024, FLOKI made a comeback just as impressive as its initial rise. This volatility is a key characteristic of meme crypto assets, and it’s important for investors to be aware of the associated risks.

Risks and Volatility Associated with Meme Coins

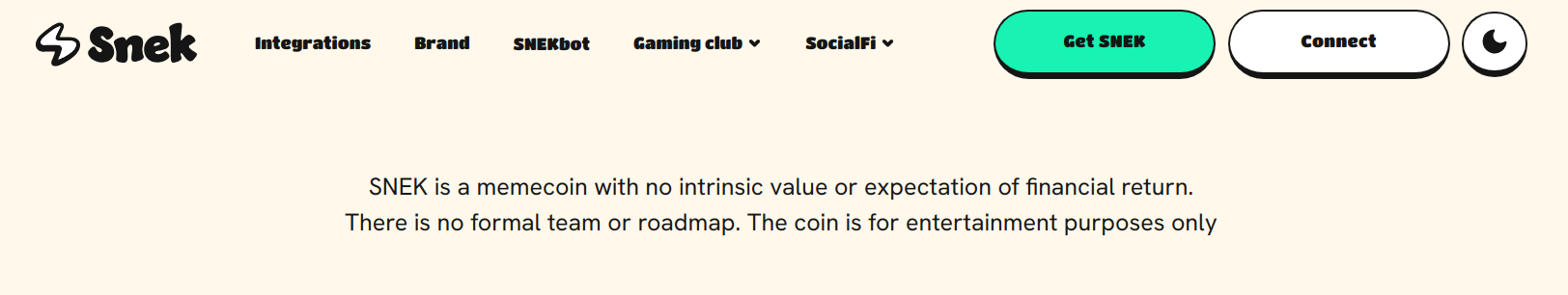

The price volatility of meme coins makes them popular for trading, but coins without utility can be more likely to crash. SNEK, a meme coin launched on the Cardano blockchain, makes no pretenses about its value and trades for a fraction of a penny.

However, to the project’s credit, the token also had a fair launch, with no tokens allocated to creators.

SNEK also provides a good example of the volatility for which meme coins have become known. After reaching $0.0025 twice, SNEK fell to $0.0009, a 64% decrease in value. A $1,000 investment at the March top would have been worth just $360 by mid-April.

SNEK and similar coins may recover from their lows. However, it’s essential to consider the volatility risks before entering a trade. Meme assets trade with different dynamics compared to well-established projects like Bitcoin and Ethereum. When the market adopts a risk-on mindset, meme coins often run faster but also crash harder during flights to safety when traders sell risk assets.

Pros and Cons of Meme Crypto

Despite their volatility, and in some cases because of it, meme coins have pros and cons. Gains of 10x or more aren’t uncommon for technical traders. However, the bottom can fall out of the market quickly, making these coins better suited to traders who can watch the price action.

Pros Cons

The Origin and Popularity Gain of Meme Coins

If you’ve ever wondered, “What are meme cryptos?” and what the buzz is about, now you can explain meme coins to your friends. But where did the meme craze come from, and who started it all?

Dogecoin was launched in 2013 as a joke and was the first meme coin to hit the crypto scene. Bitcoin had already been around since 2009 and was fueling what seemed like rampant speculation at the time. In response, Bill Marcus and Jackson Palmer, both software engineers, created Dogecoin, a tongue-in-cheek cryptocurrency that didn’t take itself so seriously.

The Dogecoin project was a fork of Luckycoin, which was a fork of Litecoin, which was itself a fork of Bitcoin. As a result, Dogecoin shares some similarities with Bitcoin. Both coins have their own blockchain, and both use proof of work as their consensus mechanism to secure the networks. By modifying existing code, the pair built Dogecoin in about two hours.

In its first year, DOGE soared by over 1,000%, but that was just the beginning. By 2021, DOGE reached $0.73, up from its launch price of $0.0004. Dogecoin’s success paved the way for new projects, such as Shiba Inu (SHIB), once dubbed the Dogecoin Killer. Ultimately, SHIB didn’t ever displace DOGE. Instead, SHIB, along with other meme crypto assets, proved the market was large enough to support dozens of meme coins.

While many meme coins foster a community, the main attraction remains the same: fast gains. Meme coins allow you to earn outsized profits in a comparatively short period of time. Time it right, and you might double or triple your money in a day, a week, or a month. Of course, the inverse is also possible; you could lose it all — often even faster.

What Are The Most Popular Meme Coins?

DOGE still tops the list of meme assets, with a $22 billion dollar market cap that makes it a top-ten cryptocurrency, keeping company with Toncoin and XRP. Other meme coins are also lighting the market on fire, however, including a handful of other dog-themed coins, a frog-themed coin, and some that pay homage to crypto culture.

- DOGE: Dogecoin rose from $0.0004 to an all-time high of $0.73.

- SHIB: The Shiba Inu token now has its own layer-2 blockchain called Shibarium. Many early investors who bought at launch when SHIB traded for $0.000000001009 are now millionaires based on SHIB’s current $0.00002195 price.

- WIF: Dog Wif Hat is another fun meme coin embracing the Shiba Inu doge meme. Plenty of intraday volatility creates trading opportunities but long-term traders also found impressive profits with WIF. This Solana-based meme token rocketed from $0.016 to more than $4.50 in under a year.

- PEPE: Named after Pepe the Frog, a comic book character that became a popular meme in the early 2000s, PEPE launched at about $0.000000001 per token and now trades for $0.000005042, a 504,000% gain.

- FLOKI: The Floki project returns to a dog theme, this time with a Viking hat. After peaking in 2021’s bull market, the FLOKI token returned to the limelight in the first quarter of 2024, rising 10x in less than two months.

- BONK: Although the BONK token is down 67% from its highs, the token has risen more than 17,000% from its lows 16 months prior.

- WEN: The ups and downs of WEN trading make it a popular choice for swing trades. In its first three months following launch, WEN produced gains of nearly 300%.

How are Meme Coins Created?

Dogecoin was a roundabout fork of Bitcoin’s code, but where did all these other meme coins come from, and how do they manage supply? The answer differs from one project to another, with some produced by mining while others are minted as tokens. With mining protocols like Dogecoin, new supply is produced as rewards for miners that fortify the network. In the case of tokens, the token contract determines the minted supply and whether more tokens can be minted.

Can you mine meme coins?

Some meme assets can be mined. For example, Dogecoin is a proof-of-work cryptocurrency and adds five billion new dogecoins per year through mining. Many other meme coins are minted as tokens, however. New tokens are produced using a smart contract on a host blockchain like Ethereum or Solana.

Can you make your own meme coins?

If you’re able to fork an existing project or build a smart contract, you can make a meme coin. This low barrier to entry is one of the factors that makes the value of meme assets dubious. Sites like Token Tool can help you get started with minting tokens and running a token crowd sale to launch a new token.

How Do Meme Coins Work?

Meme coins are meant to be fun against a backdrop of sometimes-too-serious cryptocurrencies. Development can take as little as a few hours, like Dogecoin, or even just a few minutes if you already have an idea for a hot new meme coin and access to online tools to mint your tokens. Whether a new meme coin catches on depends on a few factors, however.

Supply plays a role, but community enthusiasm is the largest determining factor in whether a meme coin makes a big splash. A community that shares crypto memes and builds hype will help boost the price.

Whitepaper or Website

Most legitimate crypto projects begin with a whitepaper, a detailed overview of the problems the proposed asset solves, along with an explanation of how the protocol is expected to work. However, meme coins typically don’t solve any problems; they’re just fun. You can usually find details about any meme assets you’re interested in on the project website.

Minting and Mining

Many new meme coins aren’t coins at all. In other words, they don’t have their own blockchain and instead are tokens on another blockchain network like Ethereum or Solana.

A meme coin that does have its own blockchain, like Dogecoin, is a coin and has to be mined if the blockchain uses proof of work as its consensus mechanism to validate transactions. Miners solve an algorithmic puzzle to produce new coins. However, meme assets that use a host network are minted as tokens. The team pays a network fee to mint the initial supply and any subsequent supply.

Distribution

Meme coins make their way into circulation in various ways. In many cases, you can buy meme tokens on crypto exchanges. However, coins that reach centralized exchanges like Coinbase have often had a large runup already. Other methods of distribution include airdrops, in which tokens are sent to eligible wallets or made available to claim. Many meme coin buyers purchase during a pre-sale or through a decentralized exchange like Uniswap (which supports Ethereum meme coins), where users provide liquidity for the meme coin.

Trading Value

Predicting the value of meme coins can be difficult. When dogecoins were trading for a small fraction of a penny, it wasn’t easy to envision a $0.73 all-time high. By the same token, many traders were calling for $1.00 DOGE as the coin reached its highs, a price level yet to be reached years later.

Market movements for meme cryptos can involve news about the token or even a DOGE-friendly tweet from Elon Musk. One main factor, though, surrounds liquidity—the ability to trade easily. Tokens that reach major exchanges are easier to buy and sell. Liquidity often helps trading values by making the coin more accessible.

Meme Coin Life Cycle

Some meme assets are going to zero. Others will see cycles in which they come into favor or fall out of favor. FLOKI’s price followed the latter pattern, rising and falling before rising again. To make money with meme coin trading, you need a bit of luck but also a keen sense of what’s hot and what’s not. As the market takes profits and moves on to the next trade, you don’t want to be the last trader to exit the swing trade.

How to Buy Meme Cryptocurrency

Getting in early is often the best way to maximize profits on meme cryptos, a strategy that often requires buying at presales. In other cases, you might need to mine your own, as many did in the early days of Dogecoin, buy on a decentralized exchange, or buy on a centralized exchange. Let’s look at how to buy meme coins and what methods you can use.

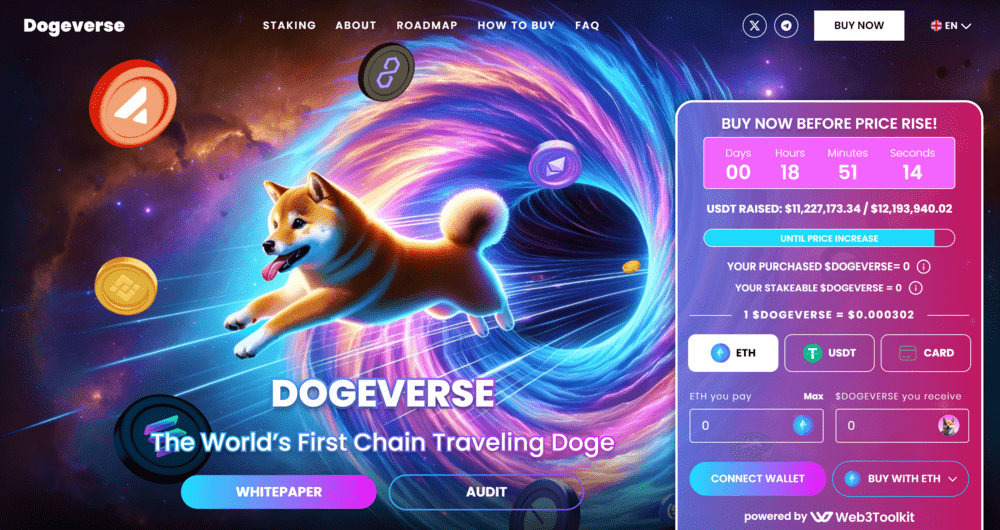

Presales

Crypto presales have become a popular way to launch meme cryptocurrencies. The recently launched Book of Meme (BOME) token launched via presale on the Solana network, rocketing the meme coin to a $1.6 billion market cap within days.

To buy via presale, you use a portal to exchange one cryptocurrency for another. For example, you might buy an ERC-20 token used on an Ethereum-compatible network; you might need to pay with ether (ETH).

Presales may offer only a limited number of tokens, making it more difficult to buy meme coins using this method.

Decentralized Exchanges

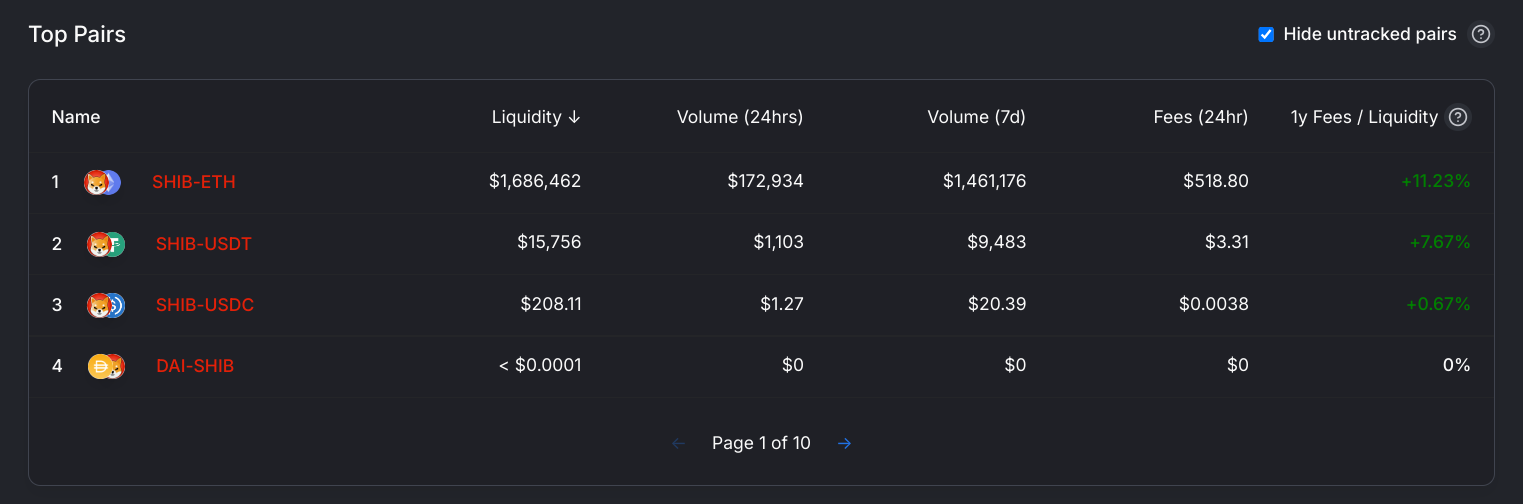

A decentralized exchange (DEX) like Uniswap provides liquidity pools that enable traders to swap Token A for Token B. For example, you can swap ETH or stablecoins like USDT, USDC, or DAI for SHIB. Larger liquidity pools typically track market prices closely, with arbitrage traders helping to keep the prices aligned with the outside world. Some DEXs are network-specific. For example, if you want to trade the Solana meme coins, you can use a DEX built on the Solana network like Raydium.

Centralized Exchanges and Brokers

While some exchanges offer early access to tokens through launchpad programs, meme coins are more likely to reach major exchanges after they see some trading volume success on smaller platforms or decentralized exchanges. When meme coins become available on exchanges, you can deposit traditional currencies or cryptocurrencies to make your trade. Most exchanges support USDT or USDC as the other side of the trading pair for meme coins.

Bottom Line

Meme coins can offer a fantastic profit opportunity, with some coins seeing four-, five-, and six-figure percentage gains over time. However, meme coin volatility is a two-edged sword and can slash your investment capital just as quickly. Meme coins also bring trading opportunities, where you can swing trade the daily ups and downs, timing your trades to build your capital.

Generally, meme coins aren’t buy-and-hold investments, though. Price volatility can outpace well-established cryptos like Bitcoin, making them riskier to hold for long periods of time. If you decide to trade meme coins, you can consider looking into presales, which is often the cheapest way to acquire tokens. Alternatively, you can look to decentralized exchanges or traditional crypto exchanges and brokers to buy meme coins with a more established trading history.

References

- What Is Dogecoin, How to Say It, and Why It’s No Longer a Joke (wsj.com)

- Money Stuff: Dogecoin Is Up Because It’s Funny (bloomberg.com)

- ‘I made doge in like two hours’ (finance.yahoo.com)

- Dogecoin Inflation (dogecoin.com)

- Retail Wave Spurs Sevenfold Surge in Dogecoin Into Crypto Top 10 (bloomberg.com)

- Lure of Quick Money Sees $100M Flow to Solana Meme Coin ‘Presales’ (yahoo.com)

FAQs

What does a meme coin do?

Often, meme coins don’t do anything at all. Rather than offering utility, they generally focus on being a fun asset to own and trade while providing a community of traders.

Are meme coins a good investment?

Some meme coins have proven to be an excellent investment. Dogecoin rose from $0.0004 at launch to more than $0.73 at its all-time high. However, timing is critical and investors who bought at the high are facing a 76% loss based on current prices of about $0.17.

Which meme coin can reach $1?

Dogecoin may still reach $1 one day. Although the coin is inflationary, which affects its value, the community remains one of the most loyal in the crypto space and Doge is still a top-ten cryptocurrency.

What are the disadvantages of meme coins?

Many meme coins have no utility whatsoever. When or if the fad passes, there’s no use case for the coin, so the price could fall. Even while still actively traded, meme coins are also volatile, and drawdowns of 70% or more aren’t uncommon.

Which crypto exchange has the most meme coins?

With about 2,000 cryptocurrencies available for trading, the MEXC exchange offers one of the largest selections of crypto assets, including meme coins. Other options include KuCoin, OKX, and Binance.

Elliott Lee

Elliott Lee

Michael Graw

Michael Graw

Kane Pepi

Kane Pepi