How to Use Aave?

Many people are wondering how they can make use of decentralized Finance (DeFi) products as they have brought new life not only to crypto but also traditional finance markets. Numerous ambitious lending protocols like Aave (AAVE) have sparked a hope that DeFi might eventually have the same omnipresence as traditional finance, and this would be a godsend to the millions of unbanked all around the world.

DeFi allows millions of average citizens to gain access to crypto wallets, which function as personal bank accounts, and grant permissionless access to all basic and not-so-basic programmable financial tools. In a near future, anyone should be able to put their assets to use in a financial application, like loans and interest yields. Aave bridges such vision closer to reality.

Brief History Of Aave

Before it was named Aave, the protocol went by the name of ETHLend. Envisioned by developer Stanley Kulechov, ETHlend intended to connect lenders and borrowers with loan requests that matched up. When ETHlend needed reimagining in order to stay afloat, it was rebranded as Aave in 2020, using liquidity pools and algorithmic determination of interest rates, giving birth to what would become the giant of DeFi today.

Aave’s Rise

Aave has risen among cryptocurrency enthusiasts as a promising application for the next generation of DeFi. In addition to lending, staking, and yield, protocols that are included in regular DeFi applications, Aave caught the crypto world’s attention with the introduction of flash loans, which are smart contract loans which you can get with no collateral that you have to pay back within a minute.

On the surface, one would wonder how you can get a loan for nothing and what the point of it is in paying the loan back in such a strict time frame. With DeFi being run by smart contracts instead of centralized entities, a whole world of possibilities opens up. Those few seconds could mean everything when attempting to You’ll be able to execute strategies that traditional finance wouldn’t normally consider, thus making things like flash loans have usefulness that traditional finance wouldn’t be able to pull out.

Aave’s Notable Features

- AAVE Token. Like the Compound protocol, Aave has its own token. The AAVE token, which is a 1:1 ratio taken from the Aave liquidity pool, generates yield when you make enough of a deposit on a derivative token.

- Switching Rates. Most DeFi protocols only have variable rates because of the volatility of the crypto market. The valuation of most coins are continuously oscillating and these qualities are also reflected when making loans. With Aave, you can choose to fix the interest rate, rather than keep a varying one, which adds a whole other dimension to lending.

- Flash Loans. Flash loans are what brought Aave attention in the crypto world. This is what distinguishes the platform from other DeFi protocols. Here, you can use smart contracts in order to execute a loan, which you have to pay back in seconds. If you’re operating with market mechanics that happen at a moment’s notice.

Learn more about flash loans here: https://www.youtube.com/watch?v=186zm5HDf7c Before getting started, you’ll need to connect a wallet to Aave in order to use any of its features. Like many other DeFi applications, a MetaMask wallet would suffice, but you can use other wallets like the Ledger hardware wallet, Coinbase wallet, or others.

Depositing Funds on Aave

In order to borrow, swap, stake, or have any voting power in Aave’s governance, you need to have some crypto deposited into Aave. To do so, click on the deposit tab at the top of the Aave protocol once you’re connected with your wallet. From here, it will detect which cryptocurrencies you have in your account.

How To Stake Tokens On Aave

To stake Aave tokens, make sure that you have Aave tokens in your wallet, which you can get by using a decentralized exchange like Uniswap. Once you have the desired amount, you can type in the amount you want to stake in the box and press the button. On the right side, it shows you the Aave per month that you would have earned through staking. It also shows the Cooldown period, which refers to when you receive your tokens after trying to take them out of staking.

This time frame exists so that the network can easily manage any tokens that are taken out without affecting the integrity of the network. Next, you will the annual percentage yield (APY) you will receive while staking. The slashing indicates how much stake you can lose in the extremely rare event of the network becoming compromised and having to slash away tokens to keep its integrity.

How To Borrow On Aave

Depositing tokens allow you to borrow tokens on Aave. In the borrow page, you will find a list of tokens that you can borrow, how much you will be able to borrow and the variable and stable APY. If you click on one of the coins, you will be directed to the next page with information about your chosen token. The utilization rate tells you the amount that the chosen asset is being borrowed compared to the sum that is available for borrowing.

The higher the number is, the more the asset is being borrowed and the higher the interest rate the borrower has to pay. The available liquidity is how much you are able to borrow, and the asset price is the current market price of your chosen token. The option for stable or variable rates is a feature that Aave became known for.

At the cost of paying more for your borrowed asset, you can stabilize the APY, making the loan rate predictable, at a much higher interest rate cost. If you believe that market circumstances will change, this is a handy option to have. Otherwise, you can use a variable APY much like most other decentralized finance applications if you think stabilization will be costlier. After this, you can visit your dashboard and see how your assets are doing.

Swaps on Aave

Much like decentralized exchanges, Aave allows swaps in a limited capacity. You can select the asset that you want to swap, the rate the swap will cost, the slippage (which is the change in price that you will allow and the swap will still execute), and finally approve the transaction. Make sure to have enough of the intended token to execute your swap.

Executing Flash Loans

As of right now, flash loans require extensive smart contract programming, so are inaccessible to the average DeFi user. Maybe a day will come when flash loans can be done at a click of a button without the need for a user to run it on lines of code. Before, creating NFTs could only be done through someone who knew how to develop on Solidity.

Now anyone can take a picture of a toilet, create an NFT with it, and attempt to auction it on OpenSea. If you know how to code and are raring to make eye-popping DeFi profits, numerous tutorials online have already sprung up for you to take advantage of DeFi’s lucrative potential. Otherwise, you might have to learn an entire profession and skills like programming to access smart contracts until they are more accessible to the average person.

Even with how difficult they are to access, flash loans have still been the talk of the town in DeFi. When lucrative trends and trades can be seen and made in the blink of an eye, exchanging assets without collateral at lightning speed is a valuable tool for traders who have already sunk their teeth deep into decentralized finance.

Conclusion

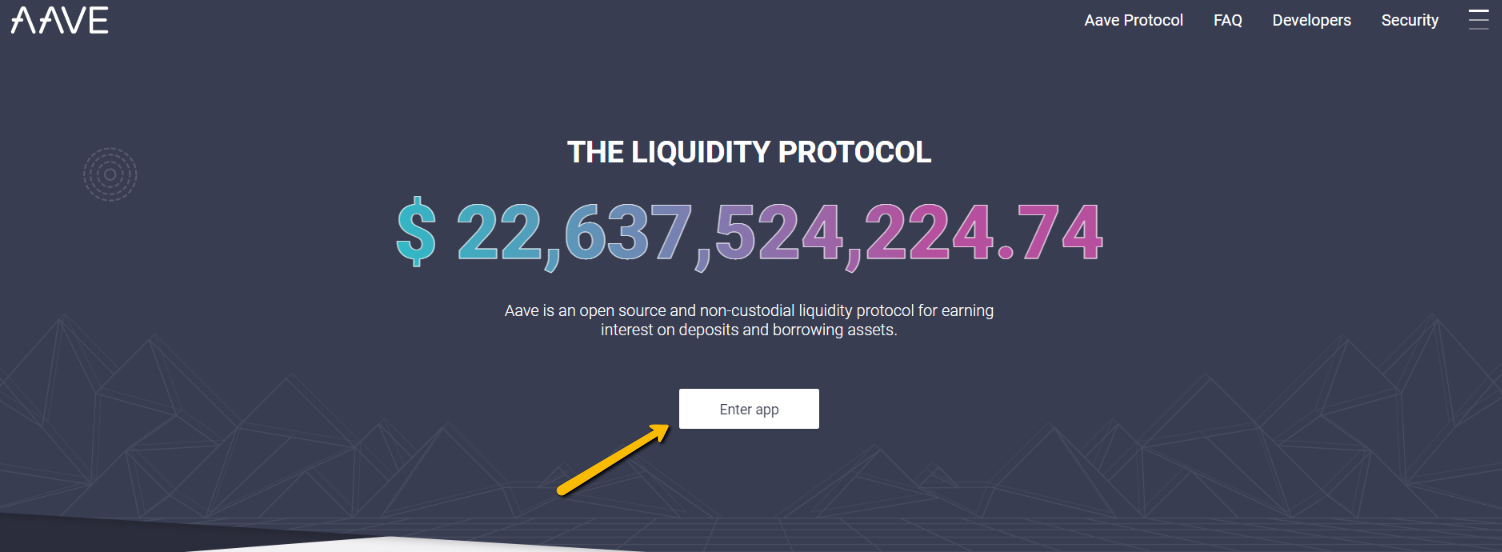

Aave was rebranded in 2020, and has made a name for itself with its impressive array of features. With over USD 20 billion worth of assets in Aave at the time of writing, Aave circulates a hefty amount in the DeFi space. As it continues to climb the ranks in DeFi protocols and cement its usefulness in the crypto space, we could potentially be talking about Aave in the future as one of the most innovative decentralized finance protocols of the current dApp landscape.

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell

Eric Huffman

Eric Huffman