Crypto Trading Volumes in Ukraine, Russia Fall After the Early War Spike

Crypto trading volumes using Ukrainian hryvnia (UAH) as the fiat currency have fallen to nearly their normal levels, despite banking restrictions in Ukraine making fiat transactions in the region increasingly difficult. From Russia, however, crypto trades using the Russian ruble (RUB) still remained well above their normal levels on the crypto exchange Binance this week.

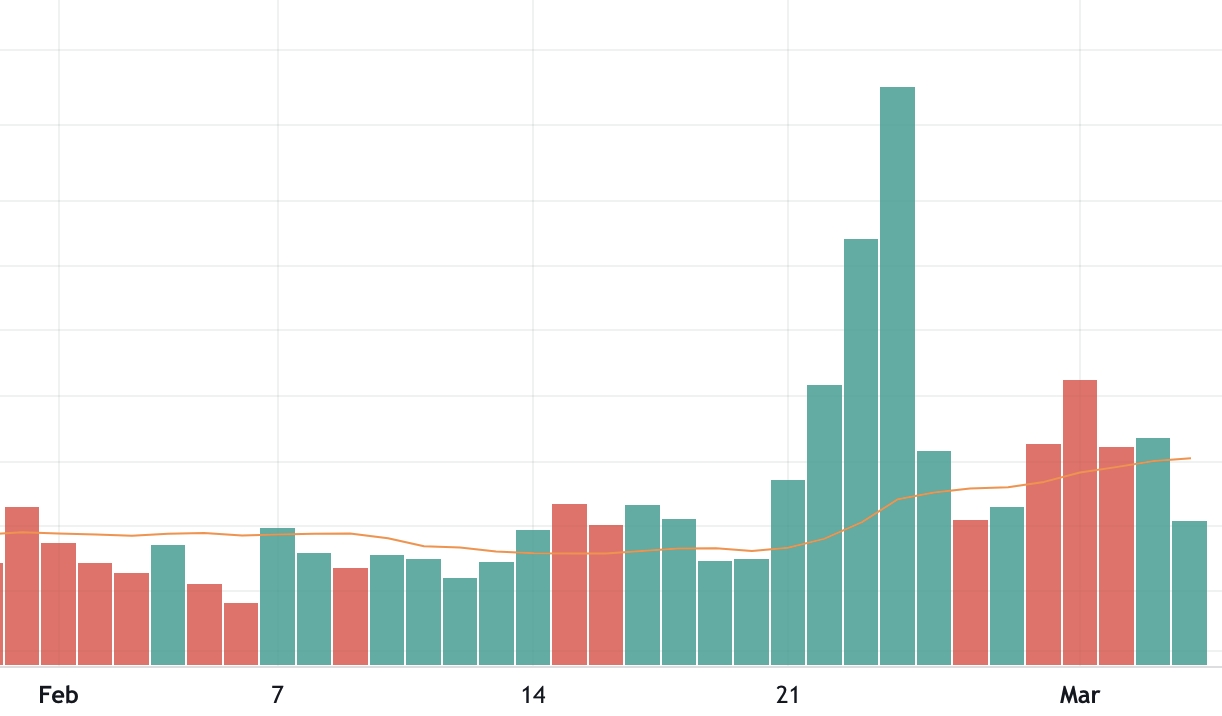

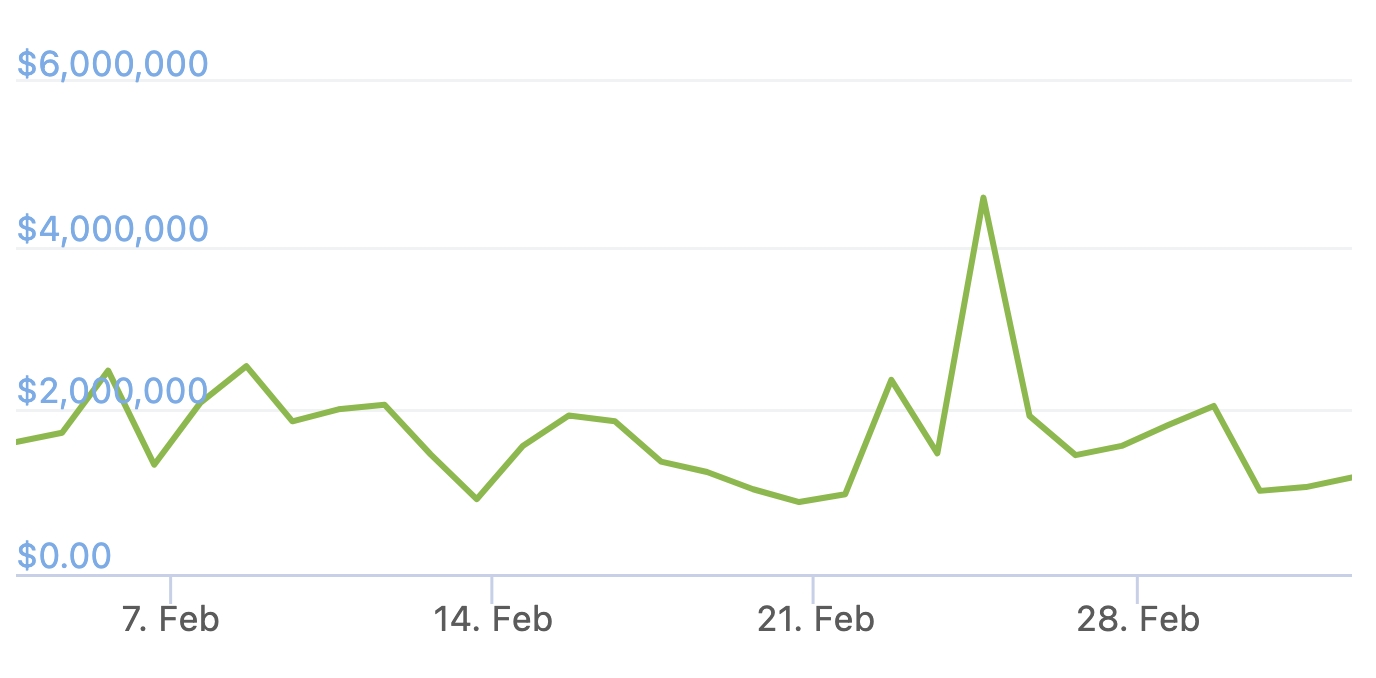

On Binance – one of the largest international crypto exchanges that deals with both Ukrainian hryvnia and Russian rubles – trading volumes in the tether (USDT) / UAH trading pair surged after the war started on February 14.

Since the initial surge, however, volumes in the pair have come down, sitting slightly above their normal level on Thursday this week.

Binance trading volume in USDT/UAH:

“We don’t think it is right for businesses or platforms to unilaterally decide to freeze populations of users’ assets. There are normal Russian citizens in London, New York. Should a bank CEO in London have the power to unilaterally decide to freeze those people’s assets? On what grounds? Just because they don’t agree with the President of their country? What happens if they also do not agree with another head of state in another country? Should they have the power to freeze all assets of citizens of that other country too? Where does this stop? For this reason, it is our understanding that we must follow international sanction lists, and not make up our own,” Binance CEO Changpeng Zhao said in a blog post today.

Also, according to him, Russians converting from ruble to crypto weakens the ruble, which weakens Russia’s powers.

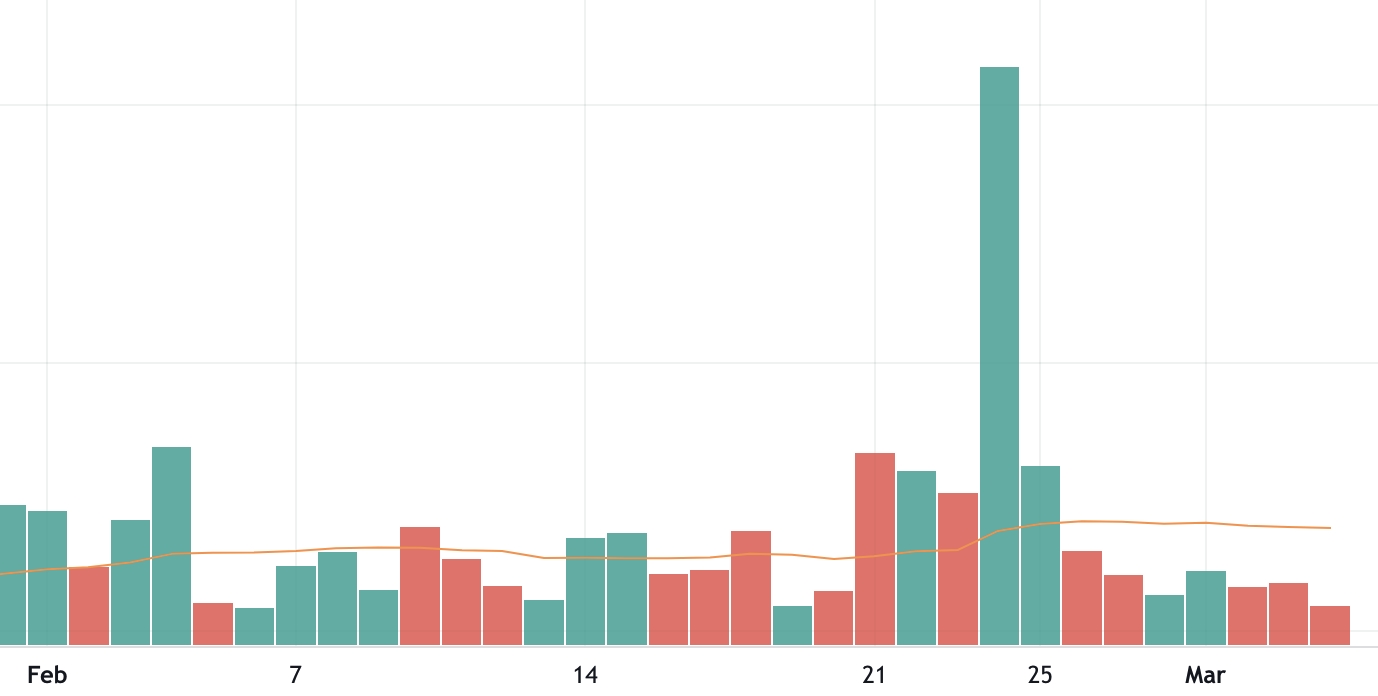

A similar picture was also seen in the bitcoin (BTC)/UAH trading pair, where volume surged to its highest level since October last year on the day the war started, before quickly falling again this week.

Binance trading volume in BTC/UAH:

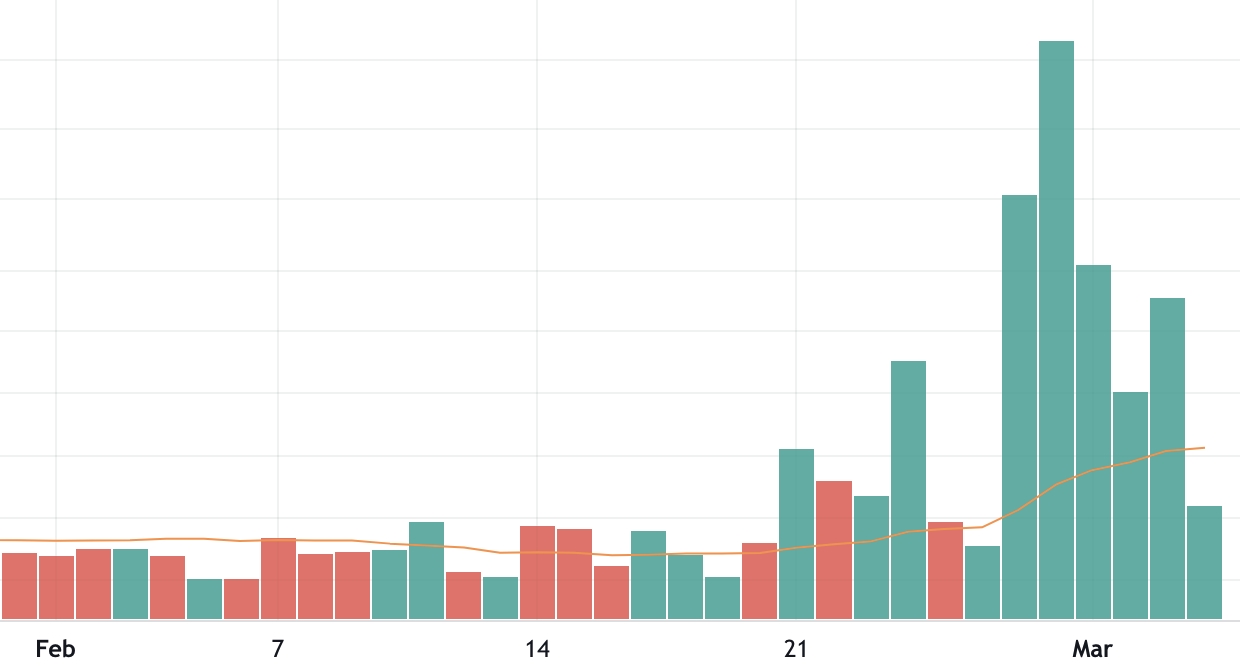

Looking at trading pairs with the Russian ruble, however, volumes on Binance’s USDT/RUB pair still remained significantly above their normal level as of Thursday. The data could indicate that the Russian appetite for US dollars is high as the country faces some of the strictest economic sanctions ever imposed.

Binance trading volume in USDT/RUB:

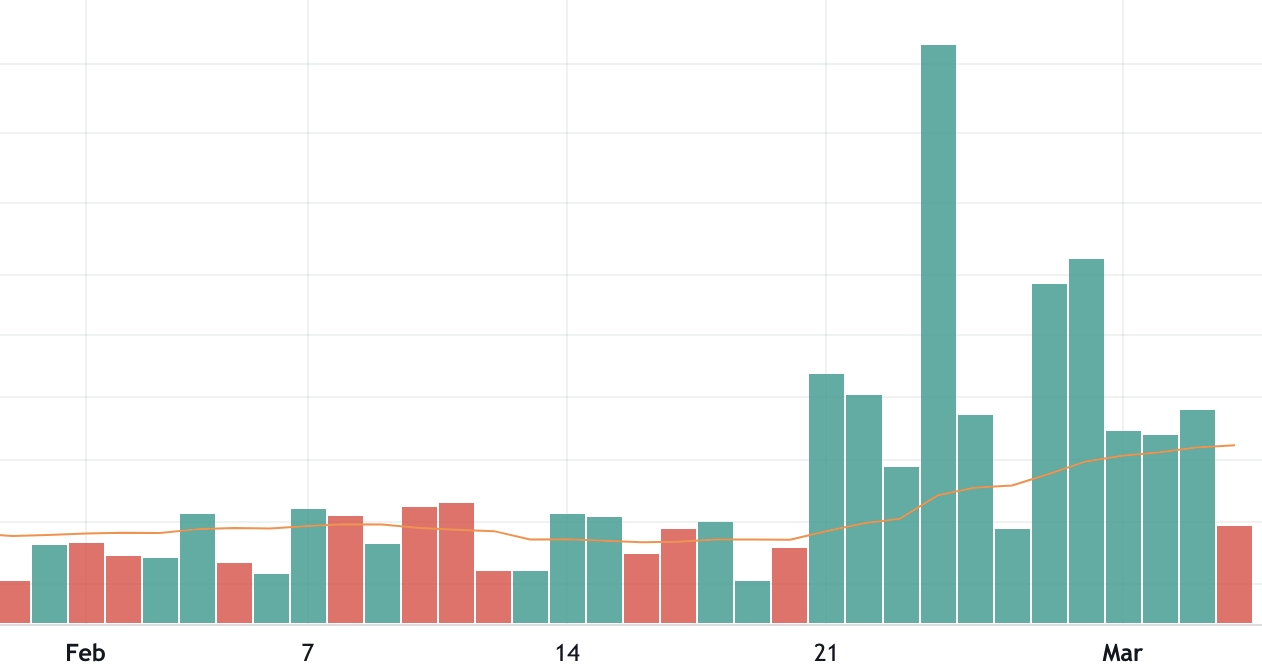

The same can also be seen when looking at the BTC/RUB trading pair, which has been markedly higher than usual both before and after the war started.

Binance trading volume in BTC/RUB:

On the local Ukrainian crypto exchange Kuna Exchange, overall trading volumes across all trading pairs also spiked as the war began, later falling back to normal levels.

Kuna Exchange offers trading in a range of cryptoassets against both the Ukrainian hryvnia and Russian ruble fiat currencies. The USDT/UAH trading pair was the most popular on the exchange, making up nearly 35% of the volume over the past 24 hours.

The recent decline in trading volumes across both Russian and Ukrainian fiat pairs is interesting in light of speculations that Russia could potentially use crypto as a way to evade sanctions.

So far, however, experts say there are few signs that point to this.

Speaking with Bloomberg, Madeleine Kennedy, senior director of communications at blockchain intelligence firm Chainalysis, said that her firm has not seen evidence of “large-scale sanctions evasion by sanctioned Russian entities.”

“If they do attempt to use crypto, it would be very difficult for them to do this undetected at scale,” she added.

As reported, crypto exchange Coinbase CEO Brian Armstrong shared a similar message, opining that it is unlikely that Russian oligarchs or others will use crypto to avoid sanctions.

“Because it is an open ledger, trying to sneak lots of money through crypto would be more traceable than using United States dollars cash, art, gold, or other assets,” Armstrong said.

____

Learn more:

– Bitcoin vs Gold Debate Continues as Both Assets Rise Following Ukraine War

– ‘Enormous Increase’ in Ukraine Crypto Trading Volume, USD 47,000 Next Target for Bitcoin – Arcane

– Washington, Europe Vow to Target Russian Crypto Sanctions Evasion Efforts

– Russian Oligarchs Unlikely to Use Crypto to Dodge Sanctions – Coinbase CEO

– Cut Central Bank out of Russian Crypto Regulation Picture, Urges Lawyer as Ukraine War Rages On

– Russian Ruling Party Says Crypto Regulation Will Safeguard ‘Millions of Citizens’