Bitcoin Ends Record-Long Losing Streak, BTC Inflows Grow, Ethereum Sees Outflows

As bitcoin (BTC) ended a 9-week-long losing streak on Sunday, when a green weekly candle finally appeared on the bitcoin chart. The positive weekly close kicked off a green start of the new week on Monday, with gains across the board in the crypto market.

Monday’s rally was broad in the market, with both bitcoin, ethereum (ETH), and many altcoins seeing 24-hour gains of more than 5%. Among the top 10 coins by market capitalization, the strongest performer was cardano (ADA), which at 15:00 UTC was up by 9% for the day to a price of USD 0.611.

At the same time, BTC stood at USD 31,577, up 6% for the past 24 hours, and ETH traded at USD 1,897, up almost 6% over the same time period.

The gains came as the bitcoin chart on Sunday printed its first green candle in 10 weeks, ending a record-long losing streak for the coin.

According to Marcus Sotiriou, an analyst at crypto broker GlobalBlock, BTC now faces technical resistance around the USD 31,500 to USD 32,000 level and if the price can hold above this level, “continuation to the upside” can be expected.

BTC/USD weekly chart:

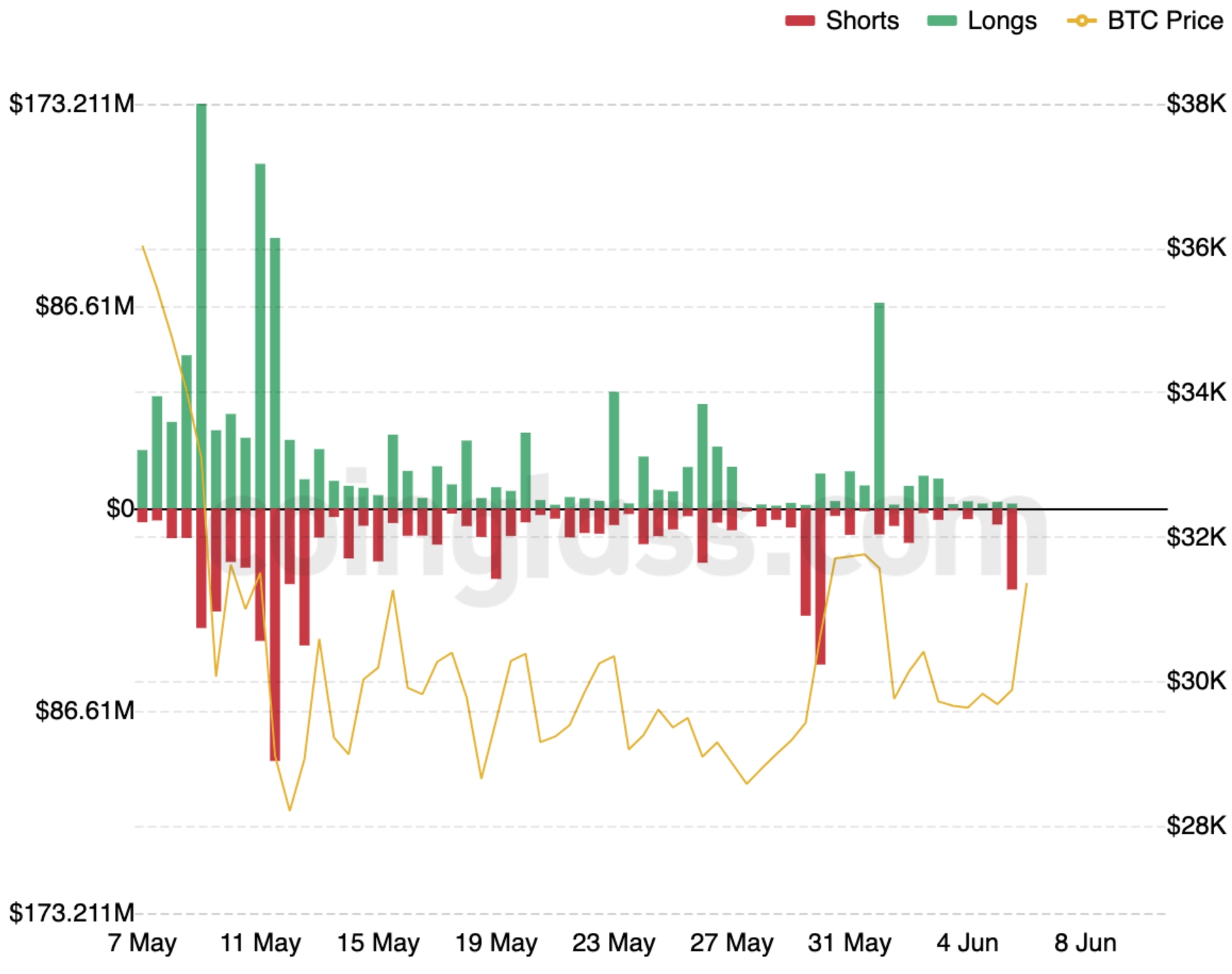

Shorts liquidated

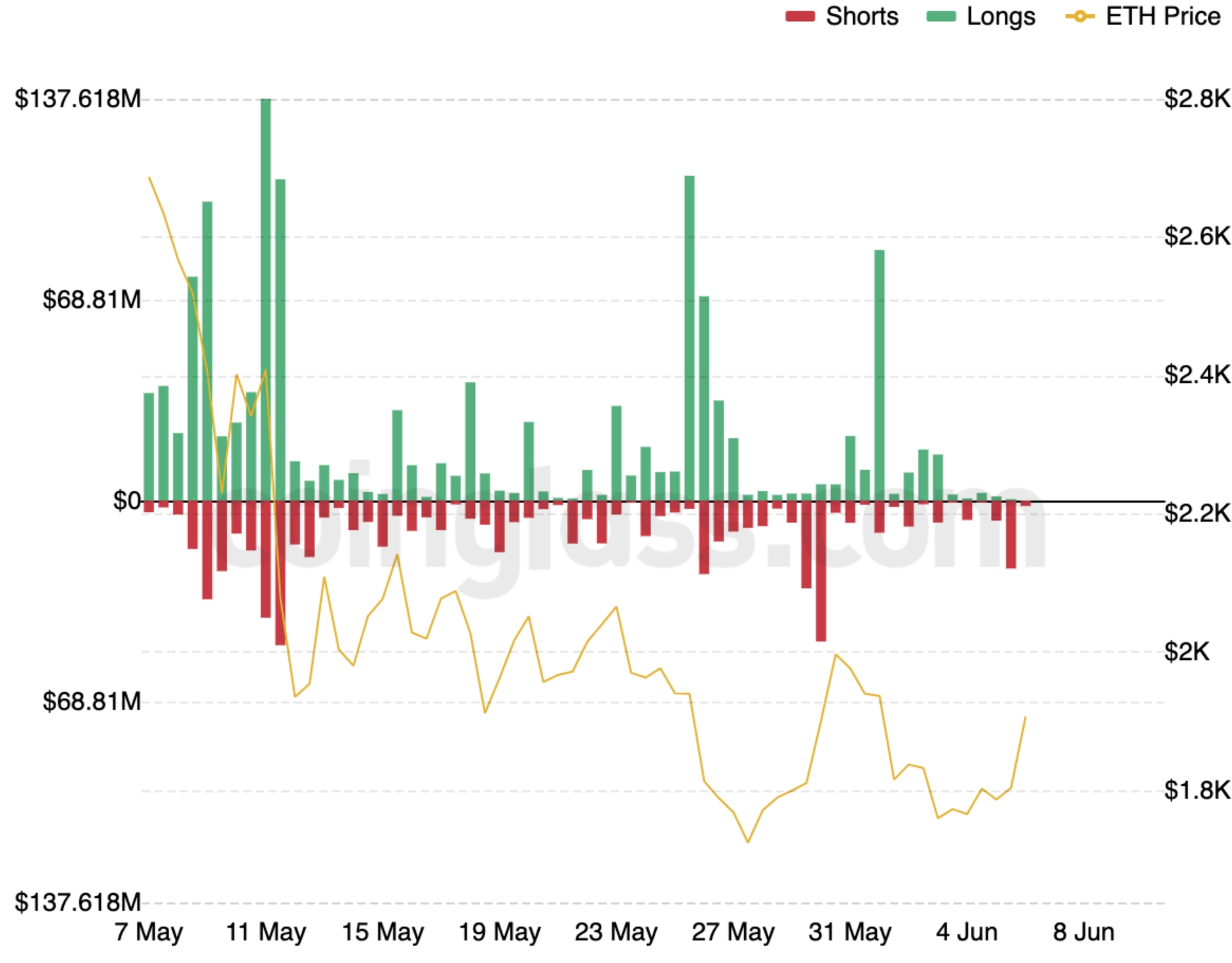

According to data from Coinglass, Monday’s rally came at the expense of traders who had positioned themselves for more selling in both BTC and ETH derivatives.

In the bitcoin derivatives market, close to USD 35m of BTC shorts were liquidated in the 12 hours from midnight to noon UTC time on Monday, marking a one-week high in short liquidations.

Meanwhile, liquidations of short ETH positions also reached a one-week high on Monday, with USD 23m liquidated across exchanges during the same time period.

Miners selling

Notably, the price spike for major coins today happened as news emerged that Bitcoin miners have started selling off coins that were previously hoarded in an attempt to cover operating costs.

Miners transferred about BTC 195,663 to exchanges in May, marking the biggest monthly increase since January, per Bloomberg. At an average monthly price of USD 32,000 per coin, the value of the bitcoin sent to exchanges is USD 6.3bn.

However, Bitcoin miner Riot Blockchain has been “stockpiling bitcoin on a bet that prices would keep appreciating.”

For smaller miners, including the privately-owned Cathedra Bitcoin Inc., the selling was necessary in order to alleviate a pressing financial situation.

“We have spent the last several weeks restructuring our balance sheet and operations to ensure Cathedra is well-positioned to endure a prolonged economic downturn,” Cathedra’s CEO AJ Scalia was quoted as saying by Bloomberg.

Rising fund inflows

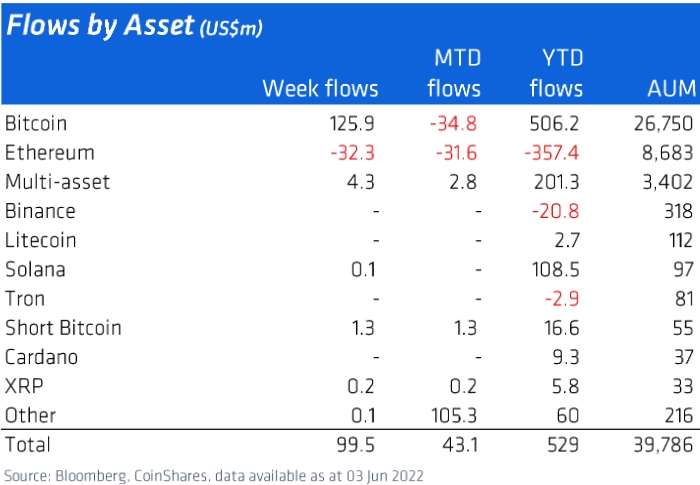

While miners sold, it appears that other investors took advantage of the low prices last week to allocate more capital to crypto-backed funds.

According to data from the crypto research and investment firm CoinShares, USD 100m were added to crypto investment funds last week, despite prices of most crypto assets being stuck in a narrow range. The figure is up from the USD 87m of inflows that was seen the week before.

As usual, funds backed by BTC saw the largest inflows, totaling USD 126m over the week (it was USD 69m a week earlier). At the same time, ETH-backed funds saw the largest outflows, with USD 32m leaving on a net basis (it was almost USD 12m a week earlier).

On-chain outlook

According to the crypto exchange Kraken’s latest on-chain digest, the crypto market has not yet shown any signs of emerging from bearish conditions, with on-chain data showing a continued decline in crypto network demand in May.

Still, Bitcoin continued to perform better than altcoins both in terms of price and on-chain fundamentals. According to the report, BTC was “the best or second-best performer in every on-chain metric,” while also having the smallest growth in circulating supply.

The report added that indicators such as Bitcoin’s Spent Output Profit Ratio (SOPR) and Market Value to Realized Value (MVRV) z-score have continued to signal oversold conditions, and said that a return to neutral conditions for these indicators would suggest network demand is returning.

____

Learn more:

– USD 25K-USD 27K per Bitcoin Is ‘This Cycle’s Bottom’ – Arthur Hayes

– As inflation ‘Mellows Out’, a Bottom in Crypto is Likely in ‘The Back Half of 2022’ – VC Investor

– Crypto & Stocks ‘Decoupling’ Prediction Flops but There’s Still Hope

– Bitcoin Undervalued, Crypto Now Better Than Real Estate – JPMorgan