Crypto Market Rises Amid ‘Altseason’ Hopes, Some Bitcoin Whales Selling

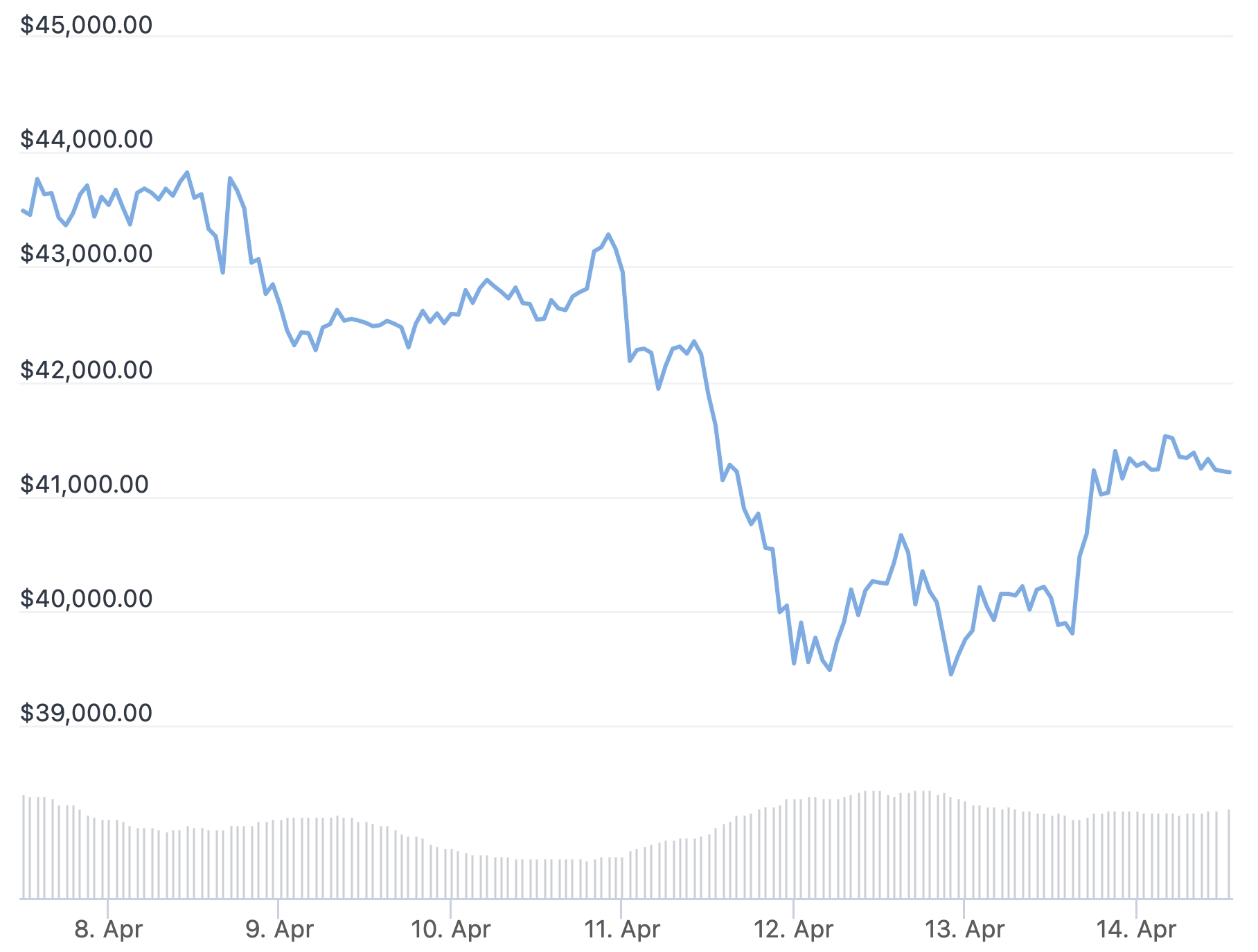

Following heavy selling earlier in the week, the crypto market moved higher on Thursday on boosted sentiment in stocks. However, some on-chain metrics could be a cause of concern for bitcoin (BTC) investors.

At 10:05 UTC, BTC stood at USD 41,215, up almost 3% for the past 24 hours and down almost 5% for the week, after strong selling action on both Sunday and Monday. At the same time, ethereum (ETH) traded at USD 3,104, up almost 2% for the day and down 2% for the week.

BTC price past week:

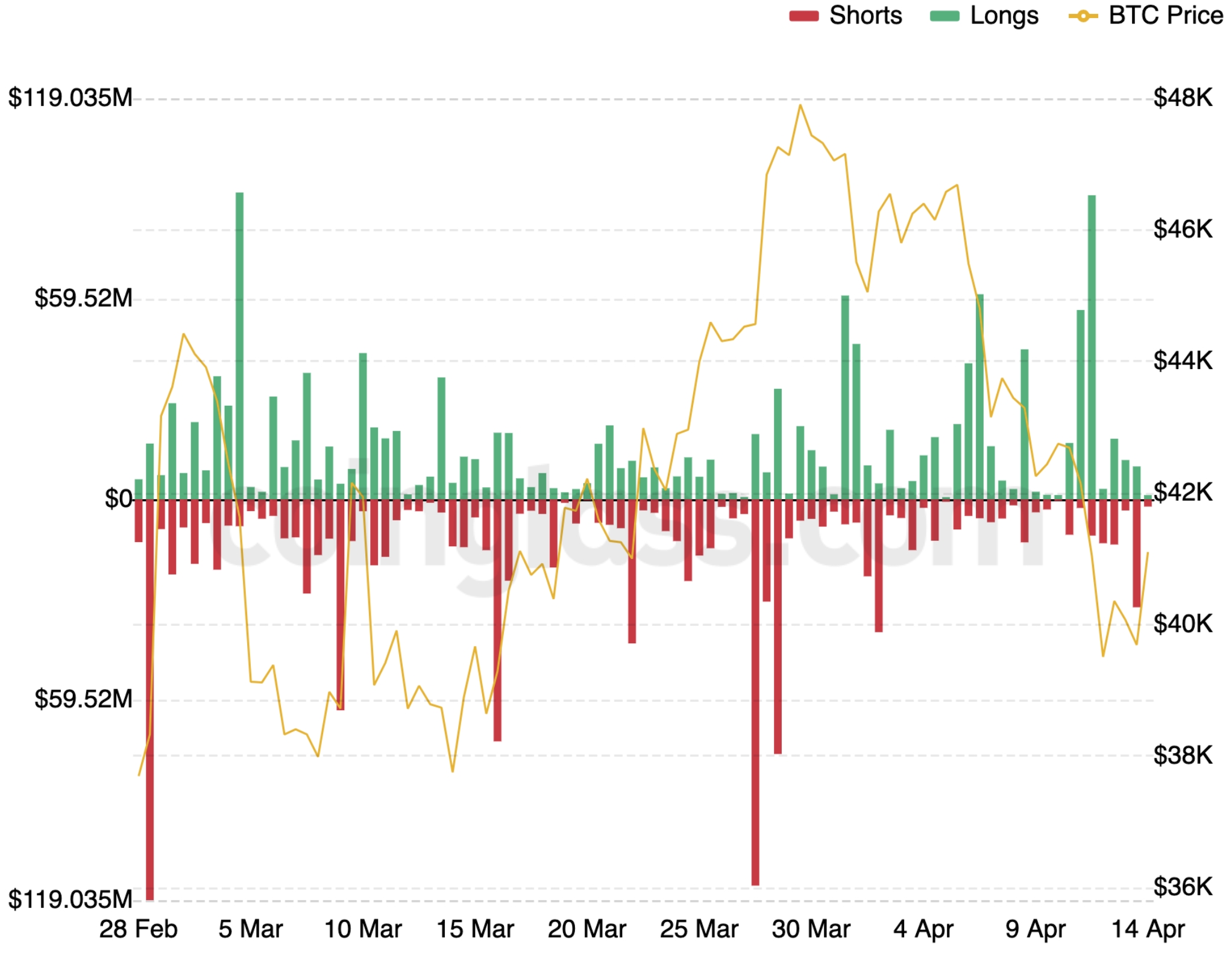

The reversal from a falling market earlier in the week appears to have caught some leveraged traders by surprise.

Between noon and midnight UTC time on Wednesday, more than USD 32m worth of short BTC derivatives were liquidated across exchanges, marking the biggest short liquidation event in a 12-hour period since April 2, per data from Coinglass.

Liquidations of leveraged BTC positions per 12 hours:

Notably, the move higher over the past day did not happen in isolation, but appears to have been triggered by improved sentiment in the stock market.

On Wednesday, the broad S&P 500 stock index in the US rose by 1.1% for the day, while stock market futures on Thursday morning in Europe are pointing to a more or less flat opening on Wall Street.

The positive sentiment in both stocks and crypto on Wednesday followed a new inflation report in the US that showed that inflation reached 8.5% for the month of March compared to the same month a year earlier.

Another season for altseason

According to some, the recent moves in the crypto market show a growing appetite for smaller, more speculative altcoins versus bitcoin.

“They are again outperforming bitcoin – they call it alt-season,” Joseph Hickey, global head of trading at BlockFi, told Bloomberg.

He added that crypto is “a momentum asset class,” and that when crypto runs, there is usually trading momentum behind it, bringing even stronger performance to smaller altcoins than to BTC and ETH.

Commenting in the same report, Russell Starr, CEO and executive chairman of DeFi Technologies, also opined that some attention is now shifting away from BTC and ETH to smaller digital assets.

From previously being confined to investments in vehicles like Grayscale’s Bitcoin Trust, more financial institutions are now asking about exposure to the likes of avalanche (AVAX), terra (LUNA), solana (SOL), cardano (ADA) and polkadot (DOT), Starr said.

Also, per CoinShares data, both BTC and ETH saw strong investment outflows last week while multiple altcoins experienced investment inflows.

The comments came as the bitcoin dominance – bitcoin’s share of the overall crypto market capitalization – dropped below 40% in April (reaching 39%), per CoinGecko’s data. The 40% level has acted as support for the bitcoin dominance on several occasions this year and last year, making it a key level to watch for signs that an ‘altseason’ could be on the way.

In January 2021, bitcoin’s dominance stood at over 70%.

Bitcoin dominance chart:

Meanwhile, commenting on the state of the bitcoin market, Marcus Sotiriou, an analyst at the digital asset broker GlobalBlock, said on-chain metrics “suggest some cause for concern.”

He explained that fresh on-chain data shows that the number of wallets holding more than BTC 10,000 – known in the bitcoin world as ‘whales’ – has “decreased substantially” over the past week.

“In this period, at least four whales have sold their bitcoin – this may seem insignificant, but each of these addresses has sold more than USD 400 million worth of Bitcoin,” he said, noting that whales “have the power to control the direction of the market.”

“I am still optimistic for the crypto market in the short term due to reaching extreme fear and negative sentiment,” the analyst concluded.

____

Learn more:

– Luna Foundation Guard Buys Additional USD 100M in Bitcoin, Now Holds BTC 42.4K

– MicroStrategy Spends USD 191M on Bitcoin After Last Week’s Loan

– Get ‘Mentally Ready’ for Lower Bitcoin Prices as Rates Rise, Bitcoin 2022 Panelists Warn

– Once the Fed Pauses, Bitcoin is ‘Going to the Moon,’ Novogratz Says