Celsius Sets Date for Auction of Assets Following Bankruptcy

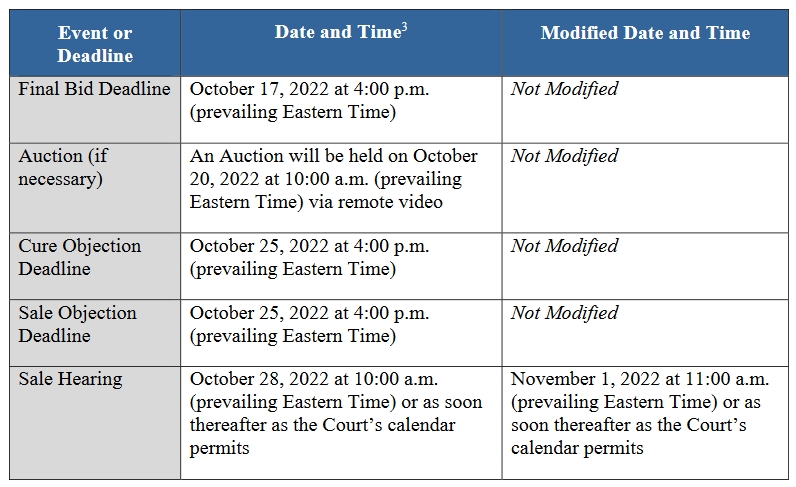

Bankrupt crypto lender Celsius Network has set a timeline for the auction of its assets and will have a final bid deadline of October 17.

According to a filing with the US Bankruptcy Court, an auction will be held on October 20, if necessary. Cure and sale objection deadlines are set for October 25.

A sale hearing before a Chief United States Bankruptcy Judge will be held on November 1, “or as soon thereafter as the Court’s calendar permits,” said the filing. It will be conducted remotely, via Zoom.

The filing added that a large number of participants is expected.

Meanwhile, the company’s so-called Chapter 11 bankruptcy protection filing on July 14 revealed a deficit of close to USD 1.2bn for the crypto lender.

In late September, Alex Mashinksy resigned from his role as the CEO of Celsius Network amid ongoing bankruptcy proceedings. However, recent reports alleged that Mashinsky withdrew $10 million from the lender just weeks before the company froze customer accounts and collapsed, following the collapse of stablecoin issuer Terra.

As reported on Monday, the US Department of Justice (DOJ) submitted an objection to Celsius’ motion to reopen withdrawals for select customers and sell its stablecoin holdings. A United States Trustee for the DOJ, William Harrington, described Celsius’ motions as “premature,” adding that “any distribution or sale at this juncture could inadvertently impact or limit distributions to other creditors in this case.”

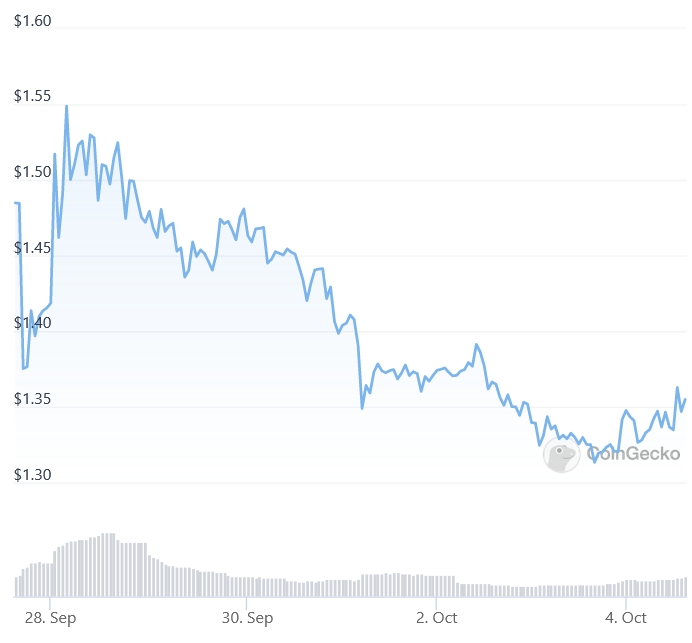

At 12:20 UTC on Tuesday morning, the 74th coin by market capitalization, CEL, was trading at $1.35, up 2.3% in a day and down nearly 8% in a week.

____

Learn more:

– Celsius CEO Machinsky Resigns Amid Ongoing Bankruptcy Proceedings

– CEL Rallies After Celsius Asks Court to Let it Return USD 50m+ in Crypto

– Celsius Saga Continues: New Filings Reveal ‘Delusional’ Plan for ‘Standalone Reorganization’, Says a Lawyer

– Why Celsius and Voyager Were More Like Uninsured, Quasi-Banks