BitMEX CEO’s Jokes About XRP End With a Flash Crash and a Wall of Silence (UPDATED)

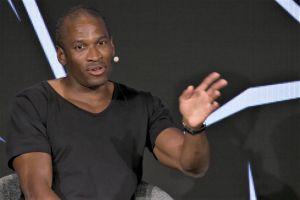

The normally outspoken CEO of major crypto derivatives exchange BitMEX, Arthur Hayes, has gone quiet after a short-lived crash occurred in the exchange’s XRP derivatives market, which may have led to large losses for some traders on the platform. (Updated on February 17: updates in bold.)

The sudden crash occurred at 14:00 UTC on Thursday when the price of BitMEX’s XRP/USD perpetual swap contract dropped from USD 0.33 to USD 0.13, a fall of nearly 60%. However, everything was over in a matter of seconds, and the price was back up again at USD 0.33 as the next 1-minute candle appeared on the chart.

The sudden crash and subsequent recovery could suggest that it was triggered by a glitch in a trading algorithm, or a by a large whale with a so-called “fat finger,” meaning someone wrongly entering a very large order. As of yet, however, no word has been heard from BitMEX or Arthur Hayes in public about the incident.

Several BitMEX clients have already taken to Twitter to express their frustration about the event, with some even claiming that their stop-loss orders – used as protection in case of sudden market drops – did not get triggered at the prices they were supposed to during the crash:

The trader also shared a screenshot that looks like a response from BitMEX that says that they “understand that price movements like this can be frustrating at times, however, there will be no rollback or refunds in this case.”

“The Fair Price Marking method meant users (including some who may believe they were liquidated) avoided liquidation no liquidations occurred on XRPUSD during this time period (14:00-14:02 UTC). Stop Market orders set by users to trigger on Last Price within the price range would have been triggered based on this move as designed,” the exchange told Cryptonews.com.

“No market can guarantee protection against sharp movements for all users under all circumstances,” they said, adding that their Insurance Fund is not intended for use here.

“It is used to guarantee profits where market conditions may otherwise produce margin shortfalls on the other side of the book,” BitMEX explained.

Meanwhile, as reported this week, Poloniex rolled back 12 minutes of trading history after a bug detected in the system caused trades to be “executed erroneously.”

“It’s prudent to note that these high leverage XRP contracts are quite new to BitMEX and antagonistic comments from the CEO calling XRP dirty names has probably not attracted all that many clients. So the orderbook is likely quite sparse. If you have people selling and there are no buyers, the market price will then drop to the meet the next available buy order. It’s simply how markets are designed,” Mati Greenspan, founder of Quantum Economics, wrote in his newsletter on Friday.

“For once, I actually agree with BitMEX’s decision to not refund their customers. Their reasoning is only half true though. They say that it was caused by ‘market factors’, which it was. The only thing is that they are the ones who created the market,” he added.

Jake Chervinsky, general counsel at decentralized finance platform Compound, also weighed in, writing: “If BitMEX were a US-regulated exchange, this would likely warrant a conversation with someone at the CFTC [the Commodities Futures Trading Commission] at minimum, if not a full internal investigation to determine how the flash crash occurred.”

“That won’t happen. I wonder if BitMEX will even respond. This is crypto in 2020,” Chervinsky added.

Interestingly, yesterday’s flash crash came shortly after XRPUSD perpetual contracts were listed on BitMEX, when Arthur Hayes used the listing announcement as an opportunity to mock the asset, writing on Twitter: “Is it called Ripple, XRP, or dogshit? Who knows, who cares. It’s worth more than zero so it’s time to trade the USD pair on BitMEX. Boo-Yaka-sha!”

Shortly after, he also offered a piece of advice to traders, which appeared to suggest that more people should short XRP.

The BitMEX flash crash serves as a reminder of the dangers associated with trading with high leverage, as the common practice is on derivatives exchanges like BitMEX. It’s important to realize that derivatives trading using leverage is always a highly risky endeavor, which should only be done by very experienced traders. Without special expertise in trading, a robust trading strategy, and proper risk management techniques, most traders would probably be better off sticking with the regular spot market, where things are generally safer.

As of pixel time on Friday (11:39 UTC), XRP is trading at USD 0.324, up 4% in the past 24 hours snf 14.6% in a week.

____

Learn more:

BitMEX and Arthur Hayes Now Have USD 300 Million Problem

Malicious Groups Collated Leaked Crypto Trader Data – BitMEX