Bitcoin Wedge Pattern May Lead to New ‘Parabolic Phase’: Analysts

Chart analysts seem to be turning increasingly bullish on bitcoin, as several different approaches all suggest higher bitcoin prices may be right around the corner.

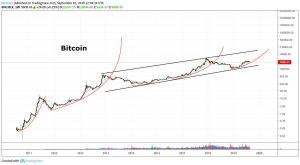

Global Macro Investor founder Raoul Paul shared a bitcoin chart along with some encouraging words to all bitcoin holders out there.

Paul’s tweet showed bitcoin’s current ‘wedge’ pattern – a pattern generally seen by technical analysts as a bullish continuation pattern – along with a comment saying “If you don’t have any bitcoin then this looks like the last time to board the rocket ship.”

The tweet has garnered lots of attention, with reactions ranging from critics claiming “Bitcoin will never scale,” to the veteran trader Peter Brandt suggesting there is a “possibility that BTC has entered [its] fourth parabolic phase.”

Brandt backed up his thesis with a logarithmic chart of bitcoin he has shared several times before with four parabolas drawn up. According to this chart, bitcoin price is now near the bottom of the fourth parabola, which serves as support for the price.

In addition to both Paul and Brandt sharing their own positive analysis of bitcoin, the general sentiment surrounding bitcoin also appears to have turned increasingly bullish recently.

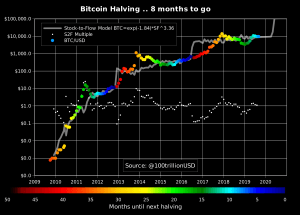

“We’ve yet to have a bear market this close to Bitcoin’s halving, and I don’t expect to have one now #bullmode,” Alistair Milne, the chief investment officer of a crypto fund, posted yesterday, while retweeting a chart showing bitcoin’s price along with time until next halving:

The next Bitcoin mining reward halving, when the supply of new coins will decrease by half, is estimated in May 2020.

Other traders took a different view, however, with bitcoin trader Nick Cote tweeting that we are now at a “critical level” for the bitcoin price. A move above current levels “would indicate a trend reversal for the bulls, with the immediate target of USD 10,300,” he said, while adding a word of caution for those who may get overly optimistic:

“Failure to breach will likely send us back to test the USD 9,100 major support level.”

Meanwhile, often-heard claims that ‘this is the last time to buy BTC below USD 10,000’ have already become a joke in the industry as the price breached this level on multiple occasions this past summer.

In either case, after a weekend of very low volatility in both bitcoin and the broader crypto market, the number one cryptocurrency did find some buyers overnight.

At pixel time (10:49 UTC), bitcoin trades at c. USD 9,831 and is up by 2% in the past 24 hours, but is still down by 5% in the past week and by 9% in the past month.

Bitcoin price chart:

Among the top 10 coins, Monero (XMR) stood out as the winner with a 24-hour gain of nearly 5%, while other coins saw smaller gains, and XRP, Binance Coin and EOS are down by less than 0.5%.